Bitcoin [BTC] breaks free: Will recent spike leave bear market behind

![Bitcoin [BTC] breaks free: recent spike leaves bear market behind - Report](https://ambcrypto.com/wp-content/uploads/2023/03/AMBCrypto_A_graph_showing_the_steep_rise_of_a_Bitcoin_line_on_a_a210e033-7bfa-4380-b211-7fcc18dfd130.jpg.webp)

- BTC’s price has jumped by over 30% in the last week.

- On-chain data brought up the coin’s exit from bear market territory.

Exchanging hands at $27,524 per coin at press time, Bitcoin [BTC] ended last week’s trading session with an impressive 35.8% increase in value, causing it to rally out of the deep bear market territory, Glassnode found in a new report.

An assessment of the king coin’s on-chain performance by the data provider revealed that the price uptick since 14 March has resulted in BTC transitioning from a deep bear market to a structure similar to past early bull markets.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Numbers don’t lie

Glassnode found that the last week was marked by increased demand for BTC as network activity increased. The report stated:

“As more people interact and transact within the Bitcoin economy, it is typically associated with periods of increasing adoption, network effects, and investor activity.”

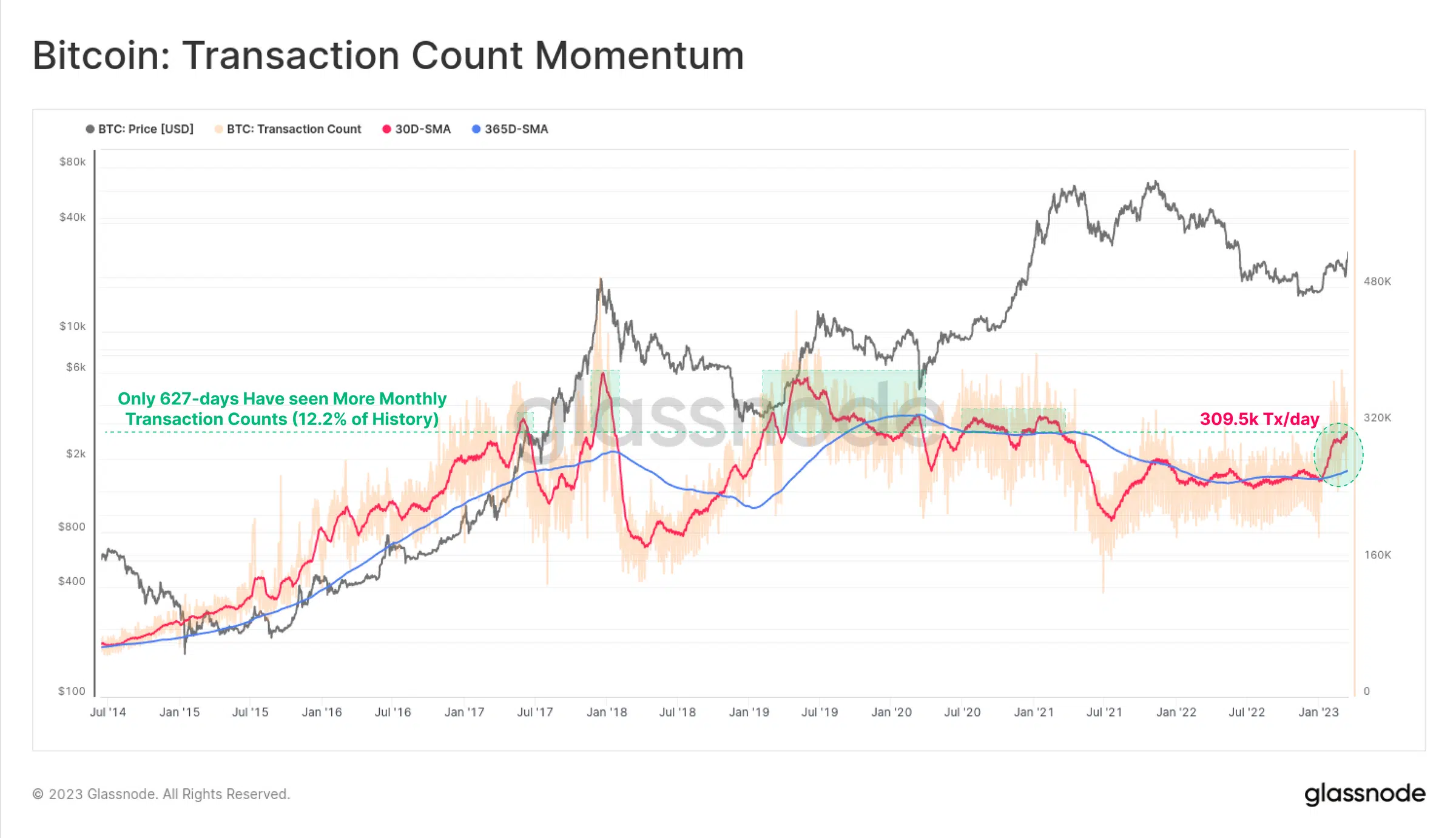

Glassnode assessed BTC’s Transaction Count and found that the coin’s monthly average transactions count grew to its highest level since April 2021, with a monthly average of 309,500 transactions per day. This represented a positive sign for the BTC market as fewer than 12.2% of all days have seen more transaction activity.

