Bitcoin: Evaluating if BTC will invalidate its current bullish bias

Bitcoin [BTC] has been making amends of late especially considering the king coin’s performance in the first half of 2022. BTC, at press time, was trading above the $21k mark after a period of redemption in the past week.

The relief rally saw prices move upwards by 10% during the past seven days. But internal and external factors continue to push BTC below its realized price. There are also on-chain indicators suggesting a “genuine bottom formation” could be underway.

As above so below

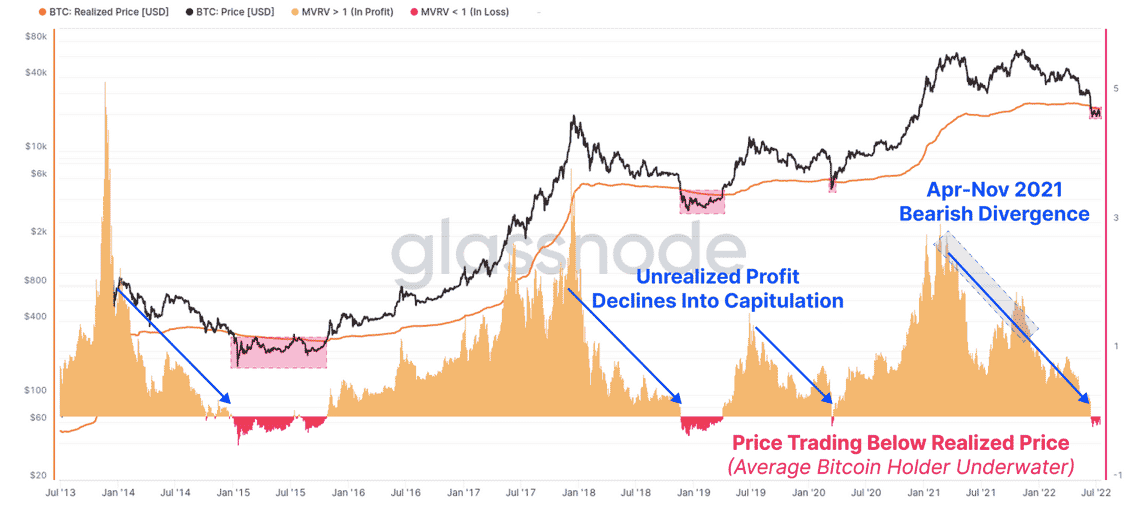

Glassnode’s latest weekly report helped in providing data for this prediction. Bitcoin’s prices have traded below the realized price for more than a month now.

The MVRV ratio is currently consolidating around 0.95 (-4.67% unrealized loss). While this looks concerning, it is not as bad as the average ratio of 0.85 (-15% unrealized loss) observed in previous bear cycles.

This means that a further downslide or a cooldown may be required to establish a bottom.

Historically speaking, market bottoms are created after large positive swings in unrealized profit and loss.

Well, this comes after capitulation and the emergence of new buyers in the market.

It also goes on to confirm that the August-November rally was more of a ‘bear market relief’ rally than the anticipation of an upcoming bull market.

