Bitcoin – Here’s Coinbase’s Q2 prediction as analysts issue new warning!

- Bitcoin slipped below $84k after a hot U.S inflation print

- New Trump tariffs could determine the next direction for the cryptocurrency

Bitcoin [BTC] briefly retraced below $84k following a hotter PCE inflation print during early Friday’s U.S trading session. BTC’s decline followed Nasdaq’s 2% drop. However, gold jumped to a new high, reiterating investors’ risk-off mode and macro uncertainty, especially ahead of President Trump’s new tariffs.

According to Coinbase analysts, the crypto’s price could remain range-bound ($78k-$88k) until then. They stated,

“We anticipate range-bound trading at least until April 2nd, the deadline for President Trump’s tariffs.”

The analysts further warned that April-June have been “tough months” for crypto on a seasonal basis. They suggested reduced exposure as a great strategy.

Bitcoin – STH distress?

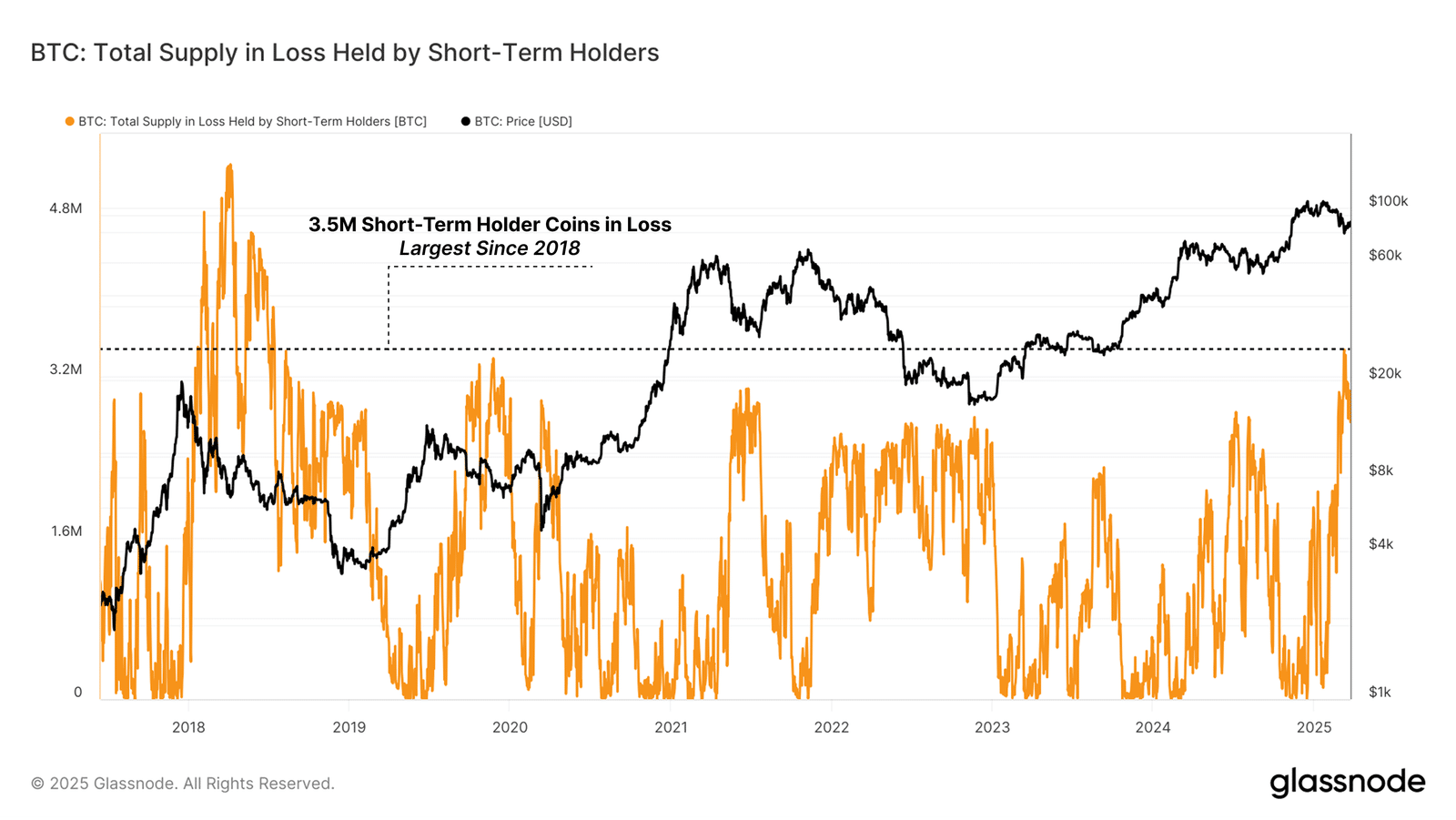

The cautious outlook was also evident on-chain, as per the financial distress faced by short-term holders (STH). These are new investors (top buyers) who’ve held BTC for less than six months and likely bought the asset above $90k or $100k.

