Bitcoin Cash [BCH] recovery underway, here are the key levels to track

![Bitcoin Cash [BCH] recovery underway, here are the key levels to track](https://ambcrypto.com/wp-content/uploads/2023/04/image-1200x800-22.png.webp)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- BCH moved up along its ascending line, at the time of writing.

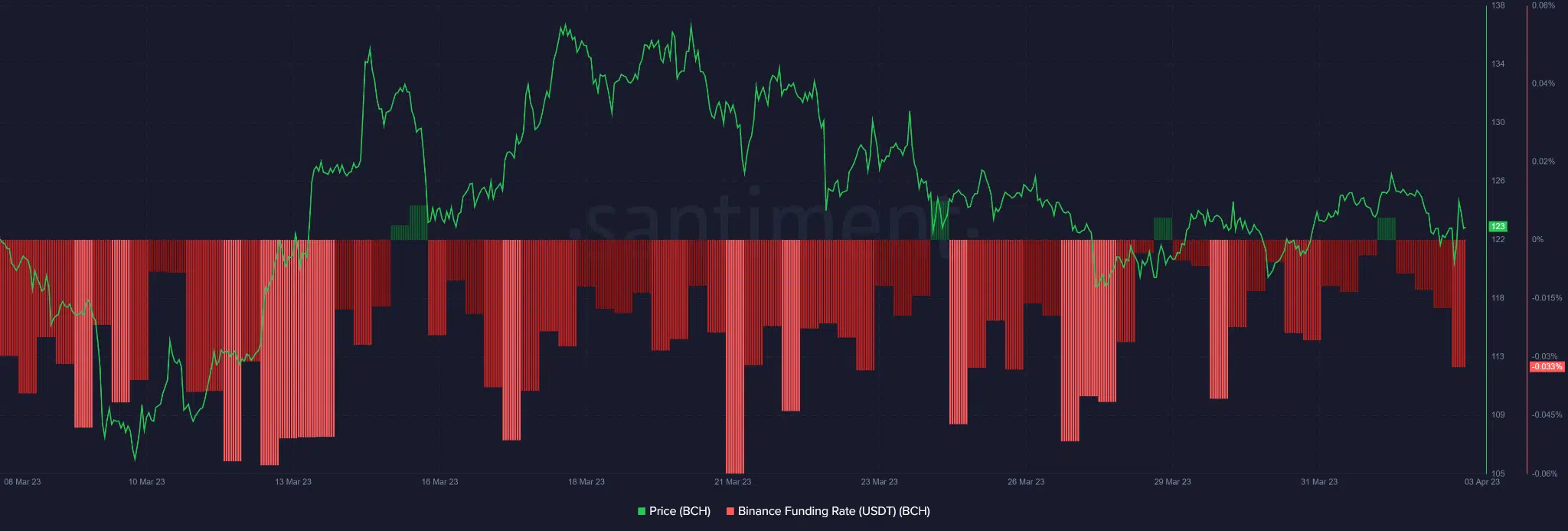

- The funding rate was negative, but quarterly holders outperformed monthly HODLers.

Bitcoin Cash [BCH] retreated from $140 in mid-March and hit $116.5 at the end of March. After that, BCH’s price action has consistently stayed above an ascending line as bulls aim to recover losses in the past few days. But there are key obstacles and levels to watch out for.

Read Bitcoin Cash [BCH] Price Prediction 2023-24

At press time, Bitcoin [BTC] had slightly dropped below $28K but seemed determined to reclaim the price level. A move back to $28K and a surge afterward could push BCH to clear immediate obstacles on its upward path.

Can bulls overcome the obstacles at $127.5 and $130?

In late March, the RSI (Relative Strength Index) retreated from the oversold zone but was almost neutral by press time. It shows buying pressure increased but later slowed due to BTC’s retracement from $28K.

On the other hand, the OBV (On Balance Volume) dipped but showed an uptick – pointing to a likely surge in trading volumes if BTC reclaims $28K.

As such, BCH could clear the obstacles at 200 MA (Moving Average) of $125 and $127.5 if BTC reclaims $28K. A close above $127.5 could tip bulls to retest $130 or surge beyond it, especially if BTC moves to $29K.

A close below the ascending trendline could attract increased selling pressure and flip the structure to bearish. It could see BCH drop to retest the $116 support level.

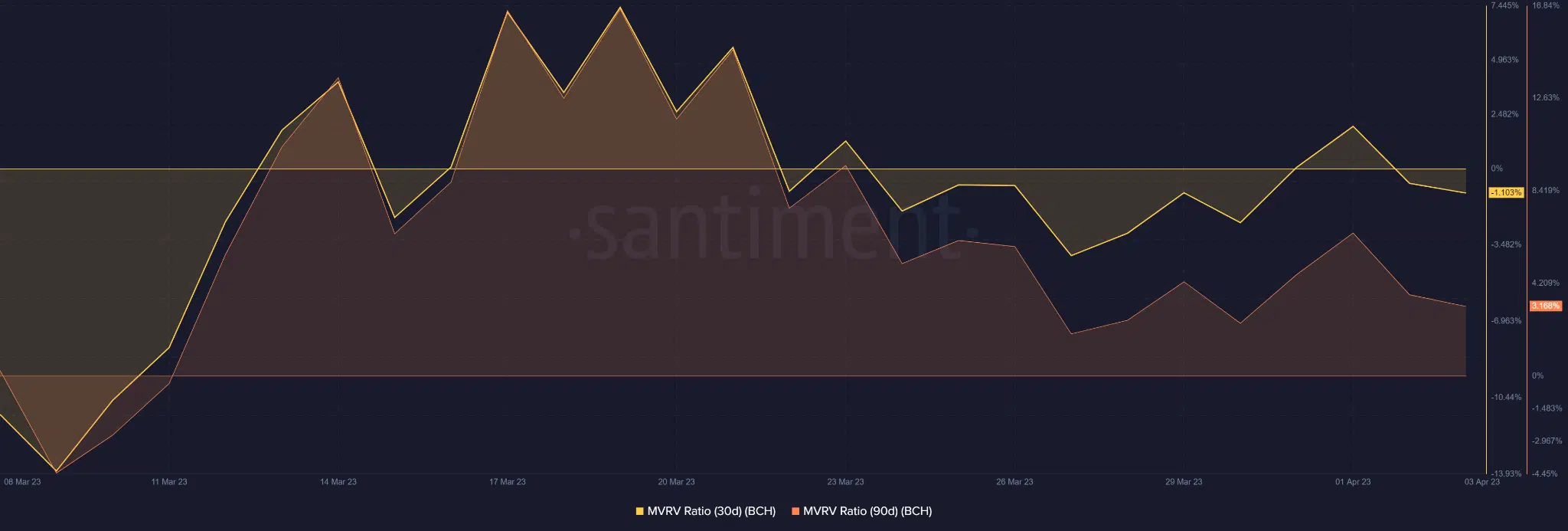

30-day MVRV was negative, unlike 90-day MVRV

According to Santiment, the funding rate remained disturbingly negative in the past few days and could undermine a strong recovery.

Is your portfolio green? Check the BCH Profit Calculator

On the performance level, quarterly holders outperformed monthly holders, as shown by the positive 90-day MVRV (Market Value to Realized Value) at press time. The 30-day MVRV was negative at the time of writing, indicating monthly holders were in losses by press time.

In conclusion, BCH could surge if BTC reclaims $28K, given its strong positive correlation to the king coin. Therefore, investors should track BTC price action for more profit trade setups.