Bitcoin [BTC]: Will high network activity affect traders? Assessing…

![Bitcoin [BTC]: Will high network activity affect traders? Assessing...](https://ambcrypto.com/wp-content/uploads/2023/04/AMBCrypto_A_busy_city_street_filled_with_people_rushing_to_and__385bfb73-a68e-4218-9be3-519a064f02c6-e1682846838351.png)

- High activity was observed on the Bitcoin network.

- Retail investors remained hopeful as traders go long.

According to newly available data, the activity on Bitcoin [BTC] network has surged. The total number of transactions carried out on the network has reached a 22-month high of 483,000 transactions.

Bitcoin Transaction Count just reached a 22-months high

The transaction count is simply the number of transactions that have been processed on the Bitcoin network over a given period of time. It reached a high of 483k transactions on a 30D MA.https://t.co/TWortoQO9b pic.twitter.com/Ow1kEf05nA

— Maartunn (@JA_Maartun) April 29, 2023

Read Bitcoin’s Price Prediction 2023-2024

Are Ordinals the reason?

The high activity on the Bitcoin network could be attributed to the growing interest in Bitcoin Ordinals and Inscriptions. Bitcoin Ordinals and Inscriptions have contributed to a large percentage of the overall number of transactions on the network.

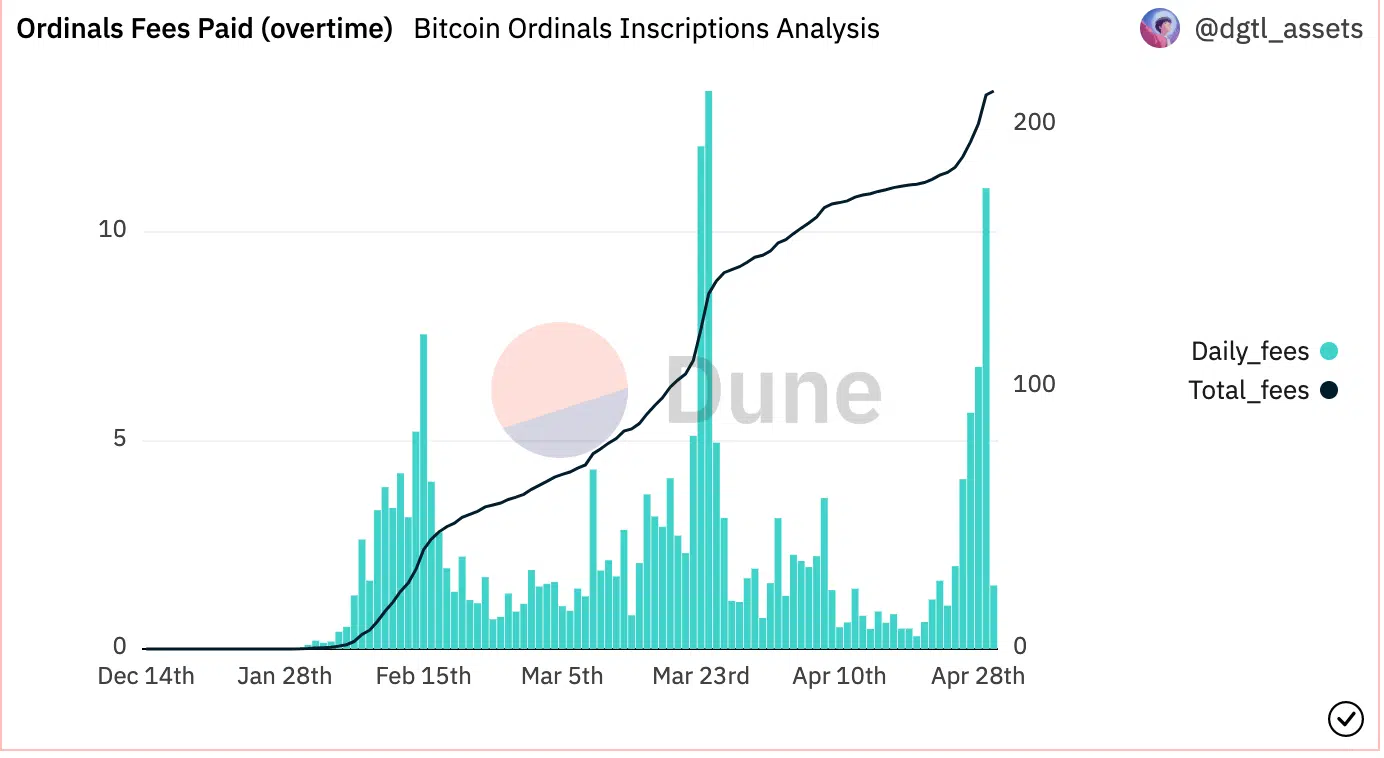

According to data provided by Dune Analytics, the overall fees for Ordinals increased significantly over the last few months.

