Bitcoin correlation with stocks and bonds rises in August – why?

- Bitcoin’s correlation with U.S. stocks and bonds has increased this month.

- This has been due to an increase in institutional investors’ exposure to the crypto asset.

In the last two weeks, the correlation between Bitcoin [BTC] and U.S. equities and investment-grade bond prices has increased to 40% and 33%, respectively, research firm Kaiko found.

?BTC correlation with U.S. equities and investment grade bonds prices has risen to 40% and 33% respectively in August. ?? pic.twitter.com/MK2tKI08uI

— Kaiko (@KaikoData) August 15, 2023

This suggests that, on average, when the prices of U.S. stocks move, there’s a tendency for BTC’s price to move in a similar direction about 40% of the time.

Similarly, a 30% correlation between the king coin and investment-grade bond suggests a moderate statistical connection. It means changes in bond prices might coincide with changes in BTC’s prices around 33% of the time.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Avengers, assemble!

Typically, the correlation between BTC and these traditional financial assets increase as institutional investors intensify their accumulation of or exposure to the leading crypto asset. An assessment of their behavior in the last month showed a rise in interest among this cohort of investors.

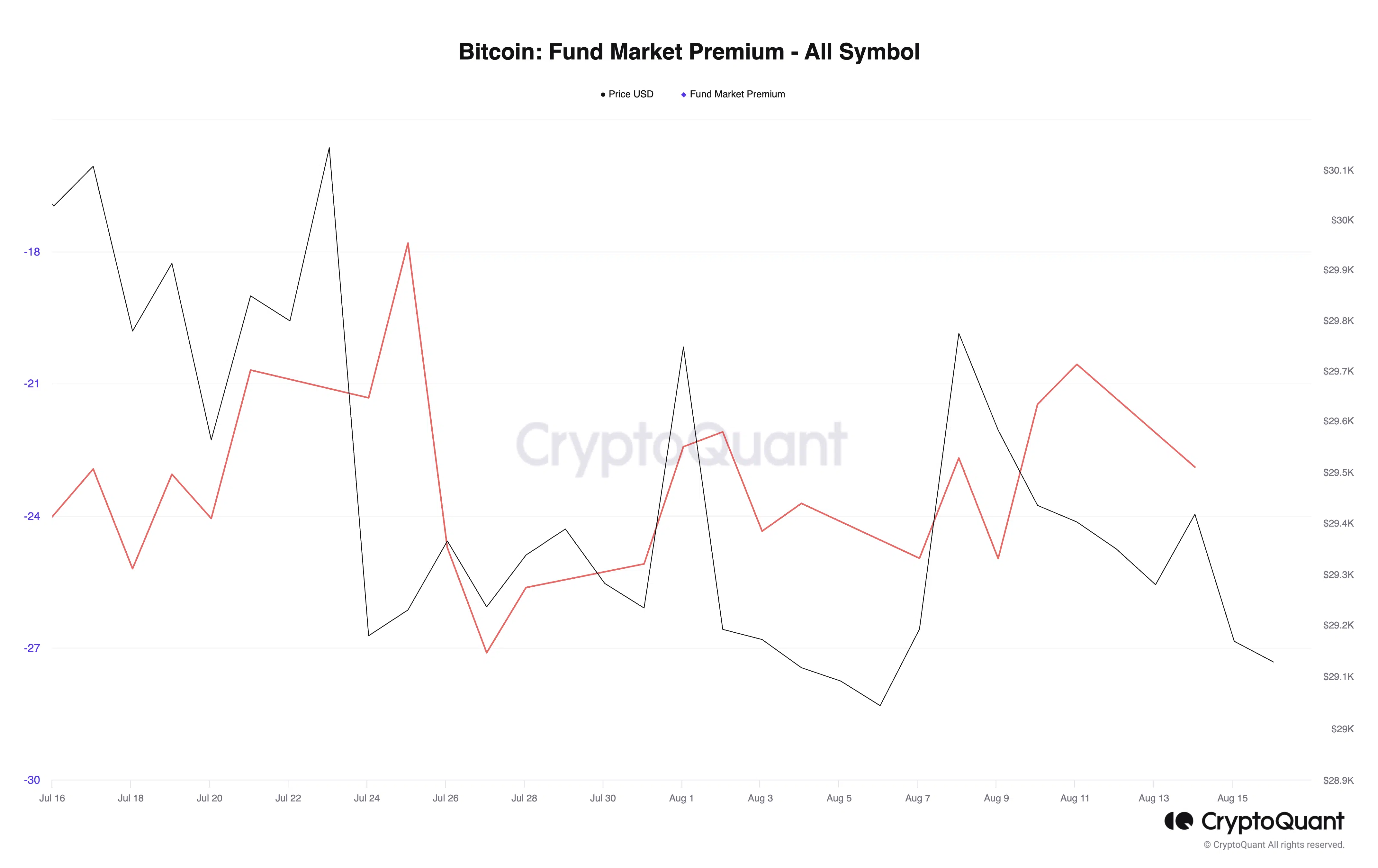

A consideration of BTC’s Fund market premium metric revealed an uptick in investor eagerness over the past 30 days to put their money in investment assets (BTC trust) that derive their price from the coin’s price movements.

