Bitcoin dominance declines as 75% altcoins outperform BTC

- BTC.D has declined by 2.24%, as an investor predicted a new altcoin season.

- 75% of altcoins have outperformed Bitcoin over the past 90 days.

Over the past month, Bitcoin’s [BTC] dominance [BTC.D] has experienced sustained rejection at $58 resistance level.

The constant failure to break out of this stubborn resistance level has brought increased enthusiasm among altcoin holders.

Bitcoin dominance was at 56.71 at press time after seeing a 0.03% decrease over the past day. This is a sharp decline from 58% witnessed a week ago.

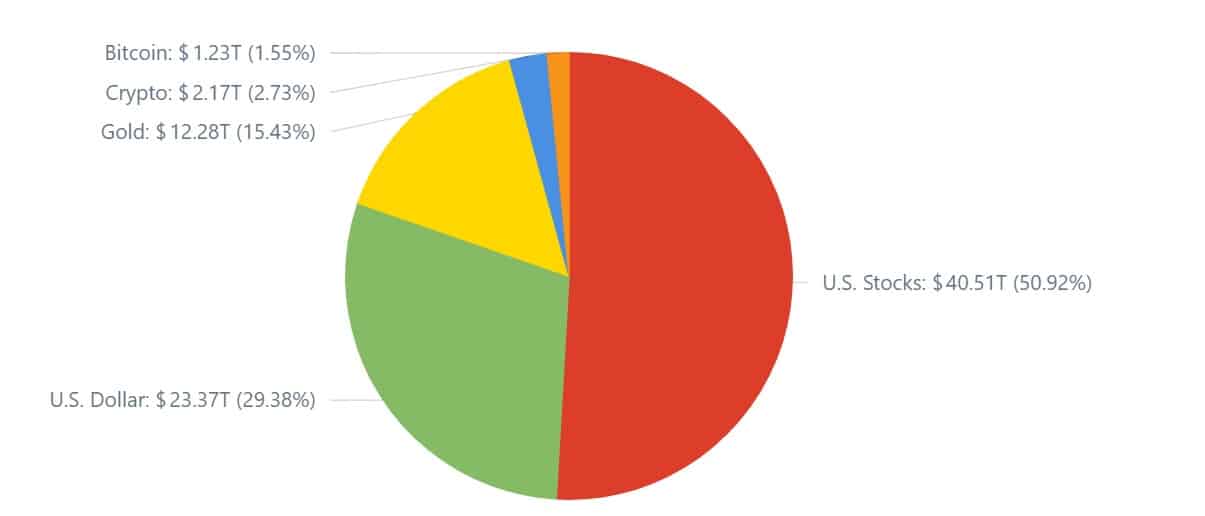

As such, its market cap stood at $1.24 trillion, while the total crypto market was at $2.18 trillion.

Therefore, this decline leaves BTC taking 1.55% of the global assets, which is way below 2.75% of the total crypto assets.

Historically, the BTC.D decline is good news for altcoins, as they tend to surge. Thus, the current trend has left analysts deliberating over BTC and altcoin’s future trajectory.

Inasmuch, Johncy Crypto has suggested a potential altcoin season, citing the formation of a rising wedge pattern.

What BTC.D’s decline means for altcoins

In his analysis, Johncy posited that Bitcoin dominance was forming a rising wedge pattern on weekly charts, which is a bearish signal.

Therefore, a breakdown from this channel will confirm a bearish outlook for the crypto.

As such, if BTC remains trading sideways as it has down over the past week, or bullish while dominance declines, this may signal altcoin’s season.

What this means is that if Bitcoin dominance continues to decline, altcoins will gain more market share, thus positioning altcoins to outperform BTC.

However, one of the best ways to determine altcoin’s performance against BTC is using ETH/BTC ratio.

As such, ETH/BTC shows a 2.40% decrease over the past 24 hours. However, overall, ETH has outperformed BTC. In fact, it has surged by 6.28% against BTC over the past 30 days.

