Bitcoin: Signs of recovery emerge

- Bitcoin whales led the recovery charge with close to 1,000 transactions.

- BTC has gained around 5% in value in the last three days.

Last week witnessed a series of downward spirals in the price of Bitcoin [BTC] for many reasons. Nonetheless, as the weekend approached, a glimmer of hope emerged with a slight resurgence in value, accompanied by an upward trend in transaction volumes.

Read Bitcoin’s [BTC] Price Prediction 2023-24

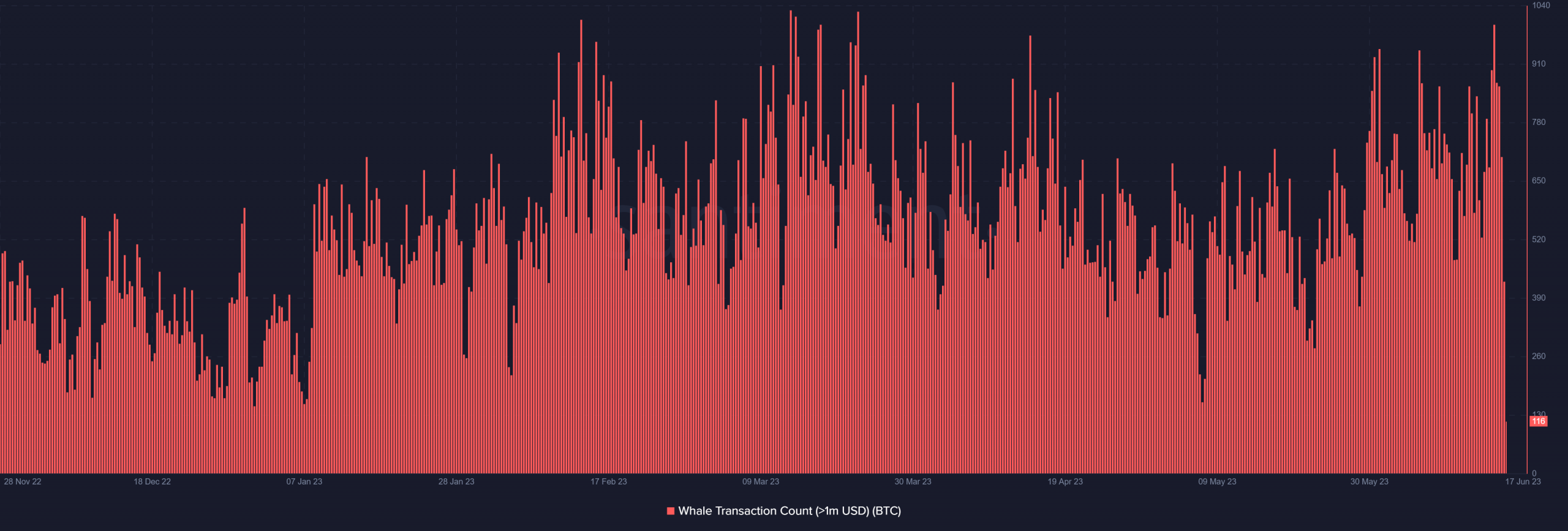

Bitcoin whales ramp up transactions

Santiment’s crucial Bitcoin metric offered an insightful view of the cryptocurrency’s recovery journey, highlighted by a surge in activity. Despite a price decline, the whale transaction metric, encompassing transactions exceeding $1 million, experienced a significant spike on 11 June.

The chart vividly displayed a surge of nearly 1,000 whale transactions, marking the highest figure in over two months.

As of this writing, this metric stood at 61. This spike signified a notable increase in substantial BTC transactions amid the ongoing decline. Although, the direction of these transactions remained ambiguous.

