Bitcoin

Bitcoin, Ethereum posted mixed results in July – What does August promise?

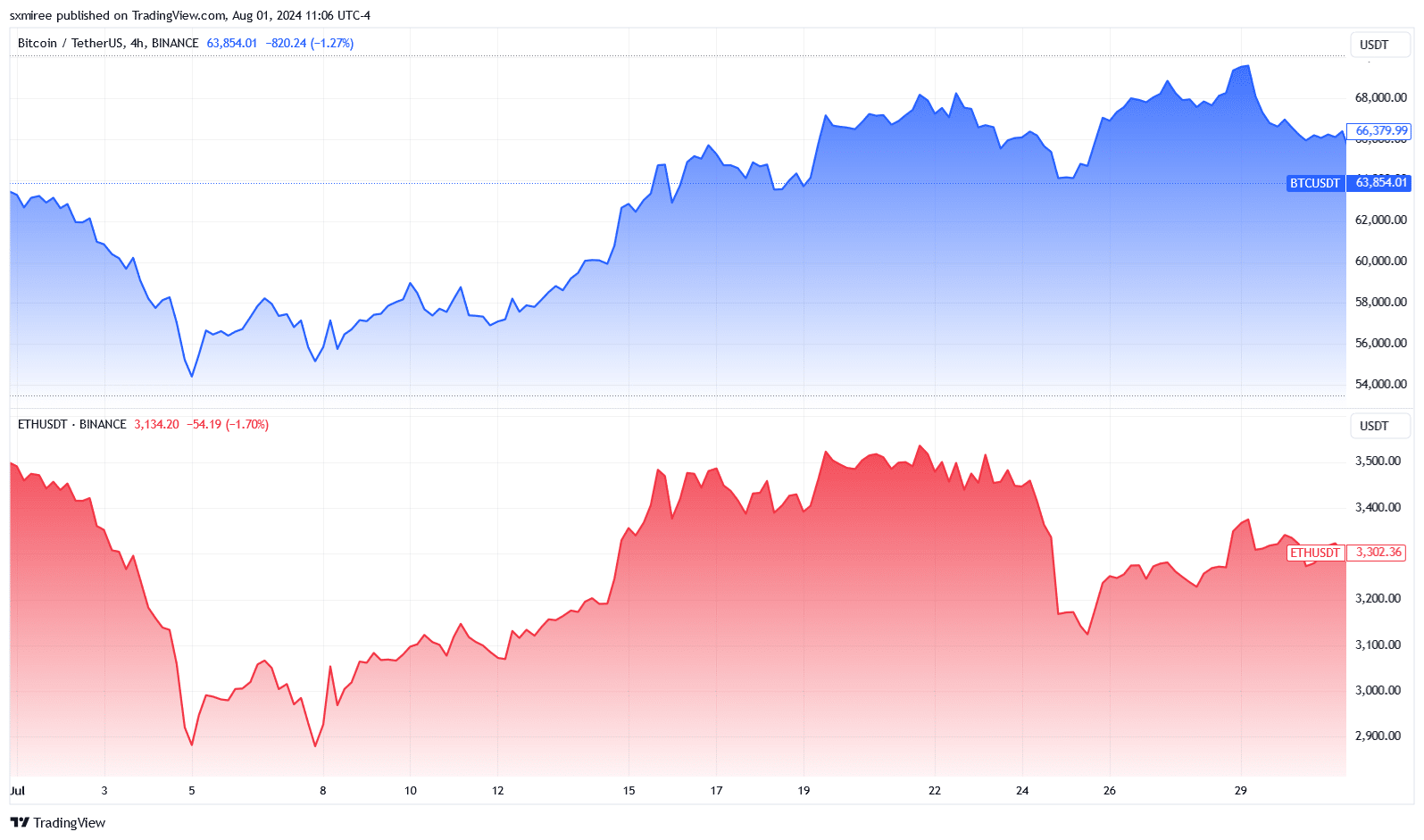

BTC registered modest returns of 3% in July as Ether dropped over 5%. Here’s what will influence price action in August.

- The crypto market saw two-way volatility in July as speculators reacted to events.

- The Federal Reserve held the benchmark interest rate at the current 23-year high for the eighth consecutive time.

Bitcoin [BTC] traded fairly unchanged on the last day of July in the immediate aftermath of the Federal Open Market Committee’s interest rate decision.

Meeting market expectations, Fed policymakers held the benchmark federal funds rate at the 5.25%-5.50% range. With June’s FOMC meeting in the rearview, traders now eye the first rate cut this year in September.

In his remarks after the FOMC meeting, Chair Jerome Powell hinted that there is an ongoing discussion of a September rate cut, whose possibility hinges on strong economic growth figures.

A rate cut outcome would potentially boost liquidity in the market, which would, in turn, be generally favorable for cryptocurrencies.

Trends across July

A mild crypto pullback ahead of the monthly close erased some of Bitcoin’s gains, with Coinglass showing that the flagship crypto managed only 2.95% returns across July.

The meager positive returns nonetheless set the stage for Bitcoin to pursue new yearly price highs.

In contrast, Ethereum [ETH] fared worse, losing 5.88% in the same period despite positive influences, including US-based spot Ether ETFs

going live.Consequently, the ETH/BTC ratio fell across July, shrinking by 10.72% by the end of the month.

Among large-cap altcoins, MANTRA [OM] and Helium [HNT] led as best performers in July, with returns of 44% and 36%, respectively, across the month.

Fantom [FTM], Flare [FLR], and Starknet [STRK], on the other hand, all lost more than 30%.

Expectations for August

A bargaining-hunting theme persisted last month as addresses with a balance of at least 0.1% of BTC’s circulating supply added roughly 84,000 BTC to their stashes, according to IntoTheBlock’s Bitcoin ownership data

.The scoop marked the highest accumulation pace since October 2014.

IntoTheBlock separately reported in an X (formerly Twitter) post that daily new addresses were up by 35% on the 30th of July since touching multi-year lows in early June.

Strategic accumulation by whale and shark investors has historically suggested anticipation of a breakout to the upside from the current ranges.

Renewed inflows of capital into the crypto market further support the bullish sentiment.

CCData noted in its latest Stablecoins & CBDCs report that the total market capitalization of stablecoins grew by 2.11% in July to $164 billion — its highest level since April 2022.

Technical outlook

Bitcoin has been trading between the bounded ranges of $58,000 and $70,000 for five months.

Bullish traders seek to flip the prevailing resistance at $69,600 as it will bring into view $72,000, which presented the next significant barrier to challenging March’s all-time high.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Thus far, bears have fiercely defended the upper boundaries of the prevailing consolidation range, successfully stymieing attempts to crack the $70,000 mark.

Multiple rejections above $69,600 since March indicate that BTC price needs a strong catalyst to overcome the hurdle.