Bitcoin [BTC] retail investors embrace the crypto winter while whales shy away

![Bitcoin [BTC] retail investors embrace the crypto winter while whales shy away](https://ambcrypto.com/wp-content/uploads/2022/11/1668418688716-e8a321f6-d18b-482c-884b-604ae1d15fe8-e1669635714349.png)

- Bitcoin retail investors have been constantly showing interest in BTC

- However, velocity, volume, and daily activity continued to decline

Bitcoin holders, who have been on the receiving end of selling pressure, could have some reasons for optimism in the coming future. According to a recent update by crypto analytics firm Glassnode, retail investors have been showing an increasing interest in BTC.

Read Bitcoin’s Price Prediction 2022-2023

Bitcoin shrimps take over

Reportedly, the net position of shrimps has grown. Since the collapse of FTX, shrimps added 96k BTC to their holdings until the time of writing. This was an all-time high spike, as these investors held around 1.21 million BTC, which was around 6.3% of the overall Bitcoin supply.

Other retail investors who were holding up to 10 BTC also expressed their interest in the king coin.

#Bitcoin Crabs (up to 10 $BTC) have also seen aggressive balance increase of 191.6k $BTC over the last 30-days.

This is a convincing all-time-high, eclipsing the July 2022 peak of 126k $BTC/month. pic.twitter.com/osjHovLRoV

— glassnode (@glassnode) November 28, 2022

However, even though retail investors showed faith in the coin, whales did not share the same enthusiasm. According to Glassnode, whales were observed to be exiting their positions. This could be due to the fact that there was still a lot of fear around investments, according to Bitcoin’s fear and greed index.

Looking at the data

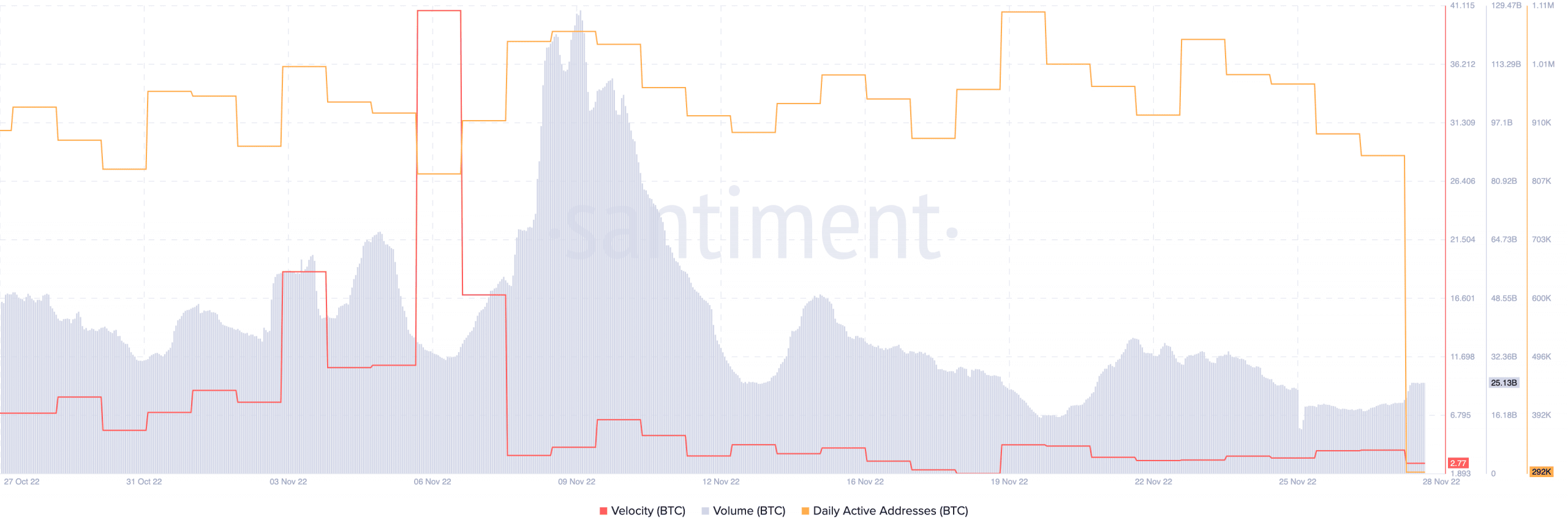

The fear sentiment can be observed in Bitcoin’s on-chain metrics as well. The daily active addresses on the Bitcoin network decreased drastically over the last few days. Along with that, there was a decrease in Bitcoin’s velocity as well, which can be observed in the chart below.