BTC illiquid supply on the rise

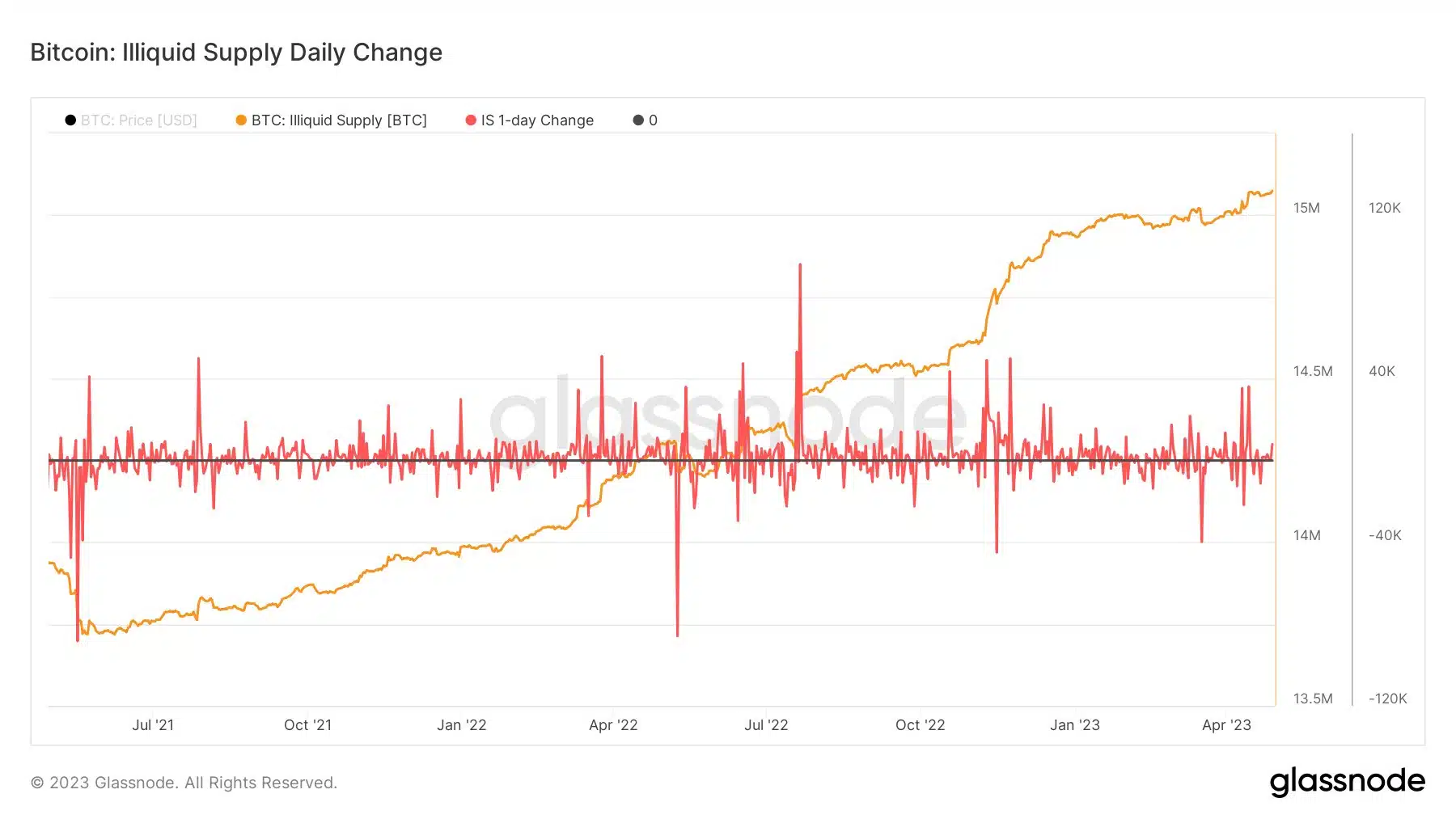

The king coin’s illiquid supply was on the rise as well. The recent surge in Bitcoin’s illiquid supply has resulted in a new all-time high, with 78% of the circulating supply now classified as illiquid.

The illiquid supply of Bitcoin refers to the number of coins that are being held by long-term holders who have no intention of selling or trading it anytime soon.

It is the portion of the circulating supply that is considered to be locked up in wallets or held in cold storage. Thus, making it unavailable for trading on exchanges or other platforms.

The higher the illiquid supply, the lower the amount of Bitcoin available for purchase or sale, which can affect its price and liquidity in the market.

