Bitcoin eyes $120K as $96K resistance flips: Is the bull run here?

- Bitcoin broke past the $96K resistance, signaling strong bullish momentum toward $120K.

- Rising active addresses and declining exchange reserves reinforced the rally.

Bitcoin [BTC] recently shattered the critical $96K resistance, aligning with predictions from the Long-Term Power Law model. This milestone opens the path for potential price discovery toward $120K.

At press time, Bitcoin was trading at $98,633.53, up 0.50% in the last 24 hours.

However, holding above $96K remains essential, as losing this level could spark localized selling. Will Bitcoin’s breakout ignite a broader bull run?

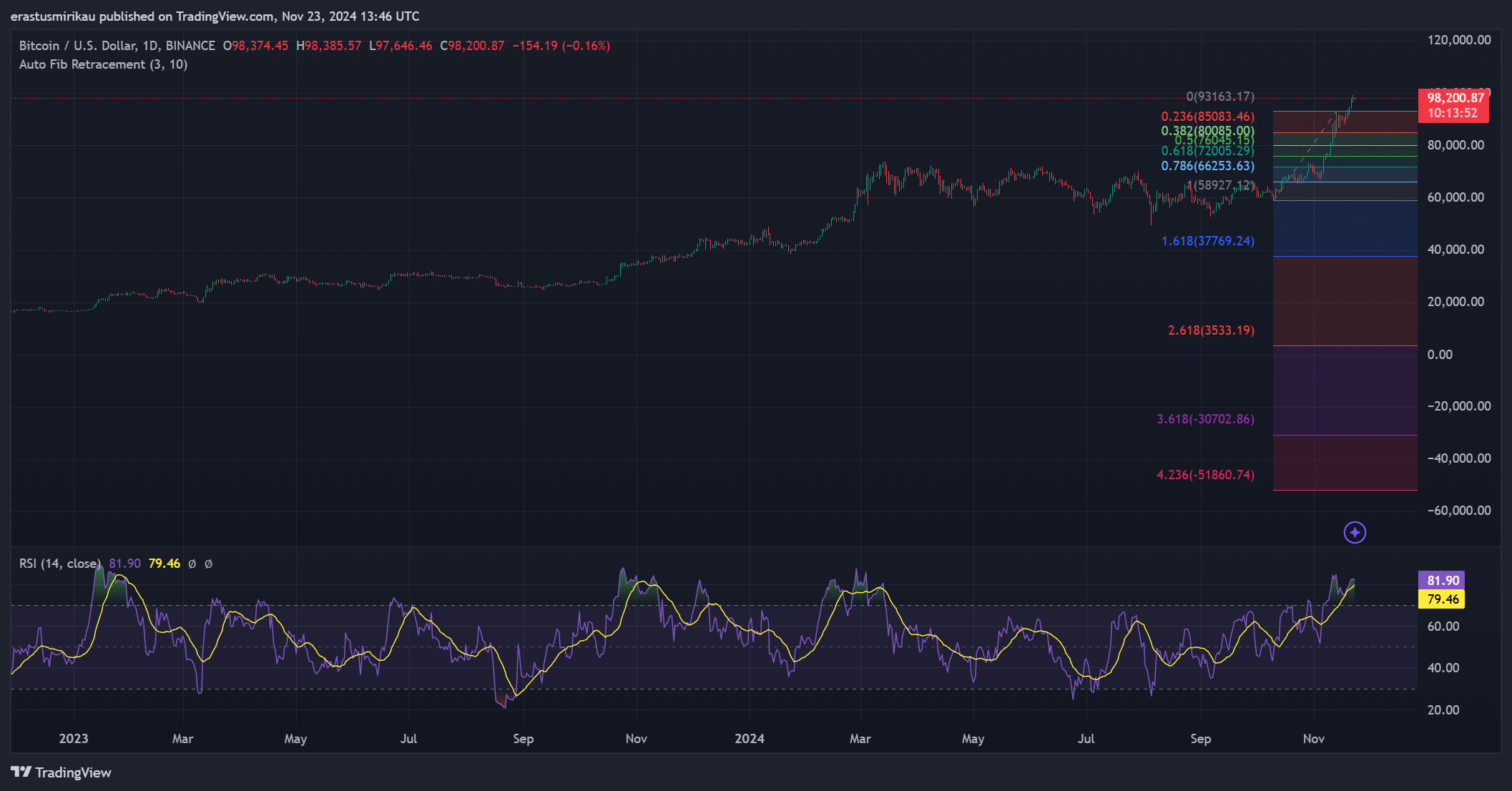

Technical signals confirm bullish momentum

Bitcoin’s price action suggested solid bullish momentum. The RSI was 79, reflecting strong buying activity at press time but also approaching the overbought territory.

