Bitcoin Cash: Is $235 the next target for BCH bulls?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- BCH’s pullback hit a key interest level for bulls around $220.

- Key magnetic areas were around $225 and $235 based on predictive liquidation.

Like Bitcoin’s [BTC] sharp pullback at $30k, Bitcoin Cash [BCH] retraced after hitting $249.7. At press time, BCH was positioned for a price reversal near $220 in the short term based on liquidation data at hand.

Is your portfolio green? Check out the BCH Profit Calculator

Previously, AMBCrypto projected that BCH could hit below $225 before rebounding. The idea was validated, but the drop extended to $206 in early October, affecting some long positions.

What’s next for near-term BCH bulls?

Liquidity and price imbalance on the chart existed at $216 – $225 (white). The price area had a confluence with the 50-EMA (Exponential Moving Average) and a previous breakout level above $220.

At press time, price action hit the above confluence area. The pullback could ease at the area, allowing bulls to attempt market re-entry, especially if BTC doesn’t post more near-term losses. Such a move will shift BCH’s focus to $237 or the price ceiling since August of $241 – $256 (red).

Conversely, an extended pullback will force buyers to re-group at the next support and H12 bullish OB below $210 (cyan).

Meanwhile, the RSI and CMF recorded sharp downticks at press time. It demonstrated the eased buying pressure and capital inflows amidst sharp reversal in the past few hours.

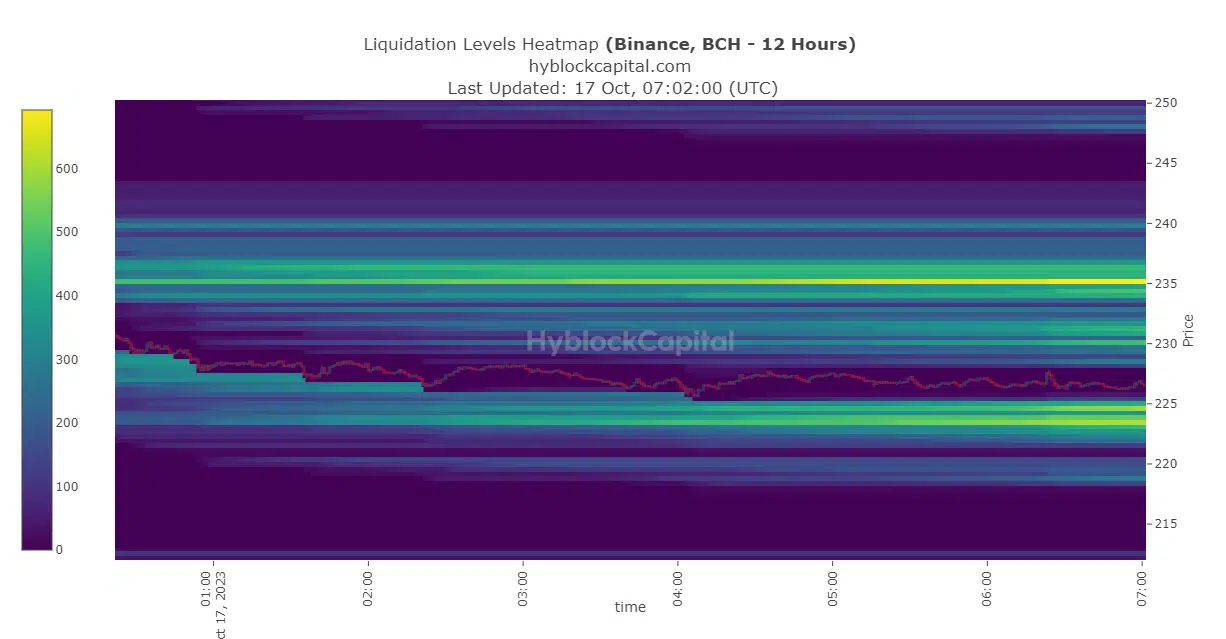

Predictive liquidation marked out $225 and $235

Based on Hyblock’s 12-hour Liquidation Heatmap, key magnet areas (orange) were around $235 and $225. The orange levels are high liquidation zones and could act as support, resistance, or magnetic zones.

How much are 1,10,100 BCHs worth today?

The confluence of $225 with the liquidity on charts suggested a bullish reversal was highly likely in the area. The next bullish target, based on predictive liquidation, would be $235.

However, tracking BTC price action is crucial to confirm the above BCH’s bullish inclination in the near term.