Bitcoin price crash alert: Analyst predicts ETF-driven plunge, time to sell?

- The forecast was linked to the sharp drop in inflows to Blackrock’s IBIT spot ETF.

- Long-term holders would book profits on average if they decide to sell their coins.

Bitcoin [BTC] long-term holders (LTH), understood to be the cohort holding the asset for at least six months, become a widely-discussed topic during a bull market. This is because they target this phase for profit-taking after quietly accumulating during the bear market.

LTH selling to increase in the days to come?

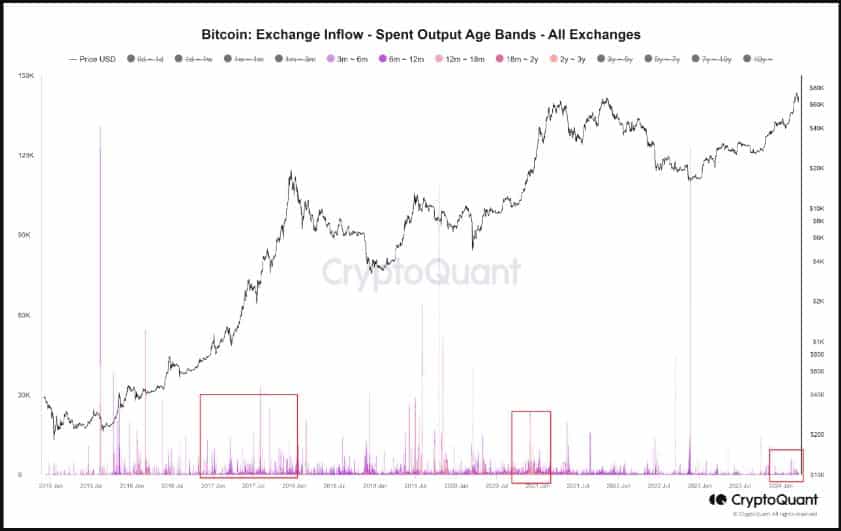

An on-chain analyst and verified author at CryptoQuant drew market’s attention towards a likelihood of LTH increasing their deposits to exchanges in the days ahead, fueling speculation and anxiety.

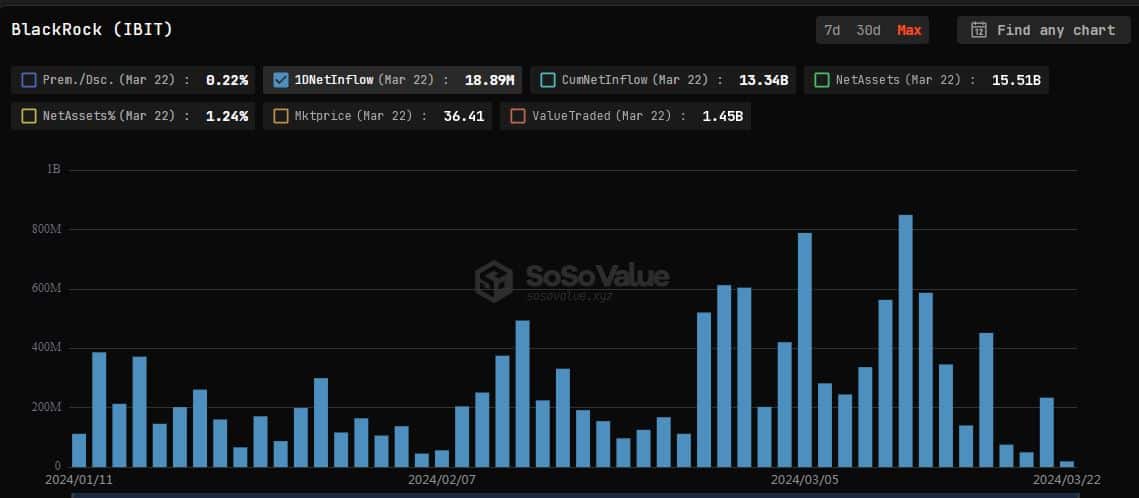

The forecast was linked to the sharp drop in inflows to Blackrock’s IBIT spot ETF, the second-largest in terms of overall holdings, and the one which led the wave of inflows over the past two months.