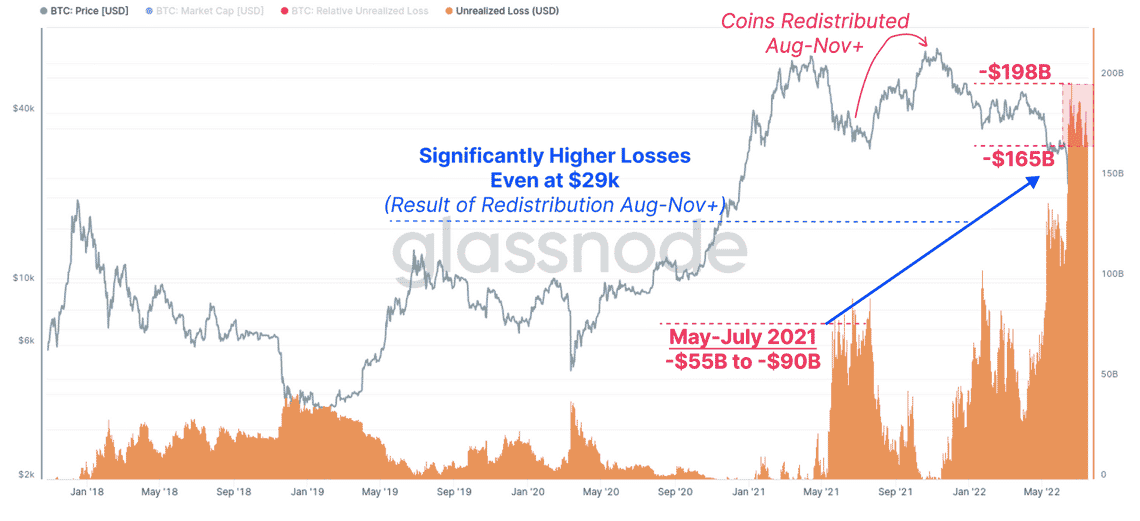

Notably, when the BTC price dropped to $17.6k, a total of 9.21 million BTC were under unrealized losses.

A month-long recovery and a relief rally to $21.2k reduced the total volume to 7.68 million BTC. It indicates that around 8% of the circulating supply has changed hands in this price range.

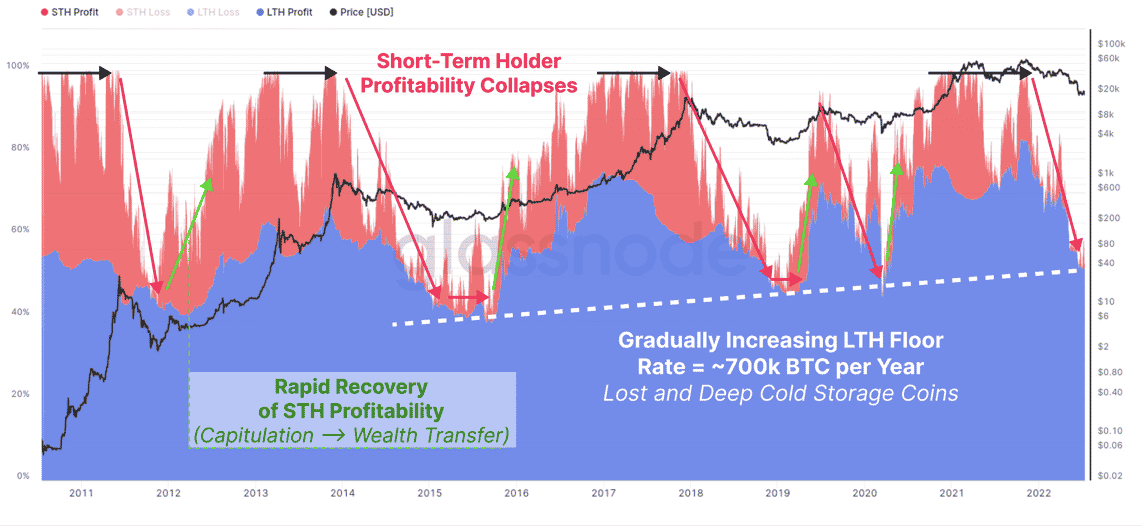

As observed in previous bear cycles, short-term holders (STH) usually go under first as markets go below their cost prices.

To find signals of market recovery, one should observe STH’s holdings in profits.

Such events usually follow bear market floors as capitulated investors transfer their coins to new holders.

Thus, the question is- Can we expect an imminent capitulation in the markets just weeks after a mini rally?

It’s hard to say as this would be very disruptive to the market sentiment. Investors seemingly just escaped the bear carnage of Q1 and Q2 of 2022 in massive losses.