This suggests improved performance by altcoins against BTC on monthly charts, as dominance has dropped from 58% to 56. 71.

Equally, memecoins have made a strong bounce, rising in market cap from $43.7 billion to $50.9 billion on weekly charts.

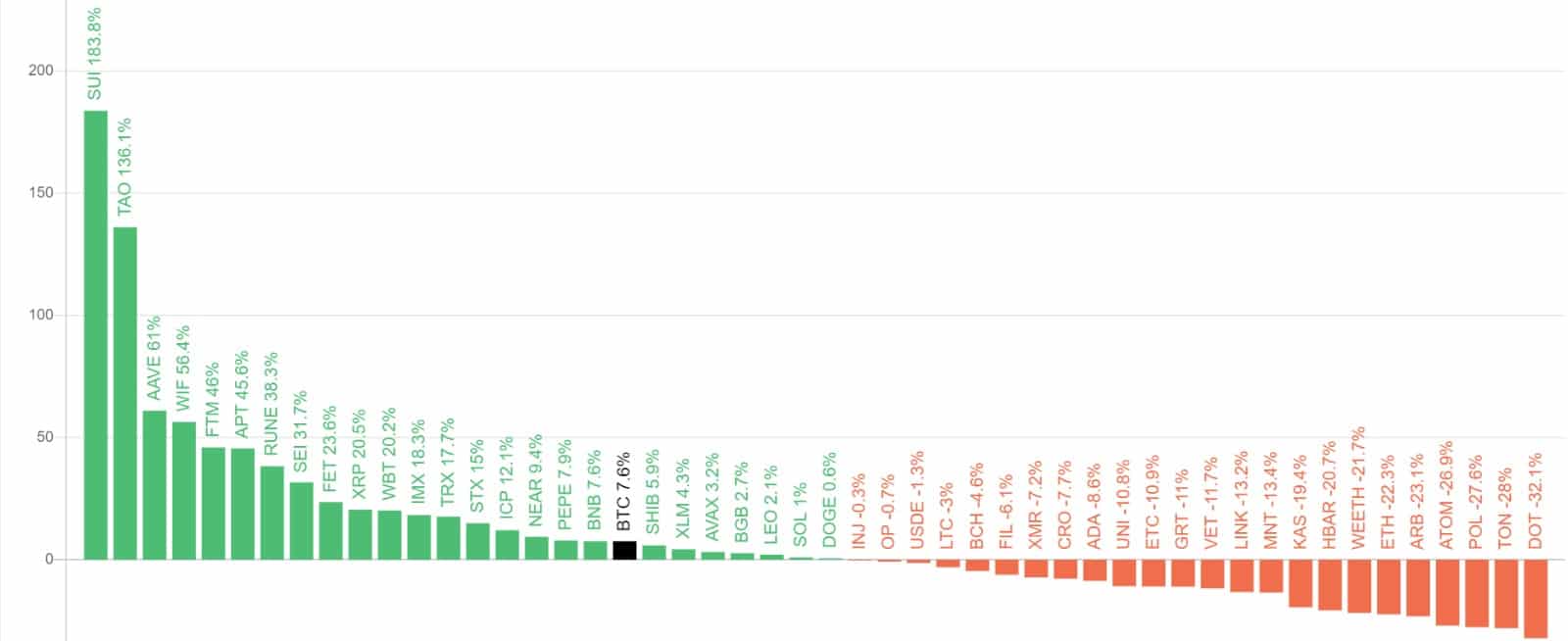

Additionally, various altcoins have outperformed Bitcoin over the past three months. Notably, Sui [SUI] is leading by 183.5%, Bittensor [TAO] by 136.1%, Aave [AAVE] by 61%, and dogwifhat [WIF] by 56.4%.

Therefore, 75% of the Top 50 coins performed better than Bitcoin over the last 90 days.