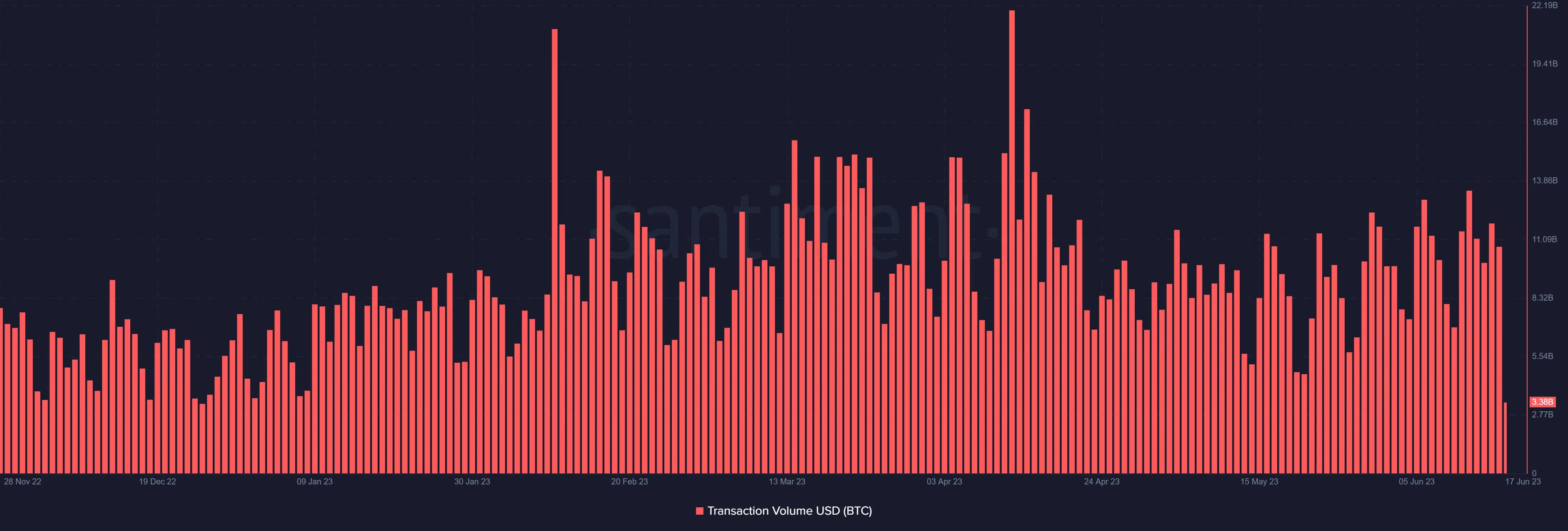

Furthermore, BTC’s transaction volume exhibited a more gradual yet discernible increase. Examining the transaction volume metric, there was a slight upward trend. At press time, the transaction volume surpassed the $3 billion mark. This escalation in transaction volume indicated that major stakeholders were actively moving assets as market polarization intensified.

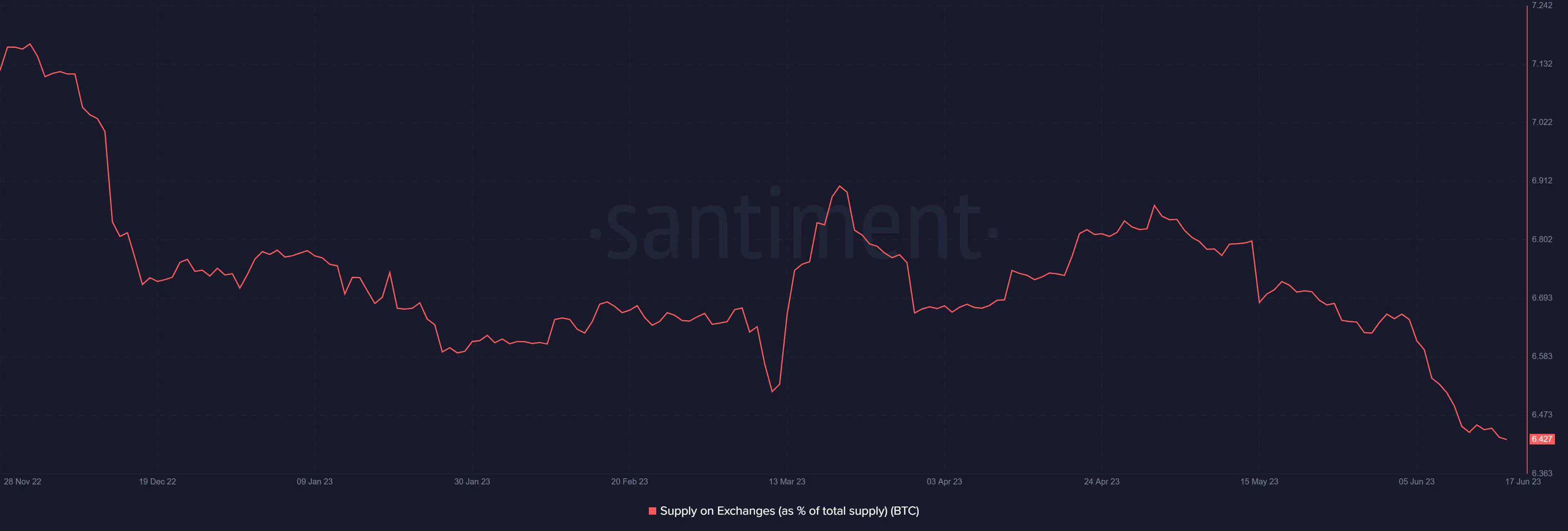

Supply on exchanges slides to record low

Amidst the price decline and the spread of fear, uncertainty, and doubt (FUD), a noteworthy shift in Bitcoin’s movement was observed as holders moved their coins off exchanges. As of this writing, the percentage of Bitcoin held on exchanges stood at approximately 6.4%. This exchange level marked a significant milestone for BTC, as it had not been witnessed in over five years.

The movement of these coins away from exchanges served as a bullish indicator, suggesting that holders were confident of a future price surge.

Bitcoin between bull and bear

When examining the daily timeframe chart, Bitcoin showcased signs of recovery from its recent downtrend. As of this writing, BTC was trading at approximately $26,600, with a gain of nearly 1%. This resulted in an overall gain of approximately 5% over the past three days.

The short Moving Average (yellow line) formed the immediate price resistance at around $27,190.

Is your portfolio green? Check out the Bitcoin Profit Calculator

However, if the price continues to rise, BTC has the potential to surpass this resistance level and advance further.

The consecutive price increases have propelled BTC into a somewhat bullish trend. The Relative Strength Index (RSI) sat at 50 at press time, indicating a delicate balance between bearish and bullish sentiments.