Bitcoin Cash’s halving – Identifying whether it will impact Bitcoin’s future

- Bitcoin Cash’s mining reward per block has been reduced to 3.125.

- Spot ETF approvals might reduce the impact of BTC halving.

In the buildup to the Bitcoin [BTC] halving, which is set to occur in a couple of weeks, Bitcoin Cash [BCH] recently completed its halving process.

Leading up to the BCH halving, there were notable fluctuations in its price. Could these movements indicate what to expect with the BTC halving?

Bitcoin Cash sees a reduction in mining fee

Based on data from Nice Hash, Bitcoin Cash recently halved on the 4th of April at a block height of 840,000. This latest halving event decreased the mining reward from 6.25 BCH to 3.125 BCH per block.

It’s worth noting that BCH halvings occur approximately every four years, with the previous one taking place in 2022 and the subsequent one anticipated for 2028.

While Bitcoin Cash has witnessed notable price fluctuations in recent weeks, it experienced declines over the past few days.

How Bitcoin Cash trended

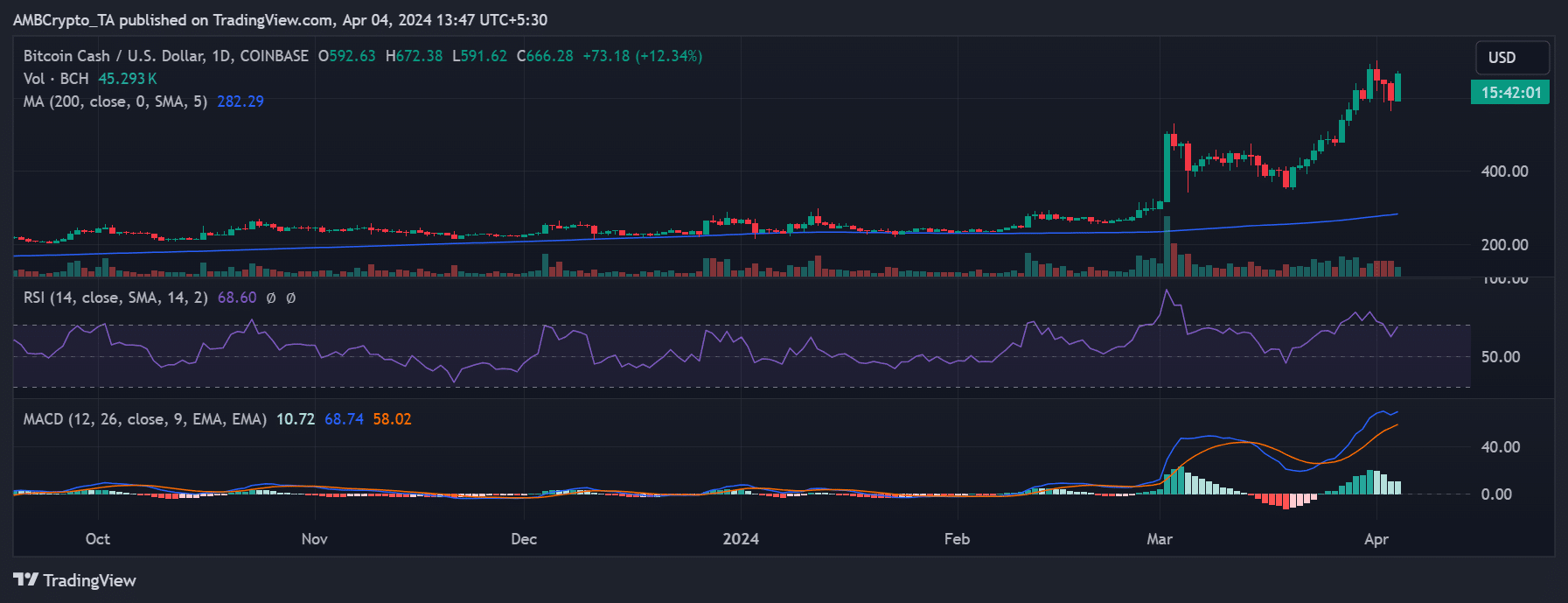

An analysis of Bitcoin Cash’s price trend showed a significant surge of 147.85% over the past three months and a 24% increase over the last 30 days.

However, in the days leading up to the halving event, it experienced consecutive declines. There was an over 9% decline just hours before the halving occurred.

