Bitcoin fulfills important prediction – What’s next?

- Bitcoin saw a resurgence of demand after retesting a key ascending support line.

- The short-to-mid term outlook was still bleak, but upcoming halving may favor long-term performance.

Roughly a month ago, we explored the likelihood that Bitcoin [BTC] would fall below $25,000. This became reality during mid-June when the price briefly dipped below the aforementioned level. But what does this mean for its performance moving forward?

Is your portfolio green? Check out the Bitcoin Profit Calculator

The prediction was based on the fact that BTC’s lower range has been restricted above an ascending support line. Bitcoin’s latest retest of the same support line has already yielded some accumulation which has consequently triggered some upside.

Although the press time performance might mark the latest local bottom, a continued rally is not guaranteed and there is a significant probability of more price weakness.

Despite the uncertainty about the price in the future, Bitcoin holders have key considerations to ponder on. For example, the next Bitcoin halving is rapidly drawing near and it may have a significant impact on BTC’s demand.

Bitcoin has historically experienced robust accumulation towards every halving. A similar outcome in the next 10 months would favor the bulls in the second half of 2023.

Only about 10 more months until the Bitcoin halving.

The market will likely be in an accumulation zone until then.

Post halving, historically has seen large and dramatic price increases.

18-24 months until the next bull peak.

I have been buying, retweet if you have been too!

— Lark Davis (@TheCryptoLark) June 17, 2023

Assessing the state of Bitcoin accumulation

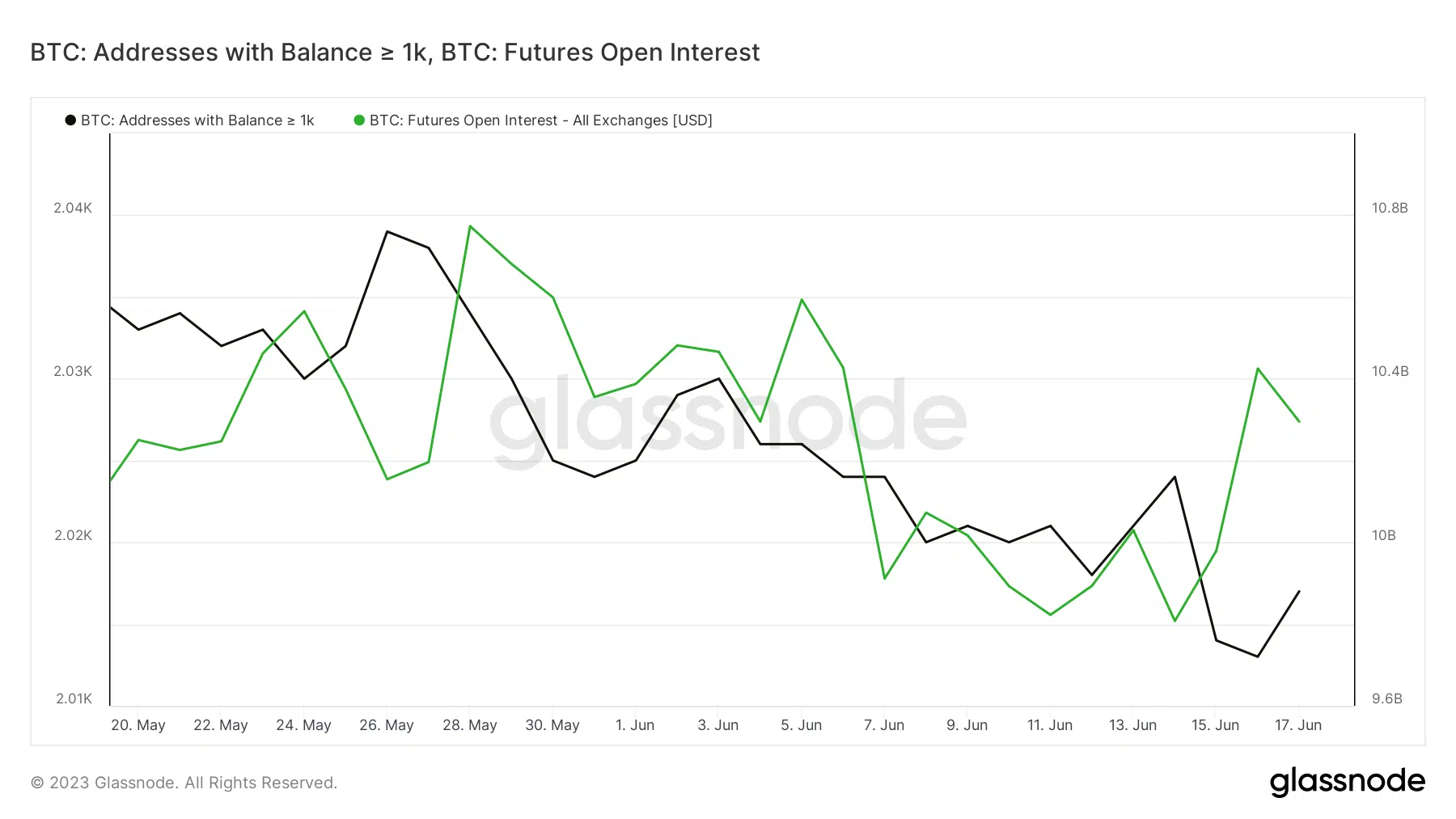

Bitcoin’s ability to bounce back strongly will depend on the level of demand currently in the market. Demand is largely driven by whales and can be gauged by activity in the derivatives segment. Whales holding over 1,000 BTC have been offloading coins for the last four weeks.

Addresses holding at least 1,000 BTC closed at the lowest monthly level on Friday. They have since then shown signs of slight accumulation. Bitcoin futures open interest also fell short significantly for the last 4 weeks but bounced back slightly on Wednesday.

Whale holdings previously retested the current levels between March and May. The same levels may support a strong psychological buy zone.

Interestingly, the exchange flow data confirmed that the amount of Bitcoin currently flowing from exchanges is higher than the amount flowing in. In other words, BTC was experiencing a resurgence in demand at press time.

? Daily On-Chain Exchange Flow#Bitcoin $BTC

➡️ $783.2M in

⬅️ $839.5M out

? Net flow: -$56.3M#Ethereum $ETH

➡️ $260.7M in

⬅️ $254.0M out

? Net flow: +$6.7M#Tether (ERC20) $USDT

➡️ $497.9M in

⬅️ $420.4M out

? Net flow: +$77.5Mhttps://t.co/dk2HbGwhVw— glassnode alerts (@glassnodealerts) June 18, 2023

Read Bitcoin’s price prediction for 2023/2024

Despite these findings, the level of Bitcoin demand in the market was relatively low at the time of writing, especially compared to periods of heavy demand. While the slight upside may indicate that the market is ready for a recovery, it does not necessarily guarantee such an outcome.

Prices may still fall, especially if market conditions fail to support a potential upside.