Bitcoin: What user adoption suggests

Another indication of BTC’s gradual exit from the bear territory was the jump in the number of new demand for the leading coin observed last week. Per Glassnode, the count of BTC’s unique new reached 122,000, with only 10.2% of days seeing higher new user adoption rates.

The surge in new user adoption on BTC’s network resulted in network congestion, which caused transaction fees to rise.

According to Glassnode:

“Elevated fee pressure is a common precursor to more constructive markets, coincident with new waves of adoption, expressed via increasing demand for blockspace.”

Is your portfolio green? Check the Bitcoin Profit Calculator

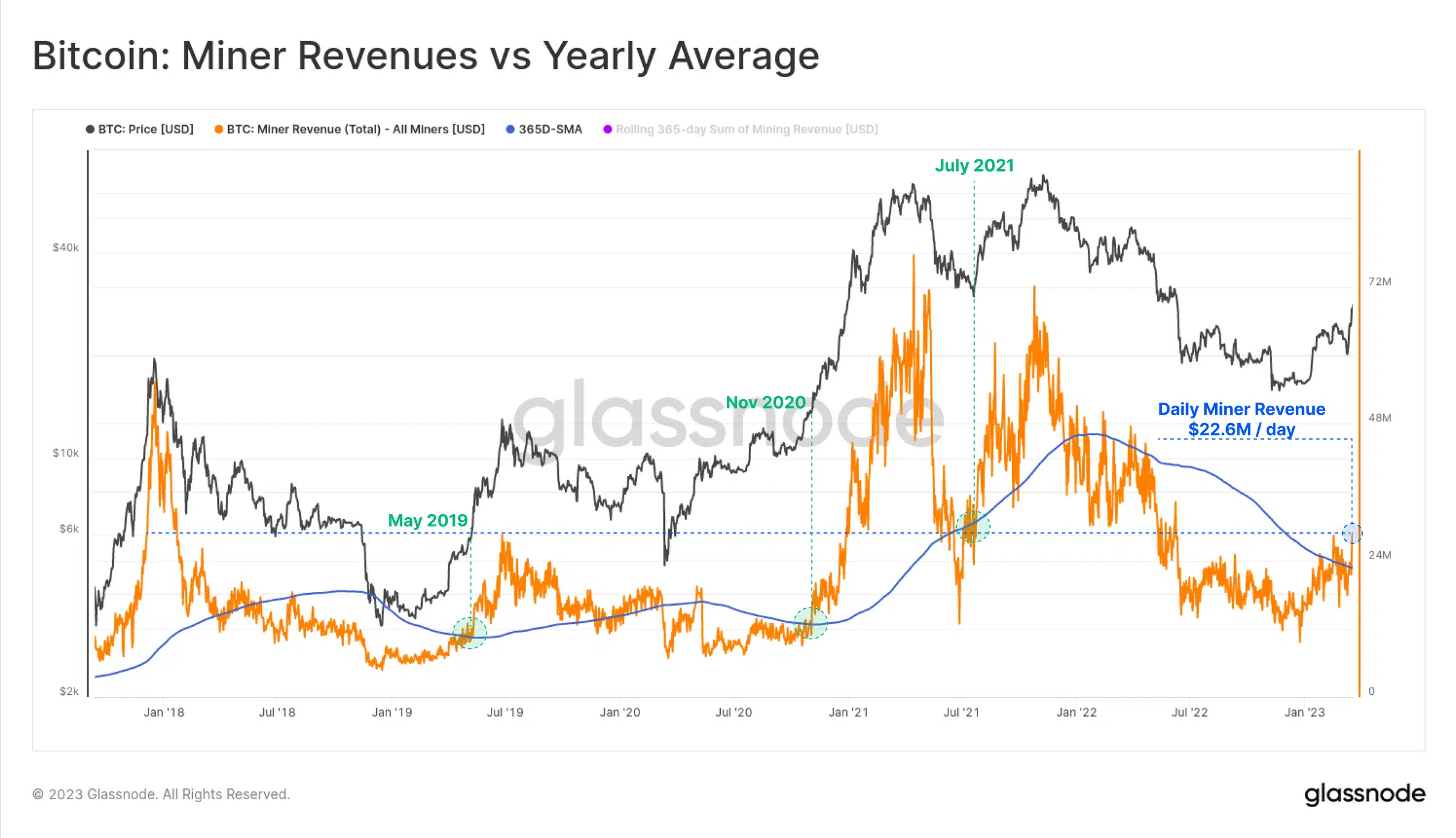

Miners benefited from the increased demand for blockspace, as total miner revenue increased to $22.6 million per day. According to the report, this represented the “highest level since June 2022, breaking convincingly above the yearly average.”

