Bitcoin Cash: 200% hike in 10 days spurs hopes of $300

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- BCH outperformed BTC in Q2 2023.

- Whales massively drove price action.

Crypto markets closed Q2 2023 on the green. Bitcoin [BTC] hit a new high of $31.4k and consolidated dominance to 50%, the first in over two years, limiting altcoins’ shine. But PEPE and Bitcoin Cash [BCH] registered stellar performance.

Is your portfolio green? Check out the BCH Profit Calculator

In particular, BCH outperformed BTC, rallying over 200% in 10 days, jumping from $105 to over $300.

BTC posted about 19% gains in the same period. PEPE and BCH’s remarkable performance at the time of writing made them part of the top three on the “Hot Trending” list on CoinMarketCap.

Can bulls maintain the traction?

The RSI (Relative Strength Index) has been in the overbought zone since 21 June – over 10 days. It denotes strong buying pressure in the same period. Similarly, the CMF (Chaikin Money Flow) surged above zero, highlighting massive capital inflows for BCH.

So, the bulls had the leverage to push forward. The next critical hurdle exists at the March 2022 high of $391. But before that, BCH bulls must clear the 78.6% Fib level ($327) and $348 roadblocks further their advance.

Conversely, any faltering at 78.6% Fib level ($327) could set a likely retracement at $273/$276. Bulls are expected to defend these levels to protect recent gains and attempt to clear the recent high at 78.6% Fib level.

How’s the futures market?

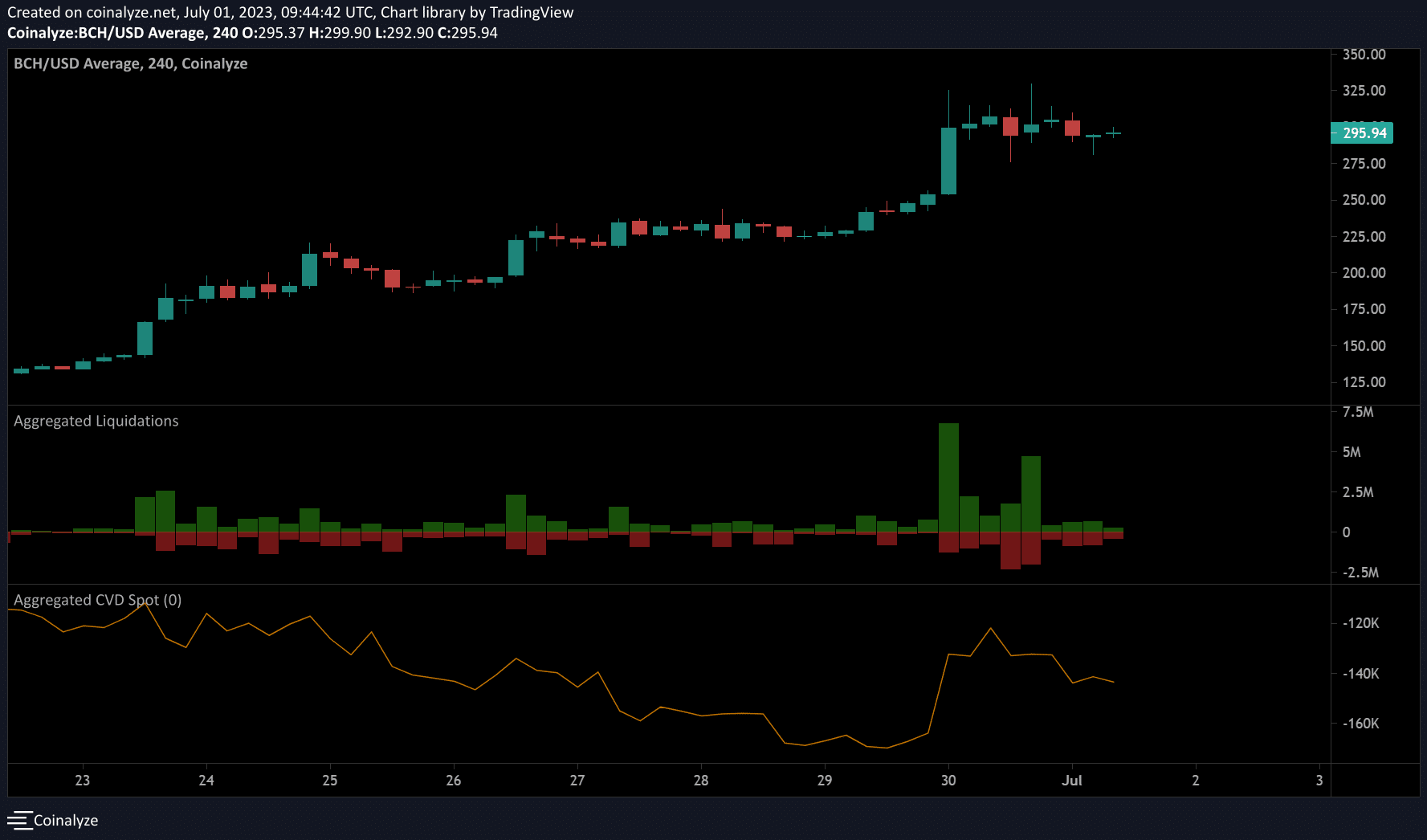

On the 4-hour chart, the CVD (Cumulative Volume Delta) surged at the end of June, denoting increased demand in the same period. However, the metric eased, meaning the rally cooled off, offering short-sellers market entry.

Unfortunately, about $8.7 million worth of short positions have been wrecked in the past 24 hours as of press time.

Read Bitcoin Cash’s [BCH] Price Prediction 2023-24

On the other hand, about $7.2 million of long positions were liquidated in the same period. This underscores a long-term bullish bias and could expose short-sellers to a bear trap.

Santiment shows that the recent BCH price action coincided with strong whale interest from 20 June. Whales were conspicuously no-show from 12 June but slid through from 20 June, setting BCH to a new high in 2023.