Bitcoin, Ethereum Options expiry – $2.4 billion at stake and that means…

- 32,000 BTC and 206,000 ETH Options expiring soon could lead to major market shifts

- BTC, ETH face high uncertainty with elevated implied volatility levels above 60%

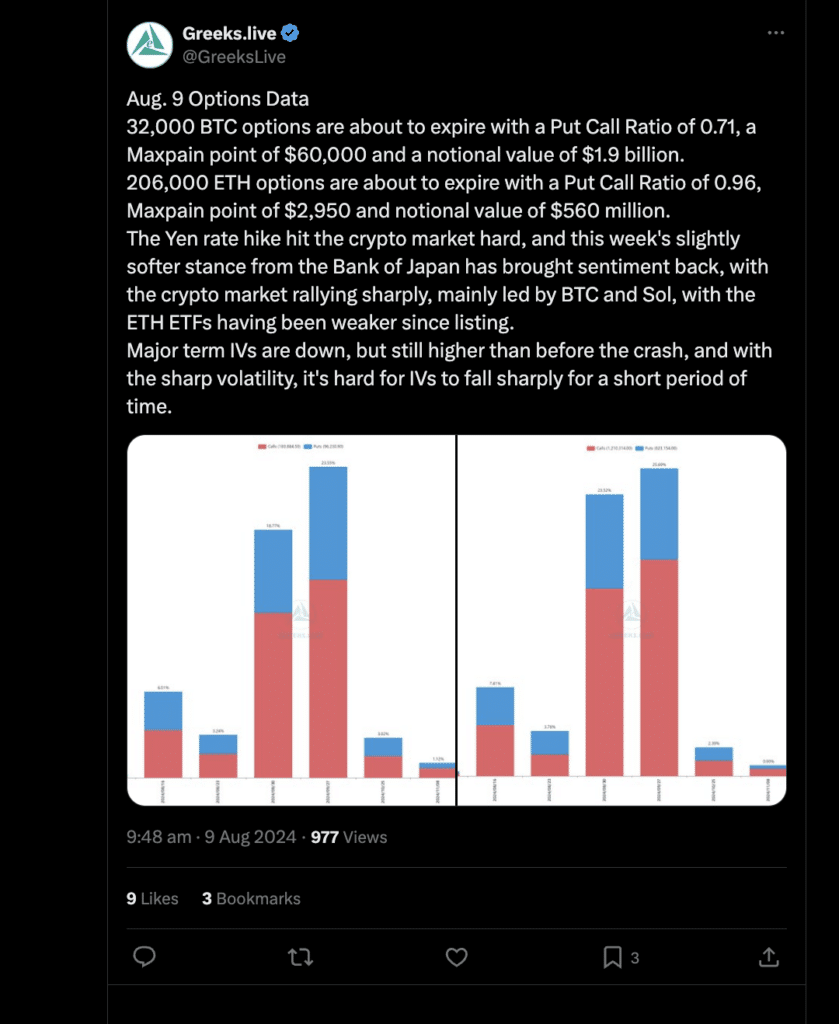

The upcoming expiry of significant BTC and ETH Options is drawing attention from market participants. In fact, according to Greeks.live on X, 32,000 BTC Options are set to expire with a Put/Call ratio of 0.71.

Meanwhile. the max pain point, the price level at which the most Options expire worthless, is $60,000. This expiry involves a notional value of $1.9 billion, suggesting potential market turbulence as prices approach this critical level.

Similarly, 206,000 ETH Options are approaching expiry too. With a Put/Call ratio of 0.96, the sentiment in the ETH market appears more balanced. The max pain point for ETH seemed to be $2,950, with a notional value of $560 million.

Source: X

These expiries could lead to significant market shifts, especially if prices align closely with the Max pain points. This could fuel notable financial losses for Options holders.

Market reaction to macroeconomic shifts

The recent Yen rate hike had a major impact on the crypto market, leading to a temporary decline in prices. However, a softer stance from the Bank of Japan this week has helped the market recover.

Bitcoin (BTC) and Solana (SOL) led this recovery, with BTC prices hitting $60,678.35, marking a 5.99% hike in the last 24 hours. Despite this rally, however, BTC saw a 6.23% decline over the last seven days – Indicating ongoing volatility.

Ethereum (ETH) also registered a significant price hike, rising 7.52% in the last 24 hours to $2,632.92. However, it fell by 16.48% over the past week.

The market’s overall fear index remains high too – A sign of sustained uncertainty despite the recent price rebounds.

High implied volatility and realized volatility

Additionally, Options data revealed that implied volatility (IV) for major terms remains above 60%, suggesting that market uncertainty is still prevalent. The BTC 7-day realized volatility (RV) spiked to 100%, far exceeding the IV level – Signaling sustained sharp price movements.

The high IV is a sign that the market is not expecting volatility to decline significantly in the short term.

Volatility often has a lingering effect, with large price fluctuations leading to extended periods of elevated IV. This trend suggests that market participants should prepare for continued instability in the near future. Options sellers, in particular, may find opportunities to build positions gradually, taking advantage of the strong IV support.

The combination of major Options expiries, high volatility, and ongoing macroeconomic shifts create an environment ripe for potential market swings.

Finally, as BTC and ETH Options near their expiry dates, traders and investors should remain vigilant.