Indeed, daily inflows into the $15 billion-strong Bitcoin investment fund have been on a downhill after peaking earlier in the month, according to AMBCrypto’s analysis of SoSo Value data.

On the 22nd of March, just about $18.89 million in Bitcoins was purchased, compared to nearly $45 million on the 12th of March.

Explaining the scenario, the researcher stated that most of the transactions between the LTH and BlackRock have happened over-the-counter (OTC) in the last two months.

This meant that despite a sharp drop in their holdings, LTH didn’t have to deposit their coins to exchanges, unlike the previous bull cycles.

However, decreasing inflows to BlackRock suggested that demand was weakening. The researcher noted,

“If this is just temporary, then there may not be any issues. However, if it persists, there is a possibility that long-term holders may start depositing Bitcoin into exchanges in the same way as before. If that happens, the likelihood of price dumping increases.”

Read BTC’s Price Prediction 2024-25

LTH cohort in profit

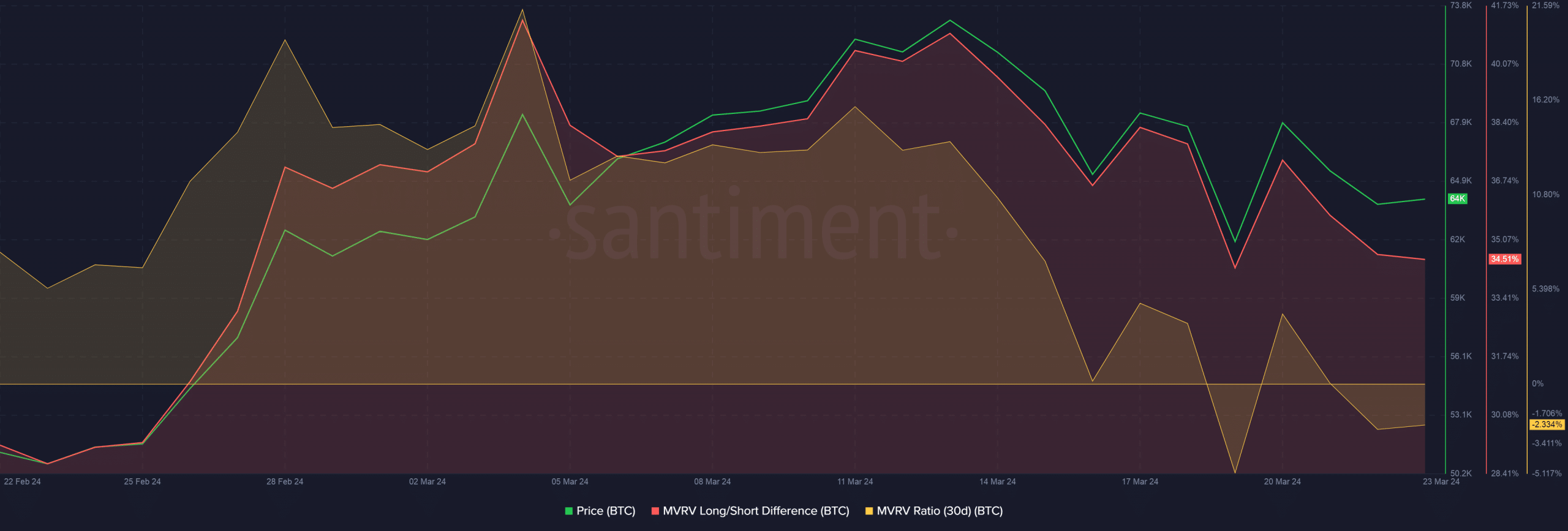

Bitcoin’s sharp descent from the $73k peak clocked earlier in the month impacted the network’s overall profitability. In fact, at press time, Bitcoin investors realized losses on average, according to AMBCrypto’s analysis of Santiment’s data.

Having said that, LTH investors would still book profits if they decide to sell their coins at current price, as evidenced by the MVRV Long/Short Difference indicator.