Furthermore, Fibonacci retracement levels indicated Bitcoin was securely above the critical 0.786 retracement zone at $85K, reinforcing its upward trajectory.

The next major Fibonacci extension at $120K can be within reach if $96K remains a firm support. However, the risk of a retracement remains.

Notably, a drop below $96K could undermine the rally and prompt consolidation or corrections toward lower levels.

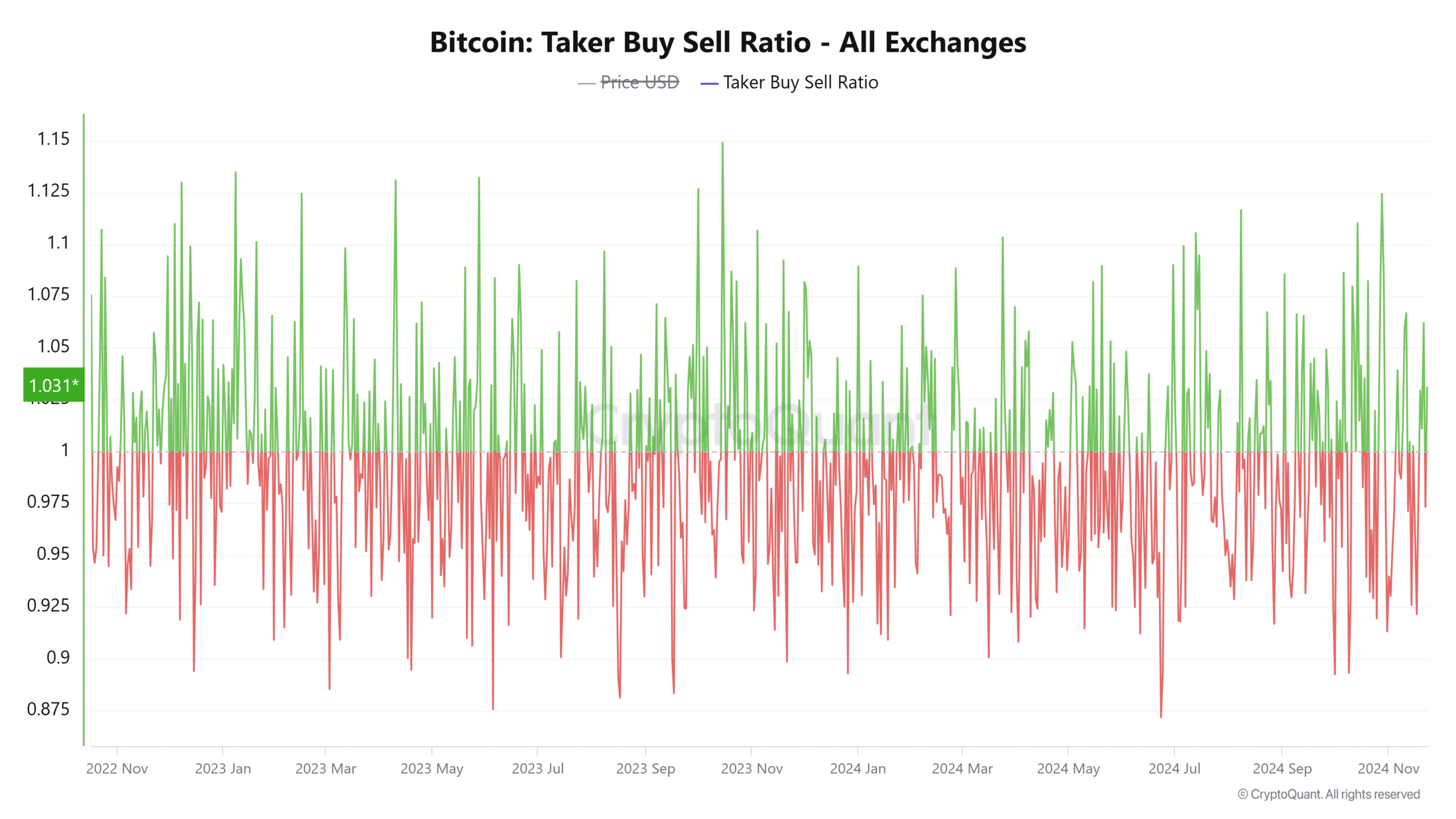

Increased buying pressure fuels BTC

Bitcoin’s buying pressure has intensified across all major exchanges, with the Taker Buy/Sell Ratio climbing to 1.03. This marks a consistent trend of buyers outpacing sellers, further supporting the surge above $96K.

