Bitcoin, Ethereum trade secrets revealed; going short might be…

The crypto market’s infamous swinging volatility continues to see different fortunes on a monthly basis. From traders selling their tokens at a loss to betting against the market (hoping for an uptick)- the market has seen it all. But what’s up this time around?

Hold tight

Bitcoin has been falling since reaching an all-time high price of $69,000 in November 2021. Altcoins too witnessed the wrath of the overall market downturn.

In fact, Ethereum fell by 11.45% whereas Bitcoin fell by 9.29%. Likewise, crypto liquidation reached 673 million just two days ago. But here’s something to look forward to as per Santiment, the analytical platform.

Following the market recovery, cryptocurrency exchanges saw high levels of short trades coming in, as people fear drops to June levels again.

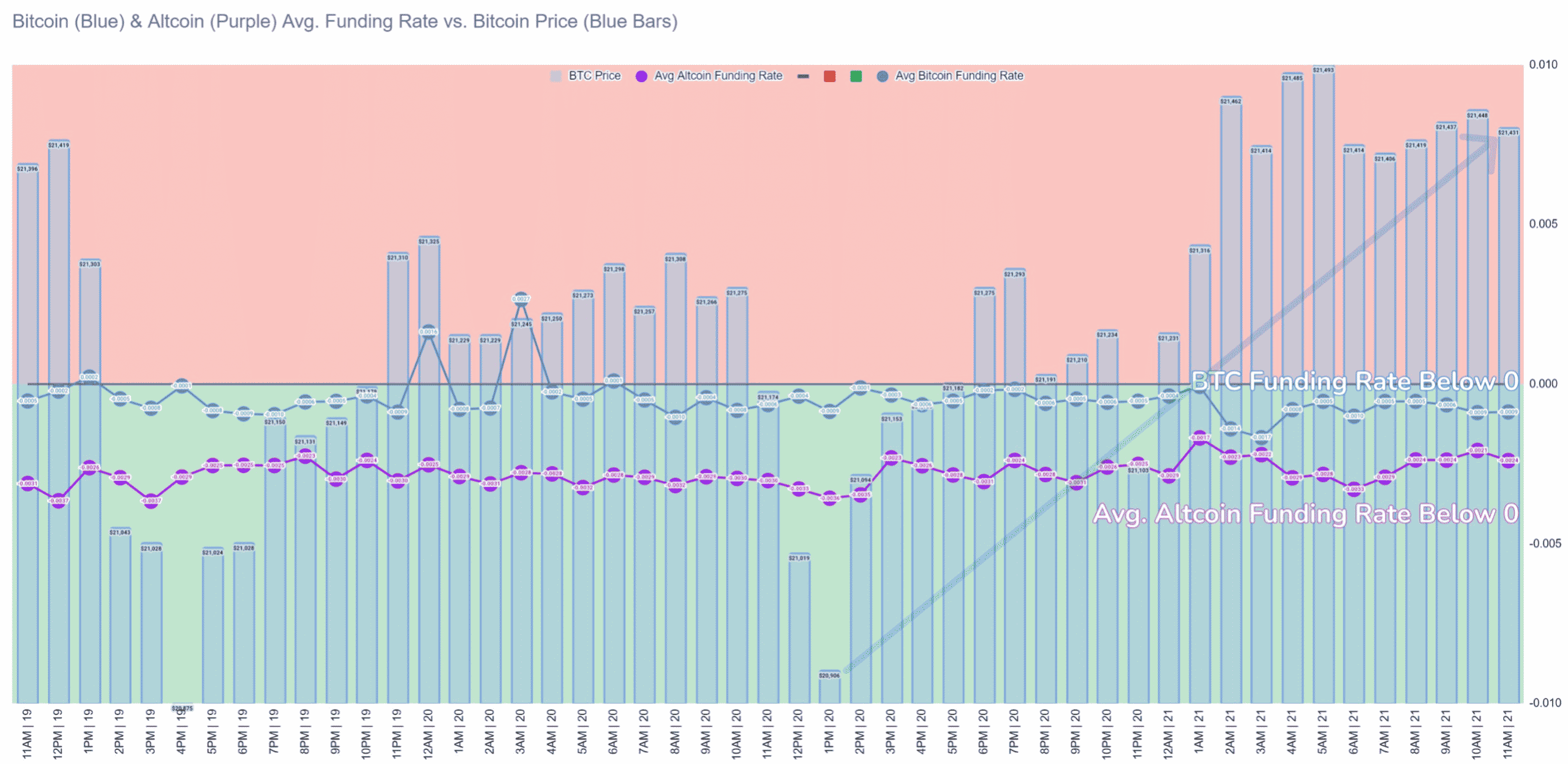

Traders have been betting against the market while the price showed some vital signs of life. The reading of the average funding rate supported this narrative.

The negative funding rate indicated that perpetual prices went below the marked price.

This swift change in funding rates indicated a turn of sentiment from greed to fear. Thus, signaling a potential sign of a bottom.

Ergo, capitalising on this “bearish” mindset, the bet against the market tide made sense for traders. Santiment further added, “as long as they bet against markets, there is a higher chance of a rise.”

Not a bad omen after all

Ki-Young Ju, the CEO of on-chain analytics resource CryptoQuant, also showed how historically, a low funding rate “could be a buy signal.” Consider his tweet from the last year- narrating the same outcome.

In this spot-driven & up-only market, a low funding rate could be a buy signal.

It seems not a good idea to wait for a correction when institutions buying $BTC.

Chart ? https://t.co/yzjLW3MUFD pic.twitter.com/IwolH6kz0c

— Ki Young Ju (@ki_young_ju) January 3, 2021

Needless to say, going against the crowd in a bullish setting could help one to buy cryptos at a discounted price.

Furthermore, the Net Unrealized Profit and Loss (NUPL) indicator surged and turned positive.

Overall, referencing the weighted average funding rate, one can assert that the short-term holders had congested the network, and a rebound could be in play.

In fact, at press time, both BTC and ETH showcased a small surge on CoinMarketCap but the uptick wasn’t significant enough to help the cryptocurrencies surpass the near-term resistance level(s).