Bitcoin ETFs close in on Satoshi Nakamoto, BlackRock leads the charge

- BlackRock’s IBIT now holds over 500,000 BTC, becoming the third-largest Bitcoin holder globally.

- Spot Bitcoin ETFs near Satoshi’s 1.1M BTC holdings, reshaping institutional dominance in crypto.

BlackRock’s iShares Bitcoin [BTC] ETF (IBIT) has emerged as a dominant force in the cryptocurrency market, now holding over 500,000 BTC and securing its position as the third-largest Bitcoin holder globally.

Is BlackRock’s Bitcoin ETF ready to surpass Satoshi Nakamoto’s holdings?

With holdings valued at approximately $48 billion, BlackRock has acquired 2.38% of Bitcoin’s total supply in just 233 trading days since IBIT’s launch.

By offering an exchange-traded product (ETP), BlackRock has provided investors with streamlined access to BTC, bypassing the complexities of direct ownership and reinforcing its commitment to advancing institutional Bitcoin adoption.

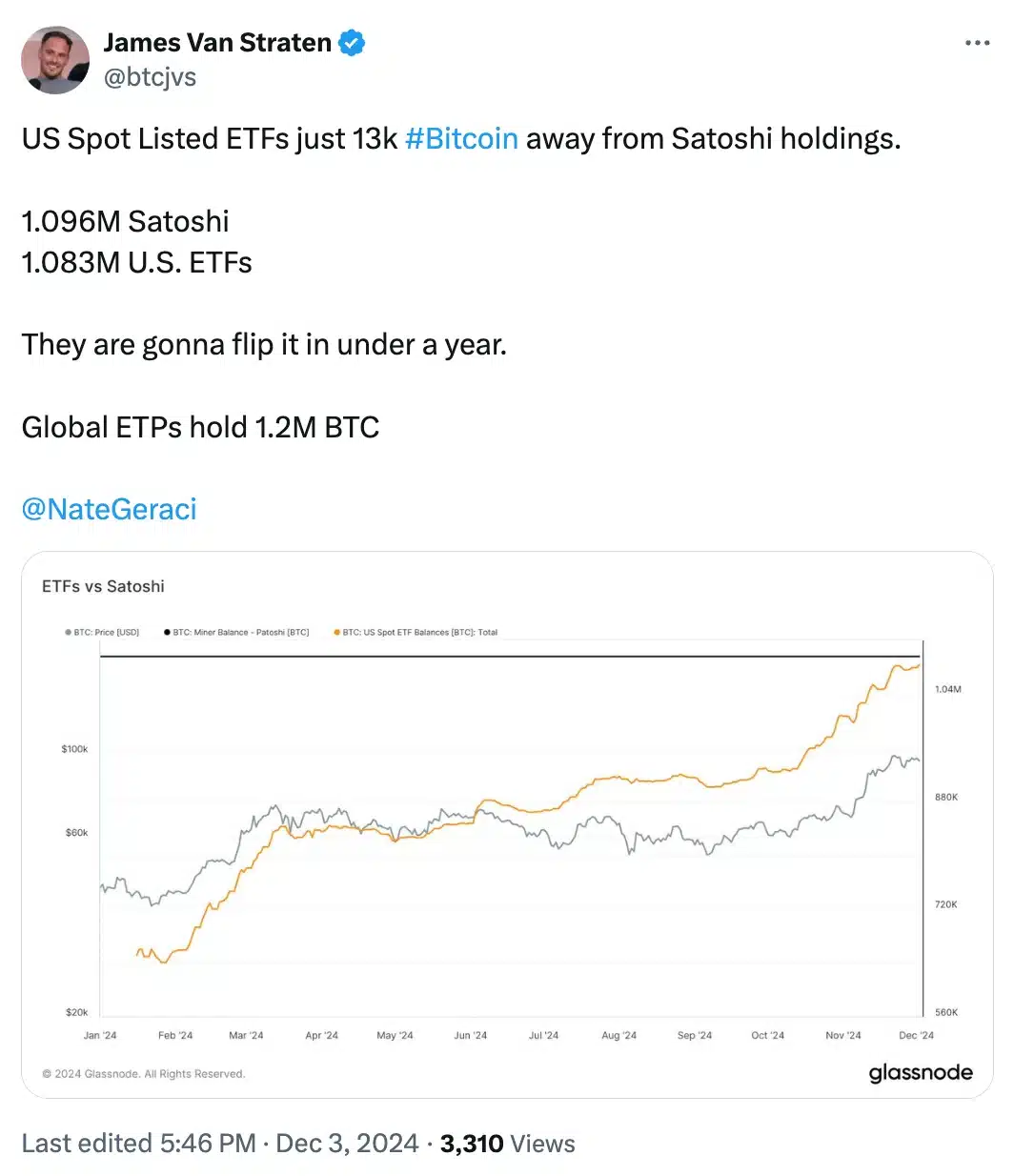

As expected, Satoshi Nakamoto, the elusive creator of Bitcoin, remains the largest individual holder of the cryptocurrency, with an impressive 1.096 million BTC—equating to 5.22% of Bitcoin’s capped supply.

However, the dominance of Nakamoto’s holdings faces potential disruption as U.S. spot Bitcoin ETFs continue their rapid accumulation.

These funds, which already surpassed MicroStrategy’s holdings earlier this year, are now just 13,000 BTC away from matching Nakamoto’s monumental stash.

This race underscores the growing influence of institutional investors in reshaping the Bitcoin landscape.

Spot Bitcoin ETF update

Spot Bitcoin ETFs are rapidly closing in on a significant milestone, with total holdings reaching 1.083 million BTC after a $353.67 million inflow on 2nd December, according to Sosovalue.

In fact, as of the latest update from Farside Investors, BTC ETF saw inflows worth $676 million on 3rd December.

Thus, to match Nakamoto’s 1.1 million BTC holdings, these ETFs would require an additional $1.23 billion inflow at current market prices.

Sosovalue data further highlights that, aside from the Grayscale Bitcoin Trust (GBTC), all other spot Bitcoin ETFs have recorded positive cumulative inflows as of 2nd December as on 3rd December GBTC received zero flows.

Critics never miss the opportunity

However, while optimism surrounds the institutional adoption of Bitcoin, critics within the crypto community voice concerns over potential centralization.

They argue that entities like BlackRock, with its rapidly growing Bitcoin holdings, could undermine the very principles of decentralization that BTC was founded upon.

Designed to empower individuals and reduce reliance on centralized control, the rise of institutional dominance is seen by some as a contradiction to Bitcoin’s ethos, raising questions about the long-term implications for the cryptocurrency’s foundational values.

For instance, one user on X noted,

“There once was a dream that was Bitcoin… this is not it,”

Blackrock’s Bitcoin ETF outshines major Bitcoin holding firms

Additionally, the latest filings by BitcoinTreasuries data show a dynamic shift in Bitcoin holdings among major corporate players.

While MicroStrategy remains the largest corporate Bitcoin holder, with 402,100 BTC following its recent $1.5 billion purchase funded by share sales, institutional ETFs like BlackRock’s IBIT are surpassing corporate treasuries in Bitcoin accumulation.

Meanwhile, crypto miner MARA Holdings has solidified its position as the second-largest corporate Bitcoin holder, amassing 34,794 BTC after acquiring 6,484 tokens for $618.3 million in recent months.

This growing competition highlights the accelerating adoption of BTC among both institutional investors and corporate entities.

Amidst the ongoing buzz, Bitcoin was trading at $96,635.38 after a hike of 1.35% in the past 24 hours as per CoinMarketCap.