Platforms like Binance, OKX, and Bybit have experienced robust activity, reflecting growing demand from institutional and retail investors alike.

This uptick in buying interest continues to bolster Bitcoin’s bullish momentum, reinforcing its position above key support levels and making $120K a realistic target.

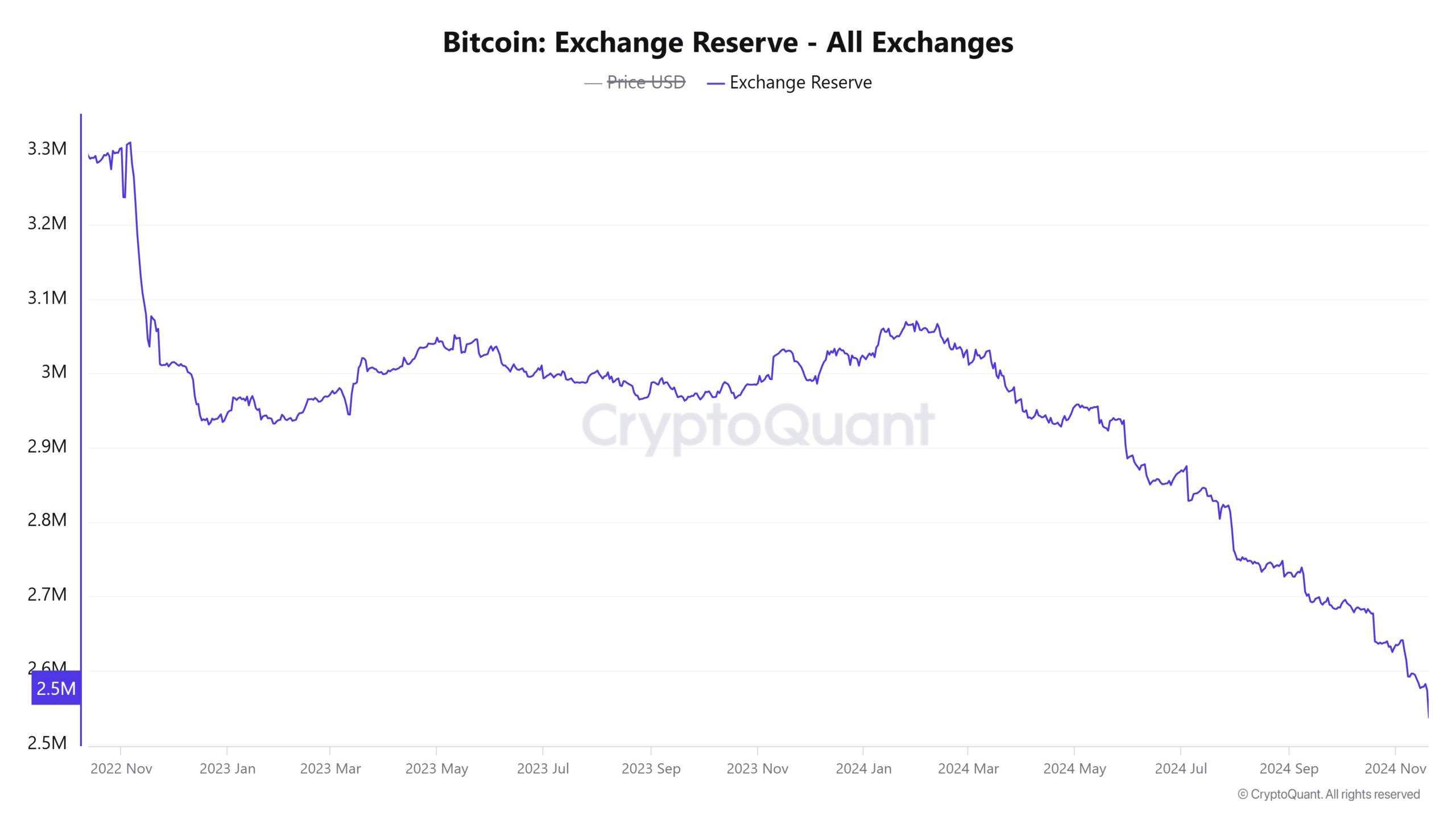

Supply on exchanges continues to decline

In addition to strong buying interest, exchange reserves for Bitcoin have dropped by 0.29% in the past 24 hours, sitting at 2.509M BTC at press time.

This decline reflects increased withdrawals to cold wallets, signaling long-term investor confidence and reduced immediate selling pressure.