According to Glassnode, the supply held by STHs hit a 7-year high loss of 3.4 million BTC.

“Recent downside volatility has created strenuous conditions for new investors, with the volume of Short-Term Holder supply held in loss surging to a massive 3.4M BTC. This is the largest volume of STH supply in loss since July 2018.”

The analytics firm added that the prevailing pressure could heighten the “probability of a market-wide capitulation event.”

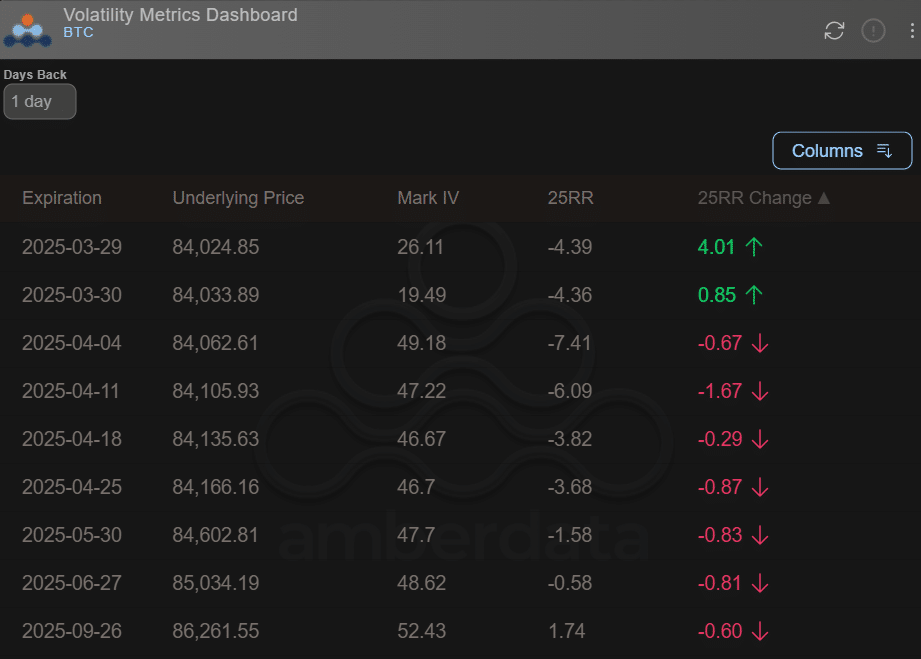

Even Options traders seemed to be positioned for further downside risk scenarios in the short term. According to Amderdata’s 25-delta risk reversal (25RR) indicator, for instance, Options expiries for 04 April (-7.41) and 11 April (-6.0) were negative, at the time of writing.

Source: Amberdata

This hinted at an uptick in hedging activity and more demand for put options (bearish bets) for the next two weeks. Simply put, speculators are expecting potential dips in early April.

