Bitcoin defies the norm, chooses to grow

- Bitcoin’s Exchange Inflow increased, while the Open Interest decreased.

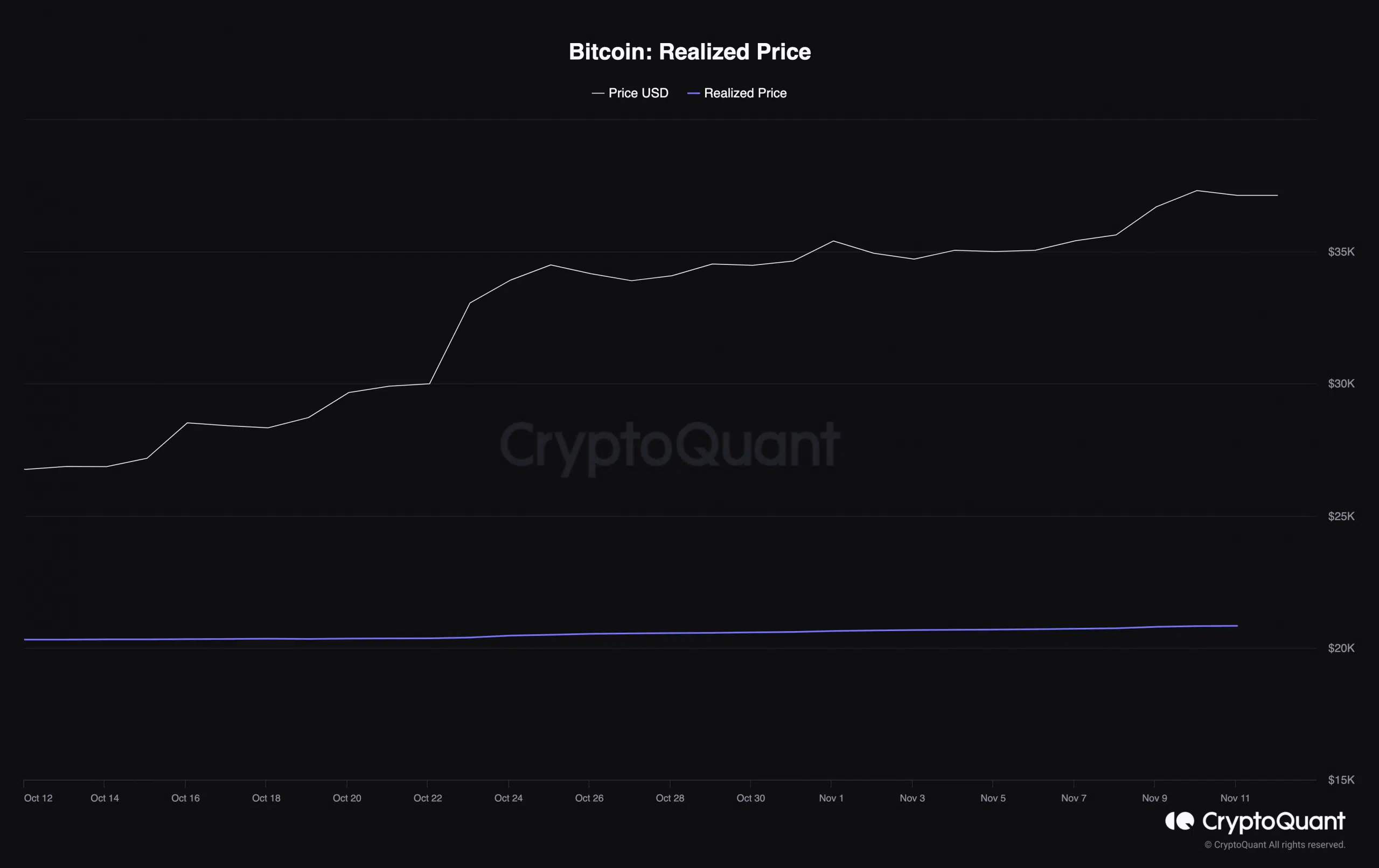

- The Realized Price of $37,134 acted as support for BTC.

A few days back, Bitcoin [BTC] witnessed a spike in Open Interest, indicating an increase in investor faith. But after having the lion’s share of Open Interest, the Bitcoin metric is back on a downtrend, as Axel Adler Jr observed.

Open Interest is typically a measure of total allocated liquidity to futures and options contracts in the market. With respect to the price action, a rising Open Interest can serve as strength for a coin’s value. Conversely, a falling Open Interest might indicate weakness in the price trend.

Falling interest, strengthening value

AMBCrypto, in a report dated the 11th of November, explained why the Open Interest has been decreasing on exchanges. In this report, we mentioned how institutional money seems to be flowing into contracts more than retail.

Another reason mentioned in another report was the growing value of altcoins, and traders’ resolve to capitalize on these price movements. Despite the decreasing interest, AMBCrypto confirmed Adler’s opinion that BTC’s price was not plunging.

When Open Interest is decreasing, it is a sign that traders are closing their positions and typically, the price of BTC decreases, but at this moment, that is not happening!

We are seeing strong demand, which is leading to an increase in price. pic.twitter.com/Efo0Hadiq6

— Axel ?? Adler Jr (@AxelAdlerJr) November 12, 2023

Typically, the usual expectation was for Bitcoin to drop below the $37,000 threshold. But at press time, the value of one Bitcoin was $37,147.

While this circumstance might be unusual, a rigorous search by AMBCrypto gave some insights as to why BTC has maintained the said position. One of the metrics we found to be backing this up is the Realized Price.

The Realized Price is the average price paid by market participants to purchase a coin. Depending on the market direction, this price can either act as support or resistance for Bitcoin’s actual value.

According to CryptoQuant’s data, Bitcoin Realized Price was $37,134 at press time. From our analysis, this value was acting as support for BTC, preventing the coin from losing its hold on $37,000.

BTC kicks again

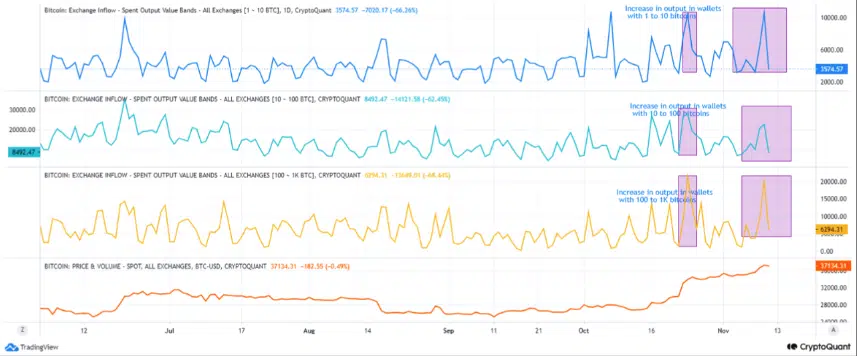

Bitcoin’s defiance of the market expectations was also found in another analysis published on CryptoQuant. This time, it was not Adler leading the insight but pseudonymous author CryptoOnChain.

Is your portfolio green? Check out the BTC Profit Calculator

According to CryptoOnChain, there has been a surge in Bitcoin Exchange Inflow. Also, a chunk of the 55,000 BTCs sent into exchange were remitted by addresses holding between 1 BTC to 1000 BTC.

Additionally, this hike in Exchange Inflow is supposed to trigger a price decrease. But like Adler, CryptoOnChain observed that:

“The last time such a high turnover happened was on October 24. Although apparently this amount of bitcoin has entered the exchanges, this issue is contrary to the current market trend.”