Bitcoin [BTC] raises hopes of trend reversal; Is Ordinals the reason why

![Bitcoin [BTC] raises hopes of trend reversal; is Ordinals the reason why](https://ambcrypto.com/wp-content/uploads/2023/05/BTC-2.png)

- BTC’s price was hovering under the $28,000 mark, but things could change soon.

- Metrics were bullish on BTC, but market indicators supported the bears.

Bitcoin’s [BTC] price action of late has not been in investors’ favor, as the chart was mostly red. The king of cryptos went below the $28,000 mark once again at press time, creating a furor amongst investors.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Is BTC setting up a trend reversal

According to CoinMarketCap, BTC’s price registered a decline of over 2% in the last seven days, along with a dip in trading volume. At the time of writing, BTC was trading at $27,706.83, with a market capitalization of over $536 billion.

? #Bitcoin's funding rate on @BitMEX is seeing its most negative ratio since the heavy bets against prices in mid-March, just before prices soared. Generally, price rise probabilities increase when the crowd overwhelmingly assumes prices will be dropping. https://t.co/HbTcSouRsU pic.twitter.com/bu1dNDFTcU

— Santiment (@santimentfeed) May 10, 2023

As per Santiment’s aforementioned tweet, BTC’s BitMEX funding rate registered a massive decline since the heavy bets against prices in mid-March, just before prices soared. Price rise probabilities typically climb when the consensus predicts that prices will be falling.

Thus, since the funding rate was low, suggesting less demand in the futures market, the possibility of BTC’s price uptick can’t be ruled out.

Bitcoin to finally take advantage of Ordinals?

Bitcoin Ordinals have been setting new records of late while BTC’s price action suffered. Recently, the number of daily Ordinals inscribed reached an all-time high, as did the Ordinals fees paid. Though BTC remained nascent during the period, Santiment’s data gives hope that the king of cryptos will capitalize on Ordinals’ achievements.

This is what the metrics say

BTC gained popularity among the whales once again, as Bitcoin addresses holding at least 1,000 BTC have been accumulating for the last four days. This was good news, as it reflected the whales’ trust in the coin. BTC’s exchange reserve was also decreasing, suggesting less selling pressure.

In addition to that, Bitcoin’s Binary CDD was green. A green chart indicates long-term holders’ movements in the last seven days were lower than the average, and have a motive to hold their assets. As per CryptoQuant’s data, BTC’s taker buy/sell ratio was also green, suggesting that buying sentiments were dominant in a derivatives market.

Read Bitcoin’s [BTC] Price Prediction 2023-24

The ground reality might be different

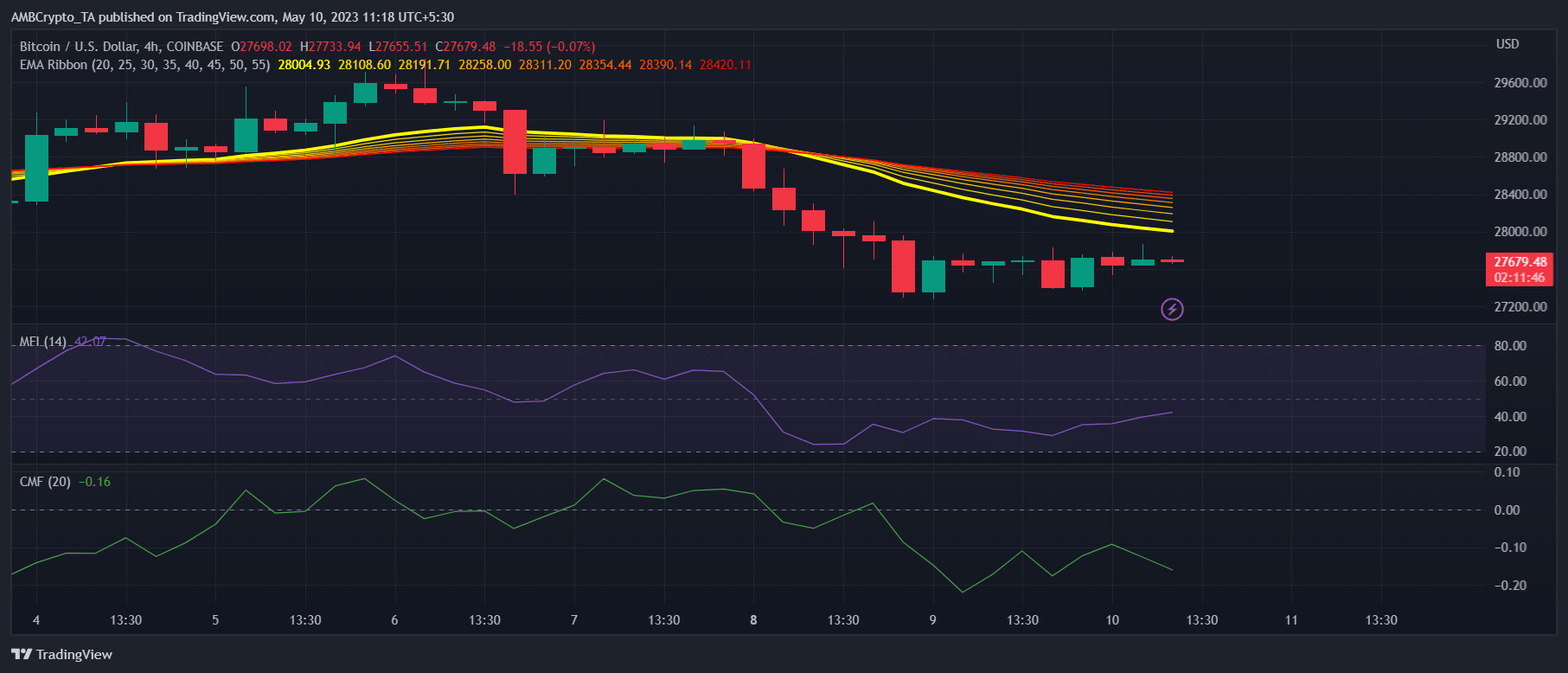

While the metrics were bullish, Bitcoin’s market indicators suggested otherwise. The Exponential Moving Average (EMA) Ribbon revealed that the bears were leading the market, as the 20-day EMA was below the 55-day EMA.

BTC’s Chaikin Money Flow (CMF) also registered a downtick, which was a development in the seller’s favor. However, the Money Flow Index (MFI) gave much needed hope as it registered an uptick.