Lower exchange reserves often lead to tighter supply, which can amplify upward price movements.

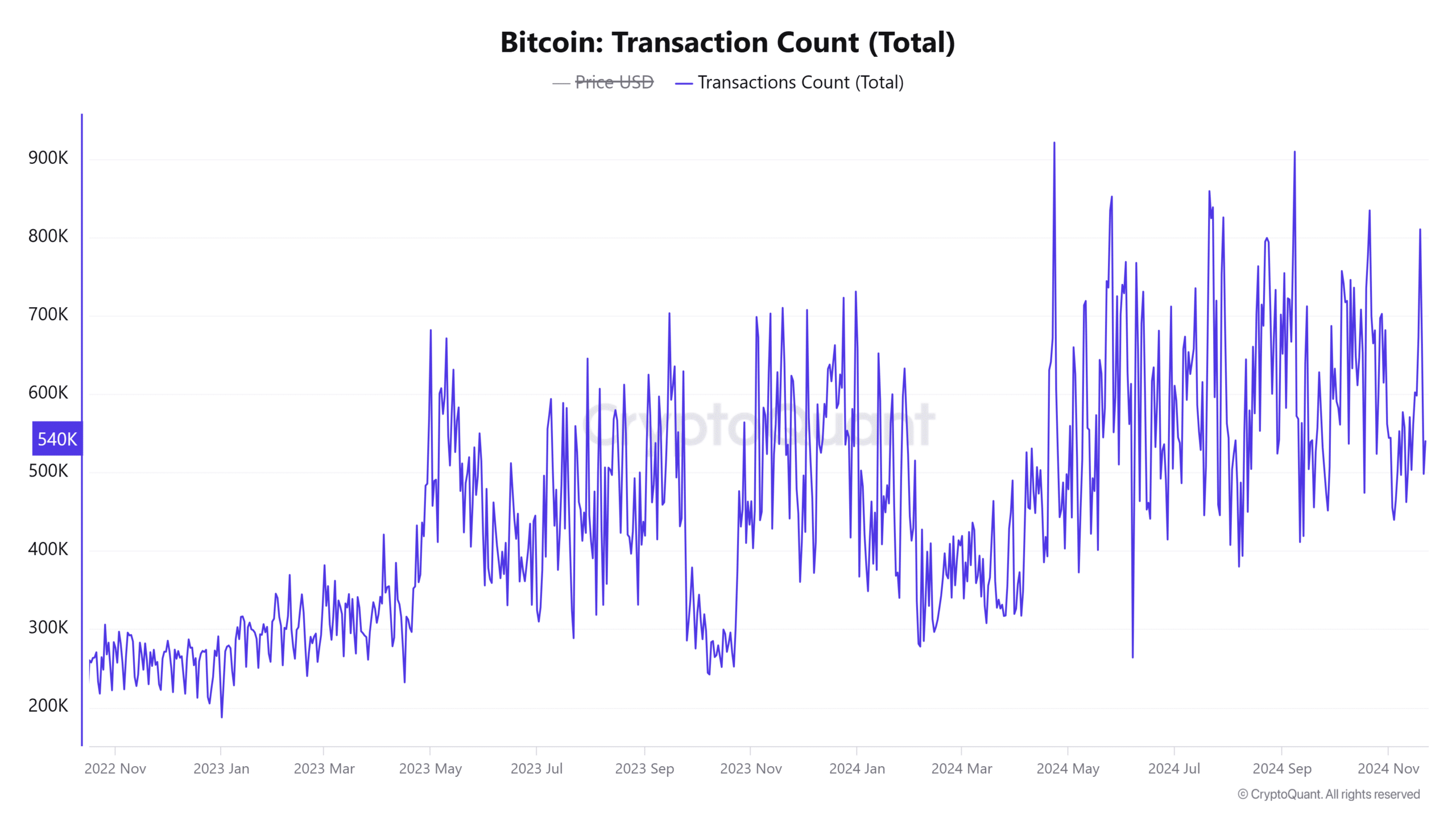

BTC network activity bolsters bullish case

Moving forward, AMBCrypto marked that Active Addresses grew by 1% to 10.703K in the last 24 hours, reflecting increased user activity.

Similarly, transaction counts have risen by 0.79% to 540K, indicating heightened utility. This combination of robust buying interest and healthy network activity reinforces Bitcoin’s bullish narrative.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin’s breakout above $96K is a pivotal moment, supported by strong technical and on-chain metrics. The bullish momentum appears sustainable, with $120K emerging as the next key target.

Therefore, as long as Bitcoin holds above $96K, the rally is likely to continue, keeping the broader bull run intact.