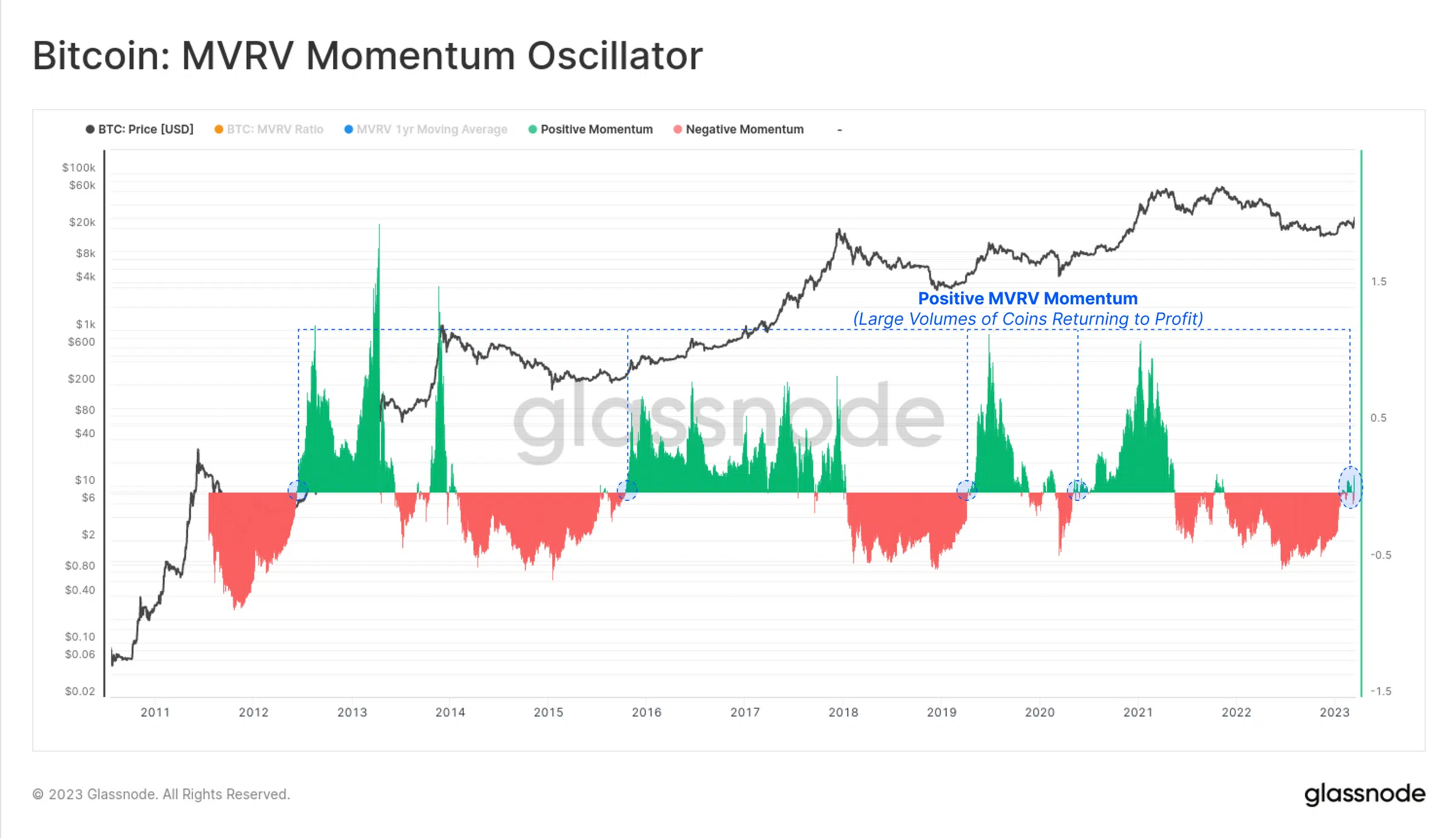

Further, Glassnode assessed BTC’s Market Value to Realized Value (MVRV) metric. This tool is used to assess the relationship between a cryptocurrency’s current market value and its realized value. The on-chain data provider found that BTC’s MVRV Momentum Oscillator had flipped to positive in the last week, and this meant:

“That a large proportion of the coin supply was acquired below the current price, and is now back in profit. Similar to the metrics above, past instances of positive flips tend to also correlate with upticks in network adoption and on-chain activity.”