A decline in velocity indicated that the frequency at which BTC was being transferred amongst addresses had reduced. To add to that, Bitcoin’s volume fell by 50%, as it decreased from 50 billion to 25 billion.

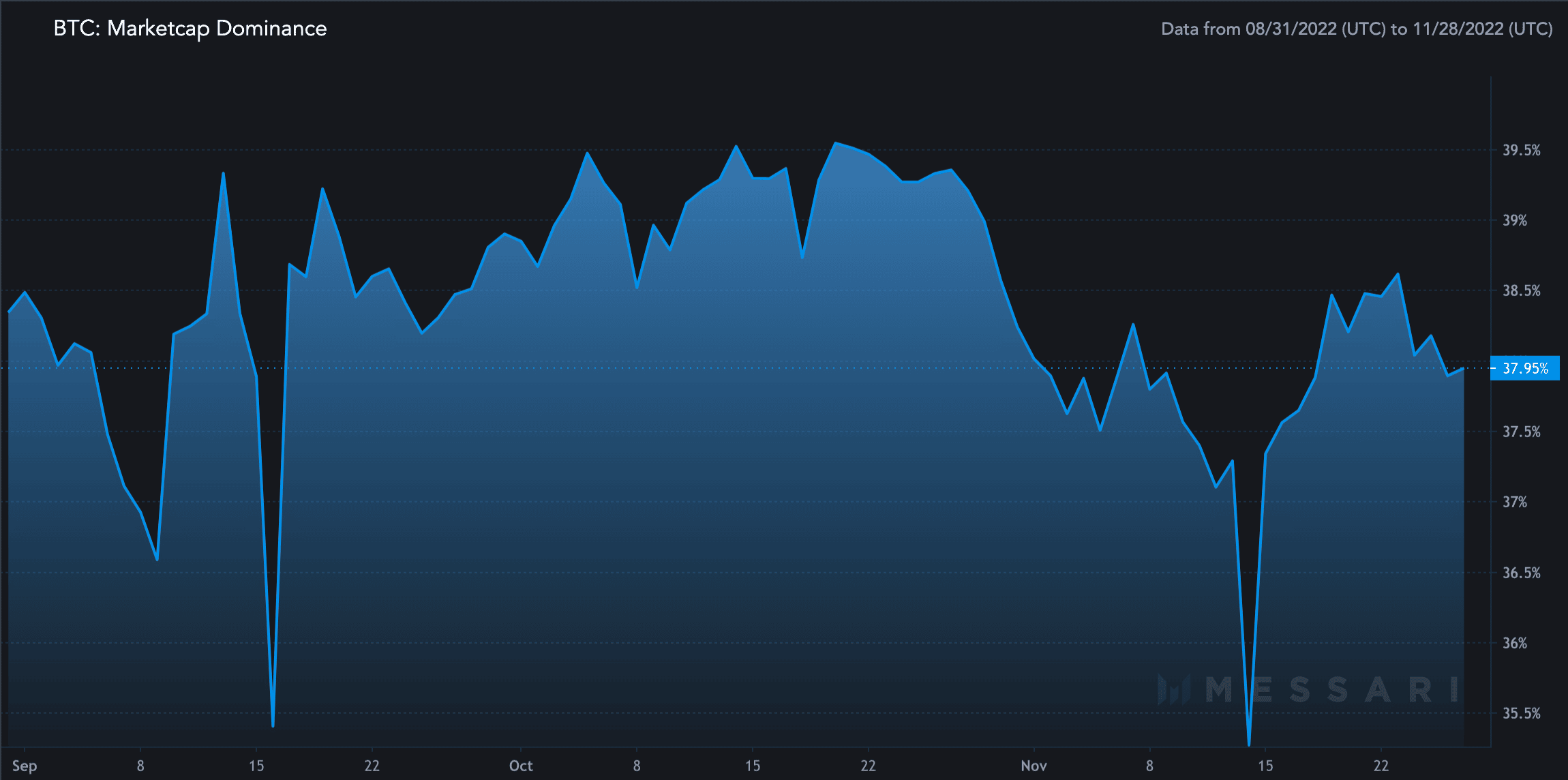

Thus, Bitcoin’s hold on the crypto market has declined due to the aforementioned factors. Its market cap dominance also took a hit by 2.67% in the past month, according to data provided by Messari. It remains to be seen whether interest from retail investors can help prop up BTC’s prices.

That said, at the time of writing, Bitcoin was trading at $16,209.19. Its price had decreased by 2.03% in the last 24 hours, according to CoinMarketCap, and the coin captured 38.48% of the overall crypto market.