Bitcoin Cash pumps 13% – a rally in the works?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bulls rallied strongly from a critical support level.

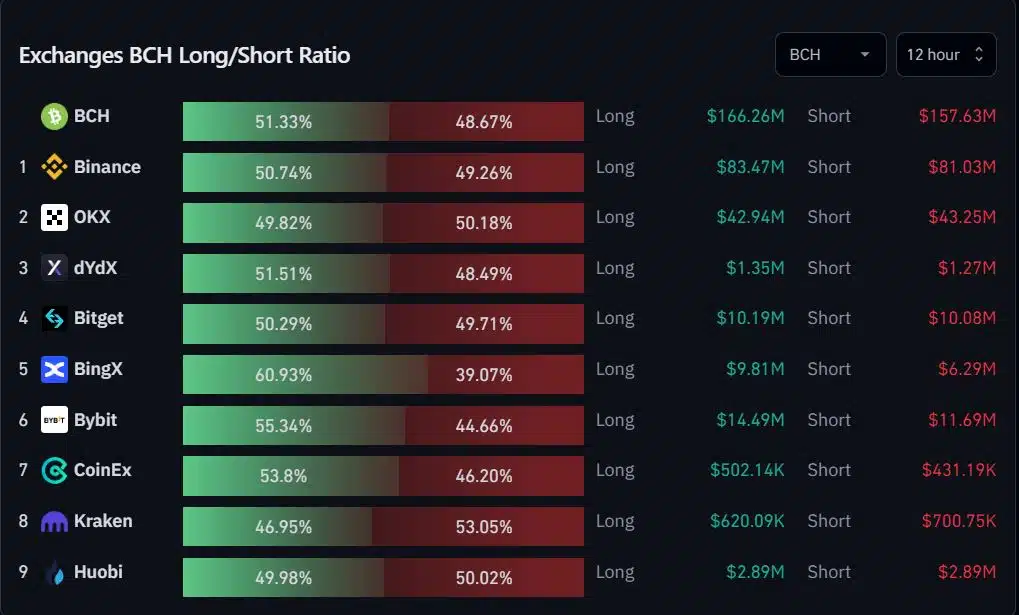

- Longs held a 51.33% advantage in the futures market.

A 13% pump over the past day took Bitcoin Cash [BCH] above the $200 psychological level as of press time, after finding support at the $186 price zone. With Bitcoin [BTC] also hitting the $26k price level, this could lead to more bullish price action for BCH.

Read Bitcoin Cash’s [BCH] Price Prediction 2023-24

Bulls halt selling pressure

BCH has been on a bearish decline since early July. This saw Bitcoin Cash drop from $325 to $165 before finding initial support at the $186 price level.

The 12-hour chart showed that bulls had rallied strongly on 29 August but met resistance at the $220 price zone. A retest of the $186 support level on 11 September led to BCH’s recent rally, with bulls looking to build on.

A long move from the current price level could result in profits for bulls at the $220 – $240 price level. This buying move would be accelerated if Bitcoin continues its bullish rebound.

However, if the king coin dips back under $26k, a shorting set-up could materialize for sellers with targets at $170 to $185.

Meanwhile, the Relative Strength Index (RSI) surged to 60 to highlight the strong buying pressure. The On Balance Volume (OBV) also jumped from 7.7 million to 8.1 million, reiterating the good trading volume for BCH.

Longs were in the majority in the futures market

Is your portfolio green? Check out the BCH Profit Calculator

The short-term bias for BCH in the futures market was bullish. Data from Coinglass showed that bulls held a 51.33% share of the open contracts. This amounted to $166.26 million long positions, which outperformed the $157.63 million short positions.

This hinted that buyers were looking to press home the bullish advantage with more gains in the coming days.