Bitcoin [BTC]: Why a ‘theoretical target’ of $21.5K is worth looking at

Bitcoin’s price, at the time of writing, flashed an interesting yet extremely bearish setup, one that has already been breached. Therefore, investors need to tread lightly around BTC and altcoins since a continuation of this trend could lead massive sell-offs.

BTC ready for a massive move?

BTC seemed to be traversing a bearish continuation pattern known as a bear flag. The 52% crash from its all-time high at $69,000 to $32,837 was the price action that created the flag pole. Following this downswing, BTC entered a stagnation period where it formed a series of higher highs and higher lows. Connecting these swing points using trendlines forms an ascending parallel channel known as a flag.

This technical formation highlights the likelihood of a 46% crash if the flag’s lower trendline at $40,0032 is breached. The pessimistic target is determined by adding the flagpole’s height to the breakout point, placing Bitcoin’s price at $21,584.

Bitcoin’s price not only triggered a bearish breakout on 23 April, but it was also rejected at a subsequent recovery rally. This development is a sign that the bear flag’s bearish outlook is already in play.

However, there is one support level at $36,271, one that could put a dent in the bearish scenario. A bounce off this barrier that pushes Bitcoin’s price back into the bear flag could invalidate the setup and also trap early sellers.

Only a weekly close below $36,271 will confirm a bearish outlook and trigger a crash to the $30,000-psychological level. This barrier could also serve as a stale support level after the market makers collect the liquidity resting below the equal lows formed around $29,000.

However, if the retail traders capitulate, the sell-off could extend to the theoretical target of $21,584.

A whale of a problem?

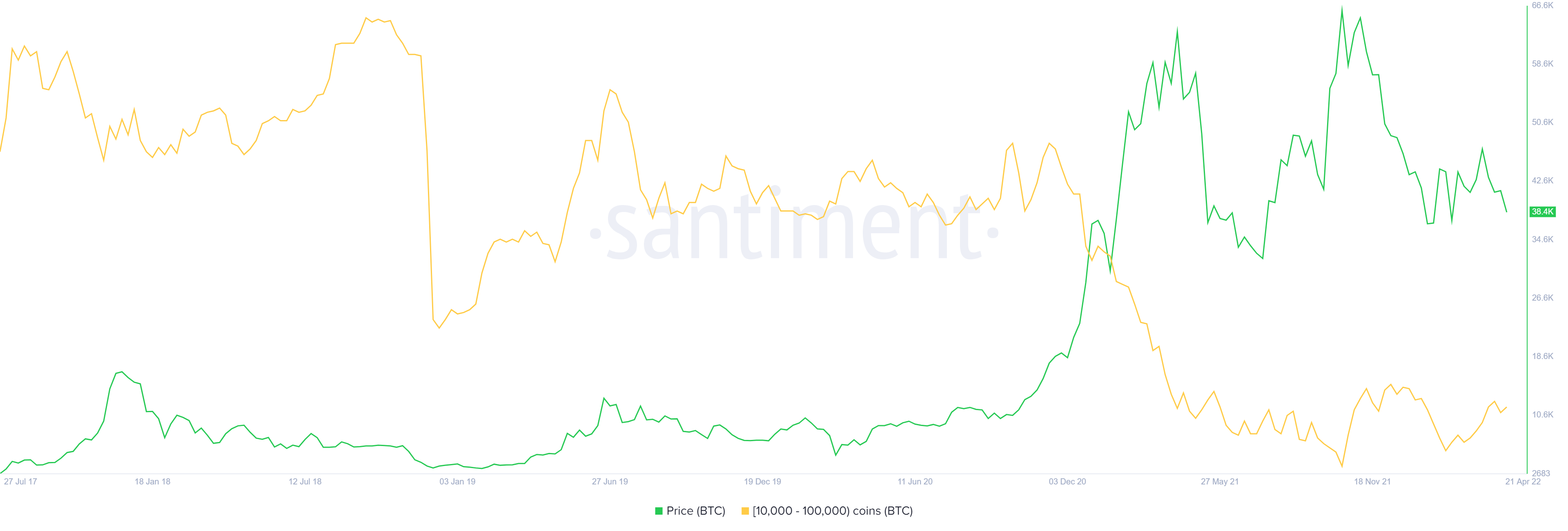

Supporting the bearish thesis for Bitcoin’s price is the offloading whales holding between 10,000 to 100,000 BTCs. These holders have been offloading their tokens since November 2020 and the total wallets have deteriorated from 110 to 83.

This decline indicates that investors are likely selling their holdings and might be expecting a further sell-off. Hence, a better opportunity to enter at a discounted price.

While things are looking up for the king crypto, a failure to move back into the bull flag’s lower trend will result in a bearish outlook. However, a daily candlestick close above $41,000 will create a higher high and invalidate the bearish thesis.

In such a case, BTC could trigger a run-up to $45,000. Here, a local top will form before BTC establishes a support level for further rallies.