Bitcoin HODLers are selling, should you buy?

Bitcoin’s price has remained largely rangebound below $50000 and above $46000 for the most part in the last two days. As we get closer to the weekend, there is no sign of slowing down. The price took a plunge from the $51000 level 2 days ago and hasn’t rebounded, since there is a shift in HODLer positions.

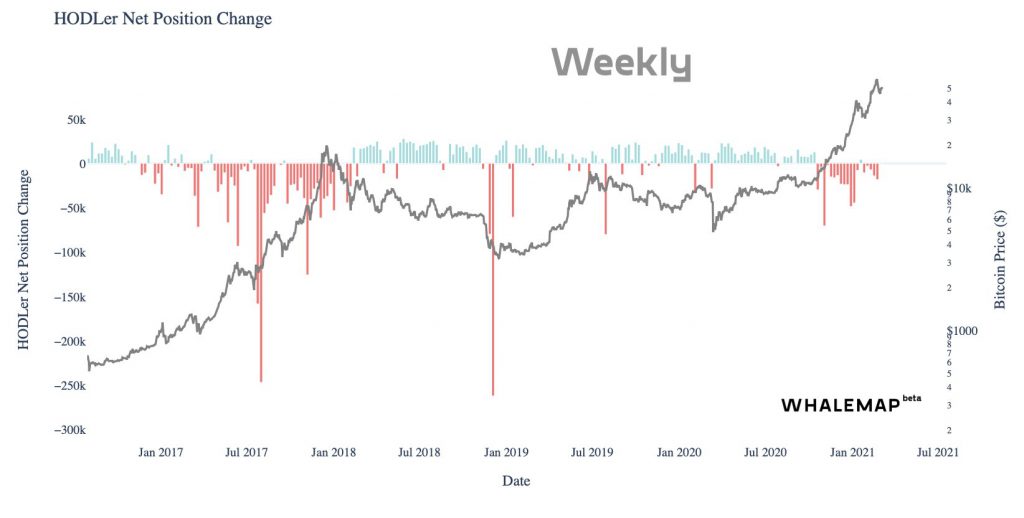

Hodler net position change chart signals an increase in the number of HODLed coins being cashed out on a weekly basis. A similar event occurred before the dip from the last ATH of $58330; more HODLers and miners booked unrealized profits in a short time, driving price downwards.

HODLer net position change || Source: Twitter

Based on the above chart, more positions have shifted significantly. More HODLed Bitcoins were sold in the past two months, than in the second half of 2020 combined. Does this mean HODLers are taking profits before directing investments to altcoins or DeFi or is this an attempt to increase selling pressure and buy again at lower prices?

Since the volume of Bitcoin HODLed by whales is increasing, at the same time when the selling is taking place, it is likely that there may be accumulation. This move from long-term HODLers, and some of which are miners and whales, maybe a move for taking profits before the next cycle.

It is likely that the plunge opens an opportunity for buying further, thus lowering the average cost per Bitcoin for HODLers. This means that the scope for unrealized profits may be widened, motivating more HODLers to sell, and leading to a drop in portfolio value for active traders and HODLers who bought above the current price level.

This is similar to MicroStrategy’s recent move of buying an additional 205 Bitcoins for nearly $10 Million in cash. These Bitcoins were bought at an average price of $48888 per Bitcoin, making it a critical price level that institutions buying in this price range are expected to support.

MicroStrategy’s net Bitcoin holdings stand at 91064, or the equivalent of $2.196 Billion. Just as HODLers who took profits to accumulate at a later price, to lower their average price per Bitcoin, for MicroStrategy it is $24119 per Bitcoin. The shift in HODLers positions played a key part in the price narrative during the rally that took Bitcoin to $58330; hence HODLers’ net position change is a key metric to watch out for in the short-term.