Examining its daily timeframe trend, Bitcoin Cash closed at around $593 on the 3rd of April. However, as of this writing, its price had risen to over $666, marking a remarkable increase of over 12%.

The chart showed that BCH was nearing the overbought zone on its Relative Strength Index (RSI) with this recent uptrend. AT press time, the RSI sat slightly below 70, showing an upward trajectory.

All eyes on Bitcoin

With Bitcoin Cash recently completing its halving, attention now turns to Bitcoin, as its halving event is less than 16 days away.

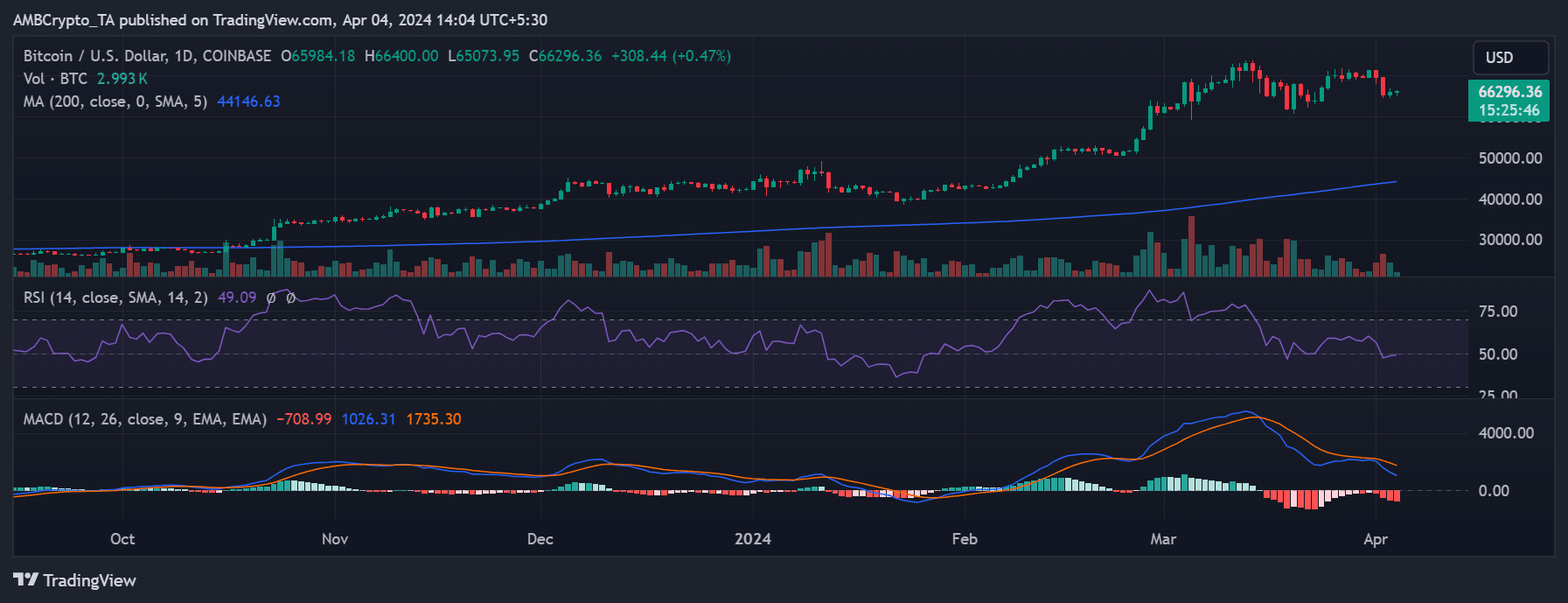

Like BCH, BTC has been on an upward price trend over the past few months. However, its surge has largely been fueled by the anticipation and eventual approval of its spot ETF earlier in the year.

During this period, BTC has achieved new price highs, leading to speculation that it could reach even higher levels before the year concludes.

As of this writing, BTC was trading at around $66,290, with a less than 1% increase. Historically, after the first halving in 2012, BTC surged by 5,500% over four years.

Is your portfolio green? Check out the BTC Profit Calculator

Following the second halving, the increase was comparatively lower, at 1,250%. Bitcoin’s performance lags behind in the current halving cycle, with only a 700% increase observed so far.

The influence of the spot ETF approval may diminish the significance of the upcoming halving event on Bitcoin’s price.