Notably, the illiquid supply witnessed the tenth-largest single-day increase this year. This was because the industry’s instability led to a shift towards self-custody among investors seeking greater control over their assets.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Retail investors remain optimistic

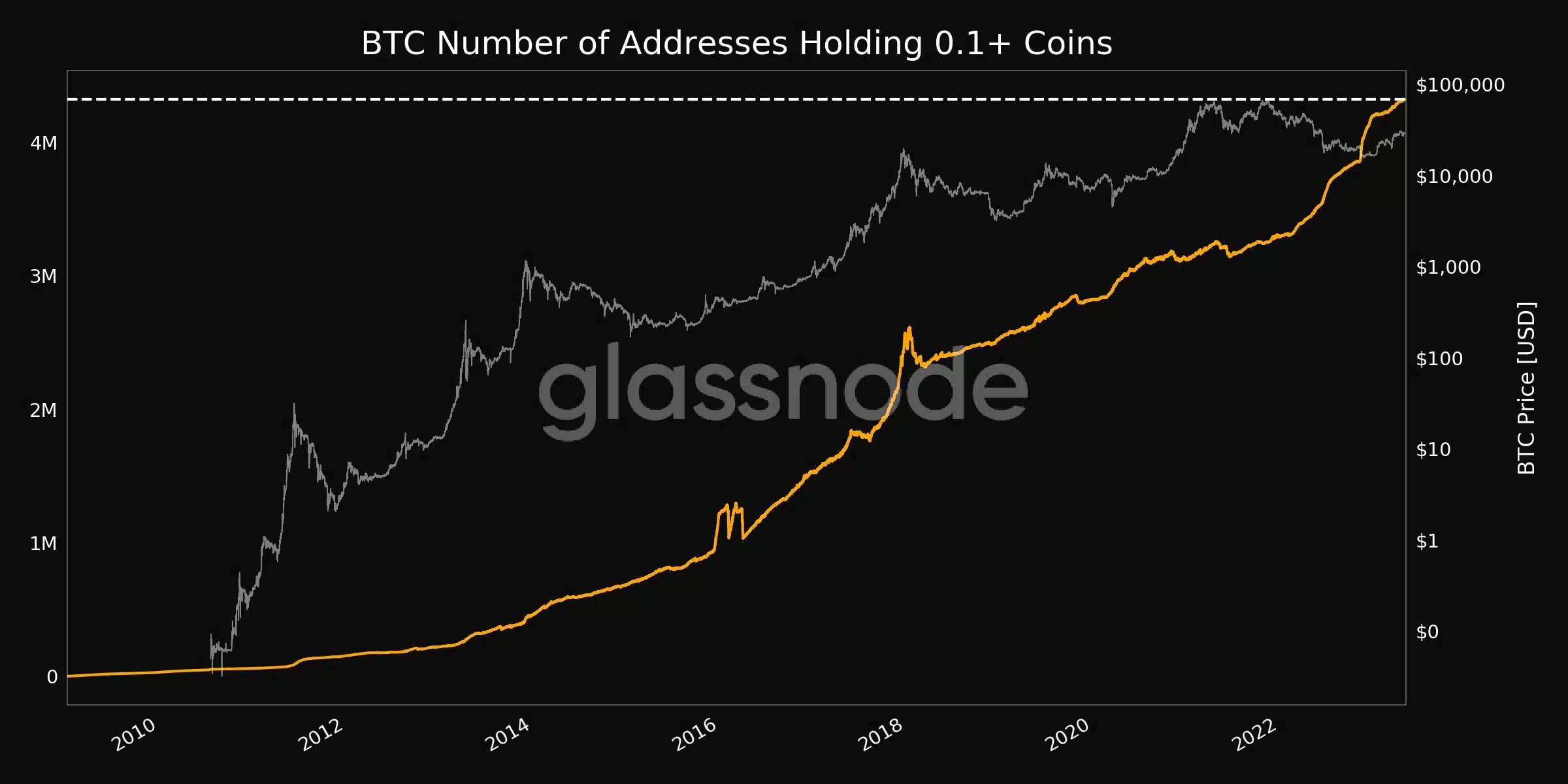

Additionally, retail investors showed their interest in BTC during this period as well. The increasing number of BTC addresses holding more than 0.1 coins was proof of this.

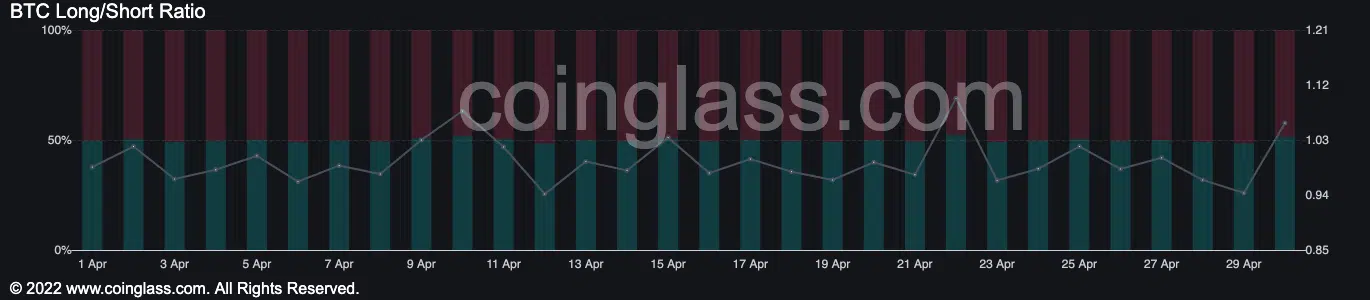

Moreover, traders shared this optimism with the retail investors. Over the last few days, the number of long positions taken in favor of BTC grew from 48% to 51.4%. Only time will tell whether the optimism showcased by the retail investors and traders is justified.