Fund Market Premium refers to the difference between the market price of a fund and its Net Asset Value (NAV). A Fund Market Premium can occur when investors are willing to pay more for a fund than its NAV.

This could be due to several factors, such as the fund’s performance, investment strategy, or overall market sentiment.

BTC’s Fund Market Premium tracks institutional investors’ interest in BTC trust. Data from CryptoQuant showed a growth in this metric, suggesting that despite the narrow price movements of BTC, investors have remained steadfast in their convictions.

Is your portfolio green? Check the Bitcoin Profit Calculator

Coinbase is missing in action

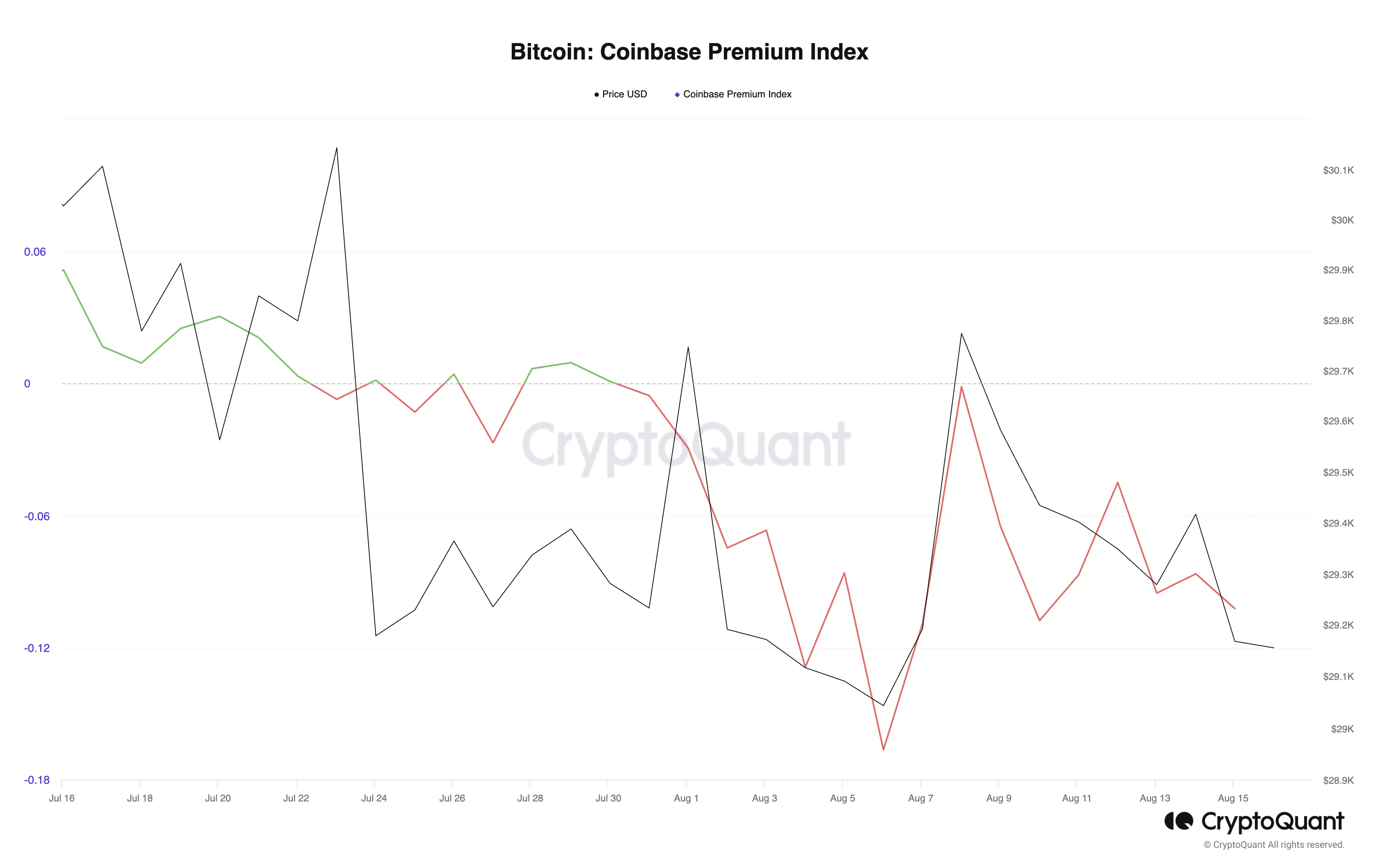

Although Coinbase is the largest U.S.-based cryptocurrency exchange, most institutional investors’ activity in the region in the past month did not occur on the platform.

A look at Bitcoin’s Coinbase Premium Index (CPI) revealed a steady decline into the negative territory during the period under review, data from CryptoQuant showed.

The CPI is a metric that measures the difference between the price of an asset on Coinbase and its price on Binance. When an asset’s CPI value is positive, it indicates strong buying pressure among institutional investors on Coinbase.

Conversely, when the CPI metric returns a negative value, less accumulation activity takes place on Coinbase.

A month ago, BTC’s CPI was 0.05. At press time, it was spotted at -0.10.