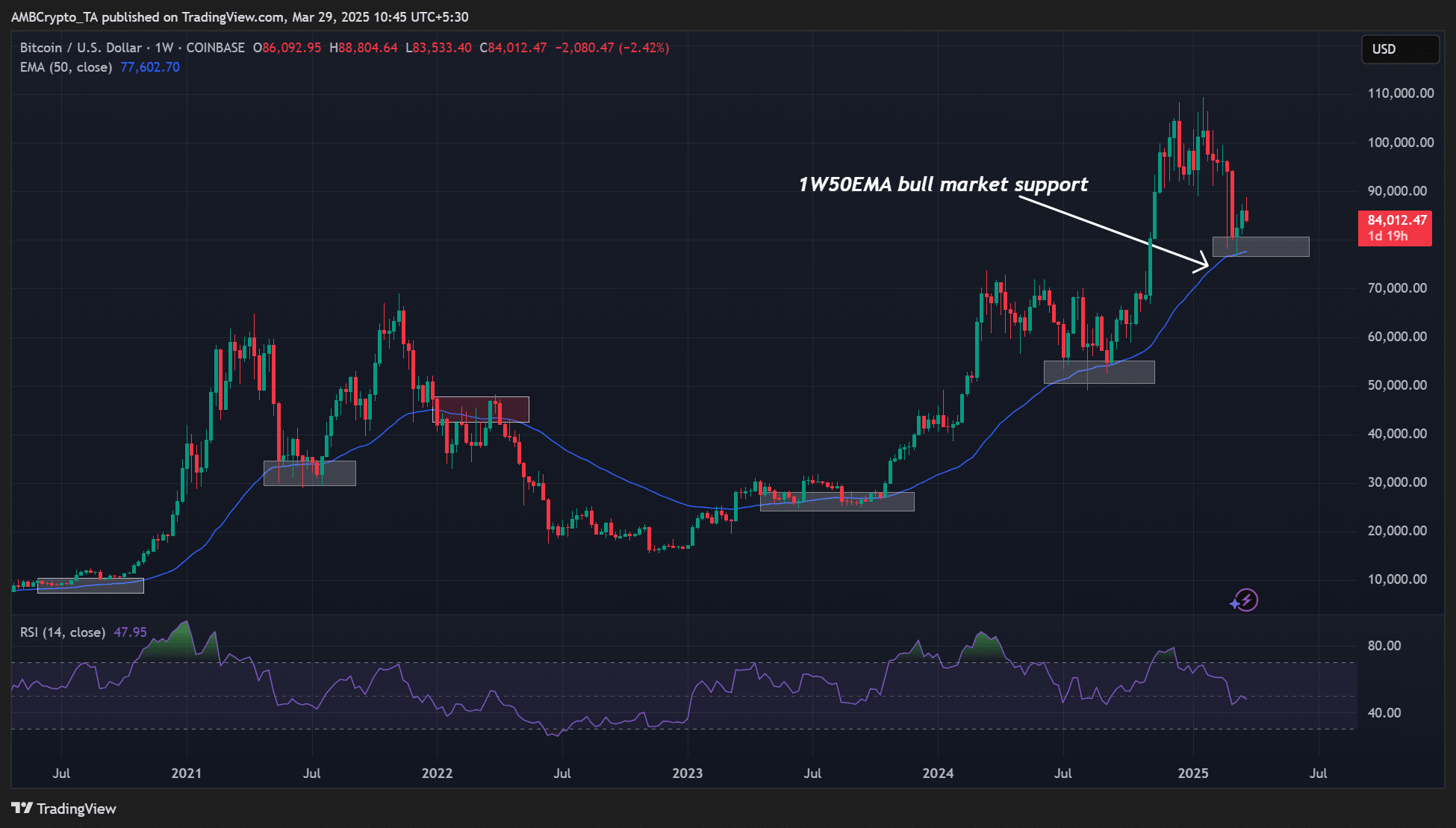

Worth noting, however, that it may not be all gloomy. When zoomed out on the weekly price charts, BTC defended the weekly 50-EMA (exponential moving average, 1W50EMA). This dynamic level was a key support in the past bull runs of 2021 and is also one in the current 2023-2025 cycle.

Simply put, Bitcoin’s overall market structure is still bullish. However, if a sustained break below 1W50EMA occurs, the asset could be deemed to be in a bearish trend – A warning shot to bulls.

So, it’s a key level to watch in Q2.