Bitcoin: HODLers remain HODLing – is an uptrend on the way?

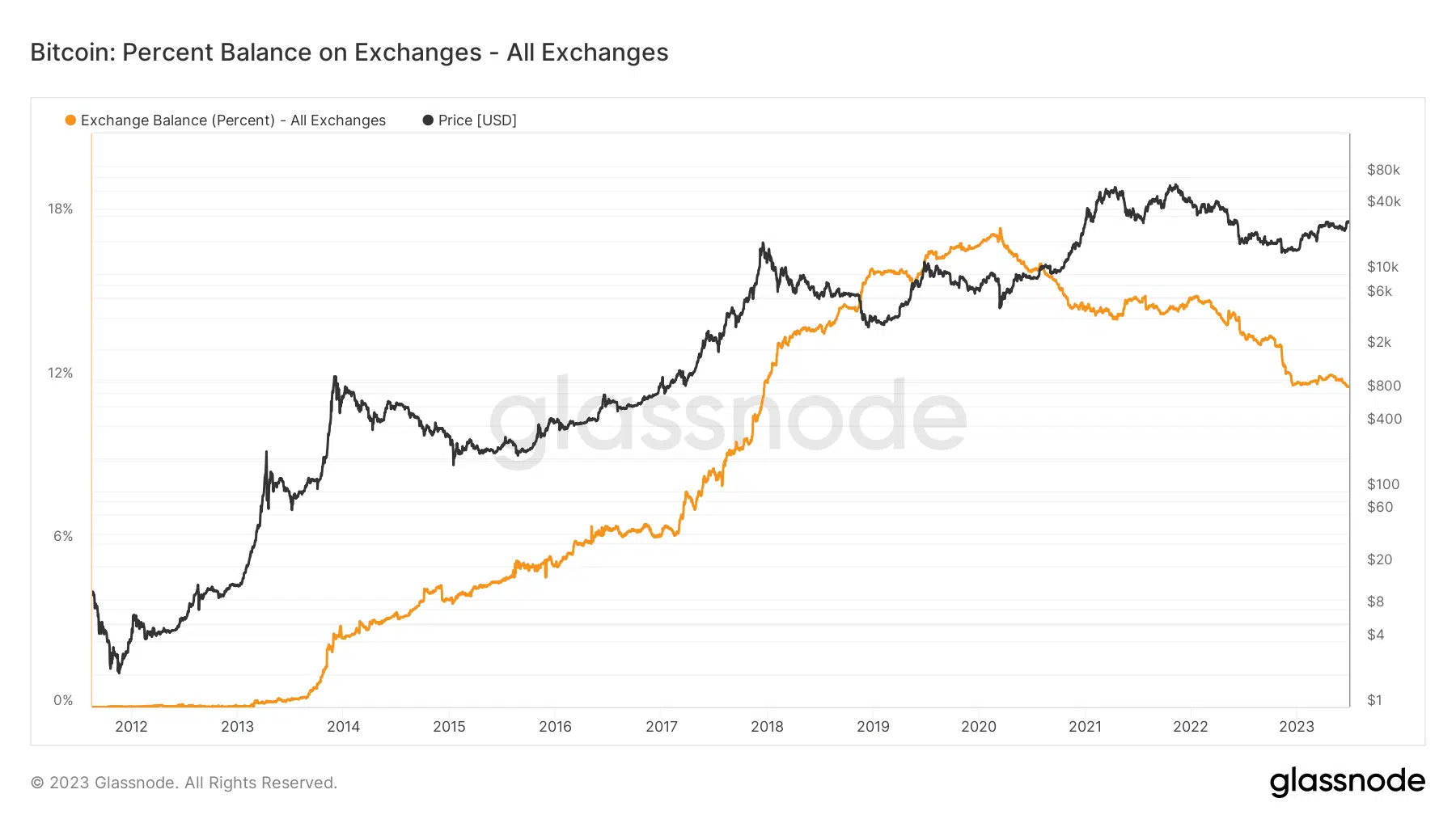

- The total BTC balance across all exchanges equated to just 11.7% of the total circulating supply.

- The amount of BTC available for purchase hit all-time lows.

Despite the gains made by Bitcoin [BTC] in its recent rally, most long-term investors continued to take coins out of exchanges in favor of self-custody. According to a popular Twitter user who tracks crypto markets, BTC’s supply on exchanges hit a 5-year low on 30 June, demonstrating investors’ tendency to HODL.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Liquid supply shrinks

As of 30 June, the total BTC balance across all exchanges was 2.2 million, equating to just 11.7% of the total circulating supply. Such balances were last seen during the historic bull market of 2017. But unlike now, they were in a steady uptrend back then.