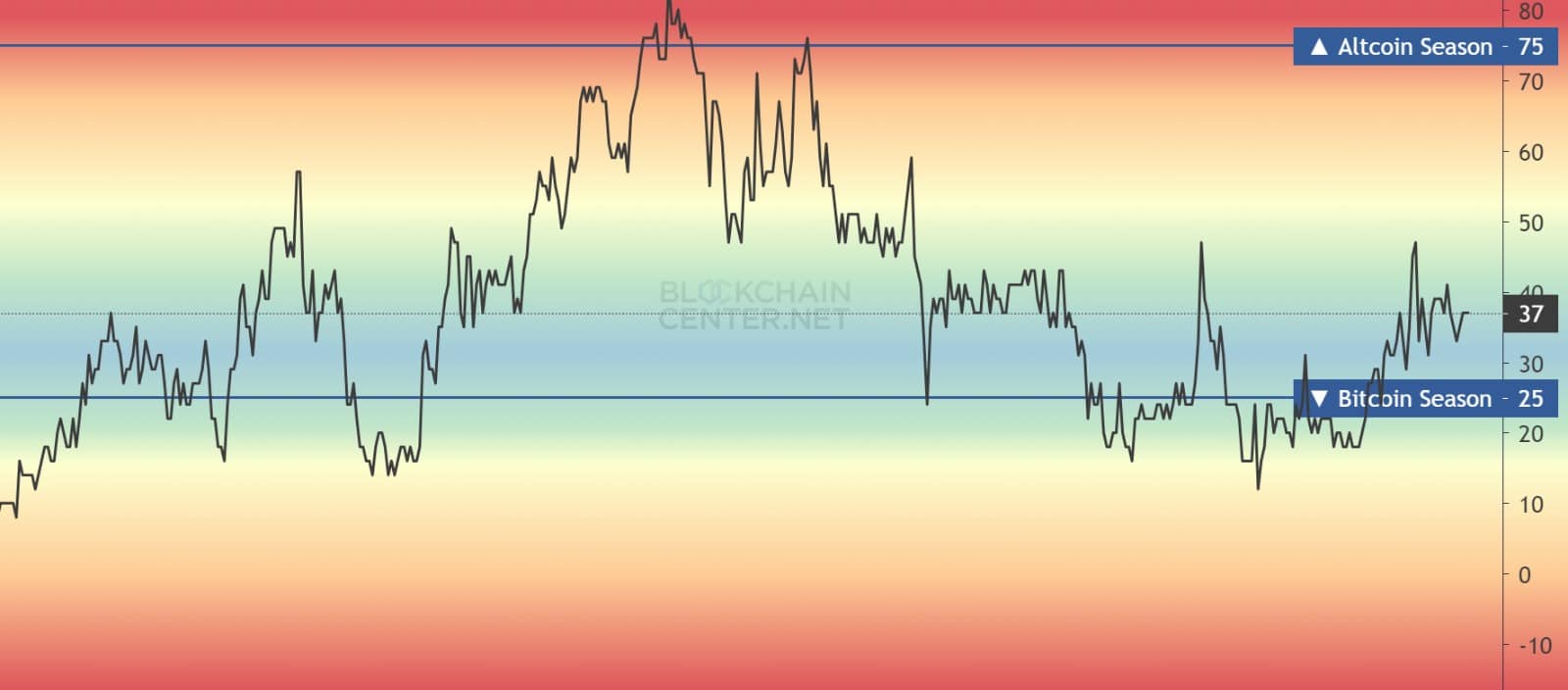

Finally, at press time, the Altcoin season index was at 37, a rise from 33 over the past week and a decline from a high of 47 reached 15 days ago while the BTC season index was at 25.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Such a scenario indicates increased demand for altcoins among investors compared to Bitcoin.

Simply put, the altcoin season is slowly gaining momentum and the potential for an upside continues to rise.

![Ethereum [ETH] targets $1,810 – Will THIS crucial level ignite a breakout?](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-59-400x240.jpg)