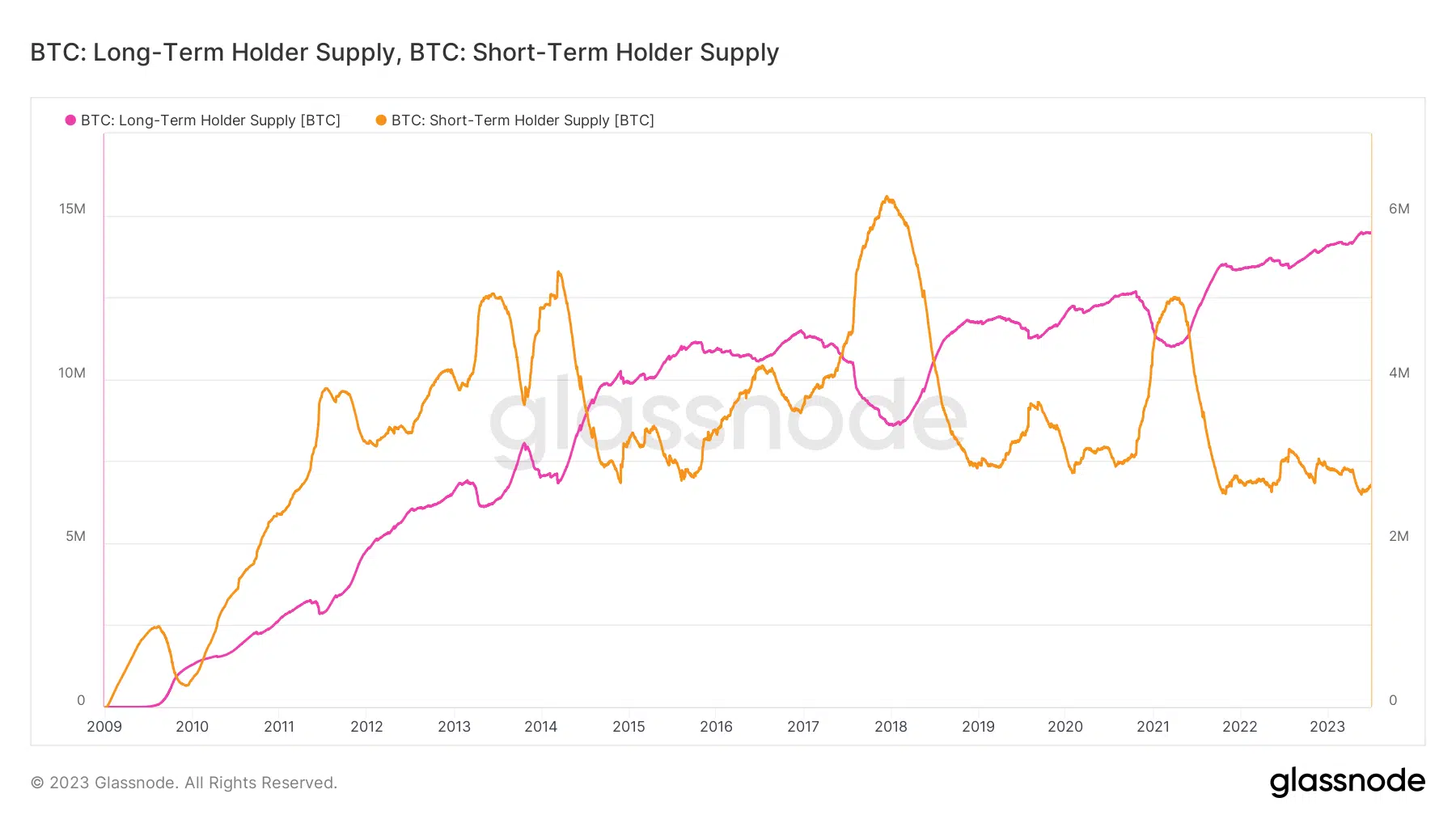

On expected lines, the drop in BTC’s liquid supply was driven by seasoned investors. Long-term investors have been consistently accumulating and transferring coins to self-custody, accounting for nearly 75% of the total supply.

On the other hand, the supply held by short-term investors or the active traders has declined considerably over the past two years.

What are the factors driving this?

A myriad of reasons could explain this behavior. Concerns regarding the safety of funds in centralized exchanges, compounded by the collapse of big entities like FTX, have been a driving force. Regulatory clampdowns on other behemoths like Coinbase and Binance have made matters worse.

However, it’s not just the negativity which was behind the HODLing trend. Over the years, BTC has shown resilience amidst market implosions and regulatory hostilities.

Because of this, it was increasingly viewed as a ‘Store of Value’ rather than a speculative asset in intraday trading. Growing interest shown by TradFi giants has also heightened its long-term growth potential.

A long-term bullish signal?

Will Clements, co-founder of a crypto research firm, took to Twitter to explain what this ongoing trend could mean for BTC prices in the near-term.

As the amount of BTC available for purchase reached a nadir, he anticipated that future buyers would have to pay significantly higher prices to persuade long-term holders to sell their holdings.

How much are 1,10,100 BTCs worth today?

Meanwhile, a report by The Wall Street Journal disclosed that the recent applications to launch a spot Bitcoin ETF were deemed inadequate by the U.S. Securities and Exchange Commission.

As of this writing, BTC recovered to $30,433.55, but was still down 0.81%, as per CoinMarketCap.