Bitcoin: HODLing is the norm for investors

- BTC’s growing dormant supply demonstrated investors’ lack of willingness to sell.

- Investors’ sentiment was tilted towards the negative side, in sync with the low volatility phase.

Bitcoin [BTC] has entered a phase of consolidation, with trades over the past week hovering within the narrow range of $26,600- $27,500, according to on-chain analytics firm Glassnode. This phase was similar to the one witnessed during the first week of 2023, when the volatility of the king coin plunged to record low levels.

How much are 1,10,100 BTCs worth today?

Due to the absence of volatility in either direction, Bitcoin’s market witnessed significantly low on-chain volume, reflecting a growing tendency by investors to hold their coins.

Hold on for dear life

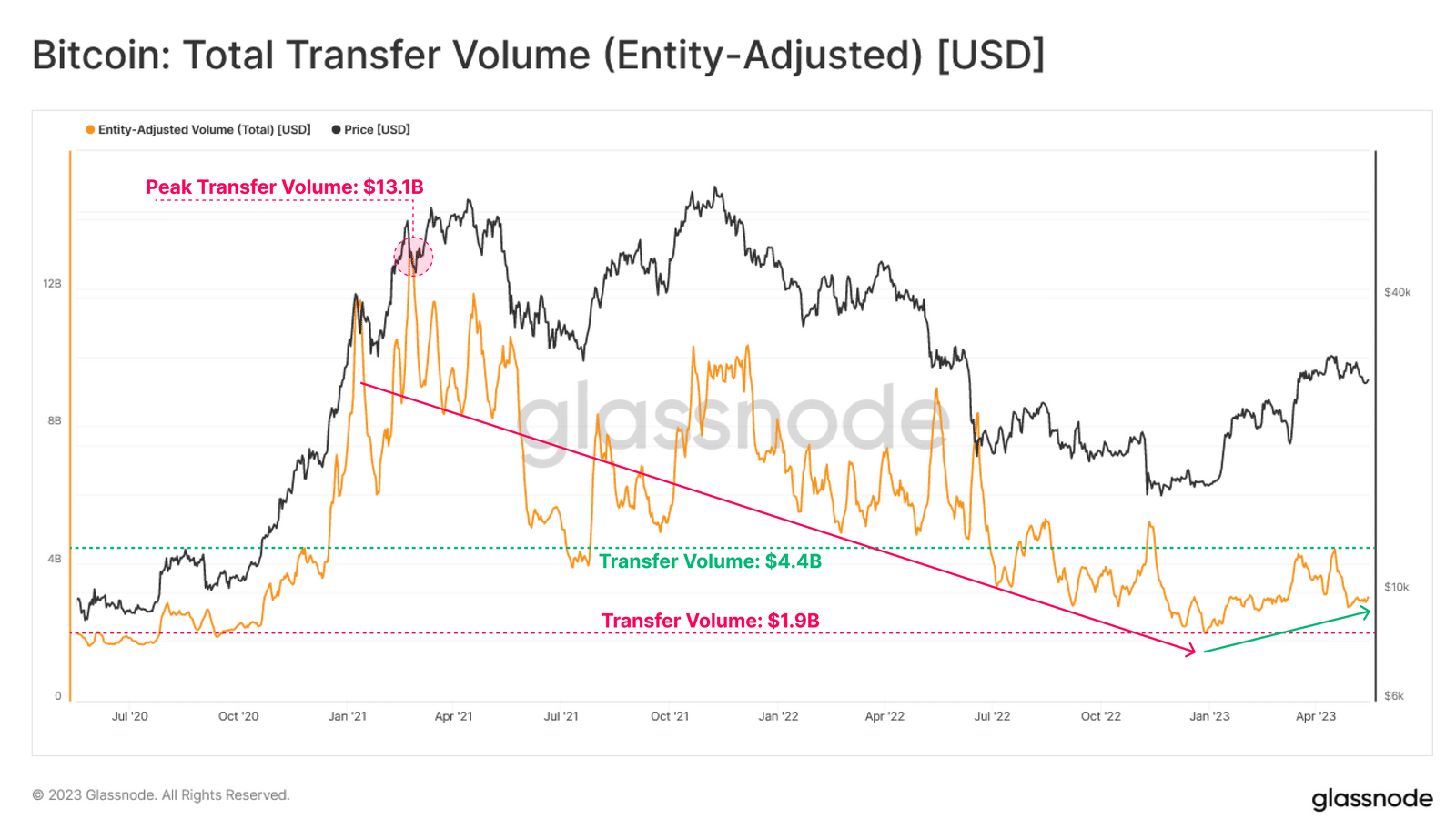

Glassnode noted a considerable decline in the transfer volume settled on the Bitcoin network. While the number of low-volume transactions involving Ordinals and BRC-20 tokens has skyrocketed, the transfers involving the movement of a large chunk of BTC tokens have dwindled.

To further emphasize this, there was a sharp decline in the exchange deposit volume as well.

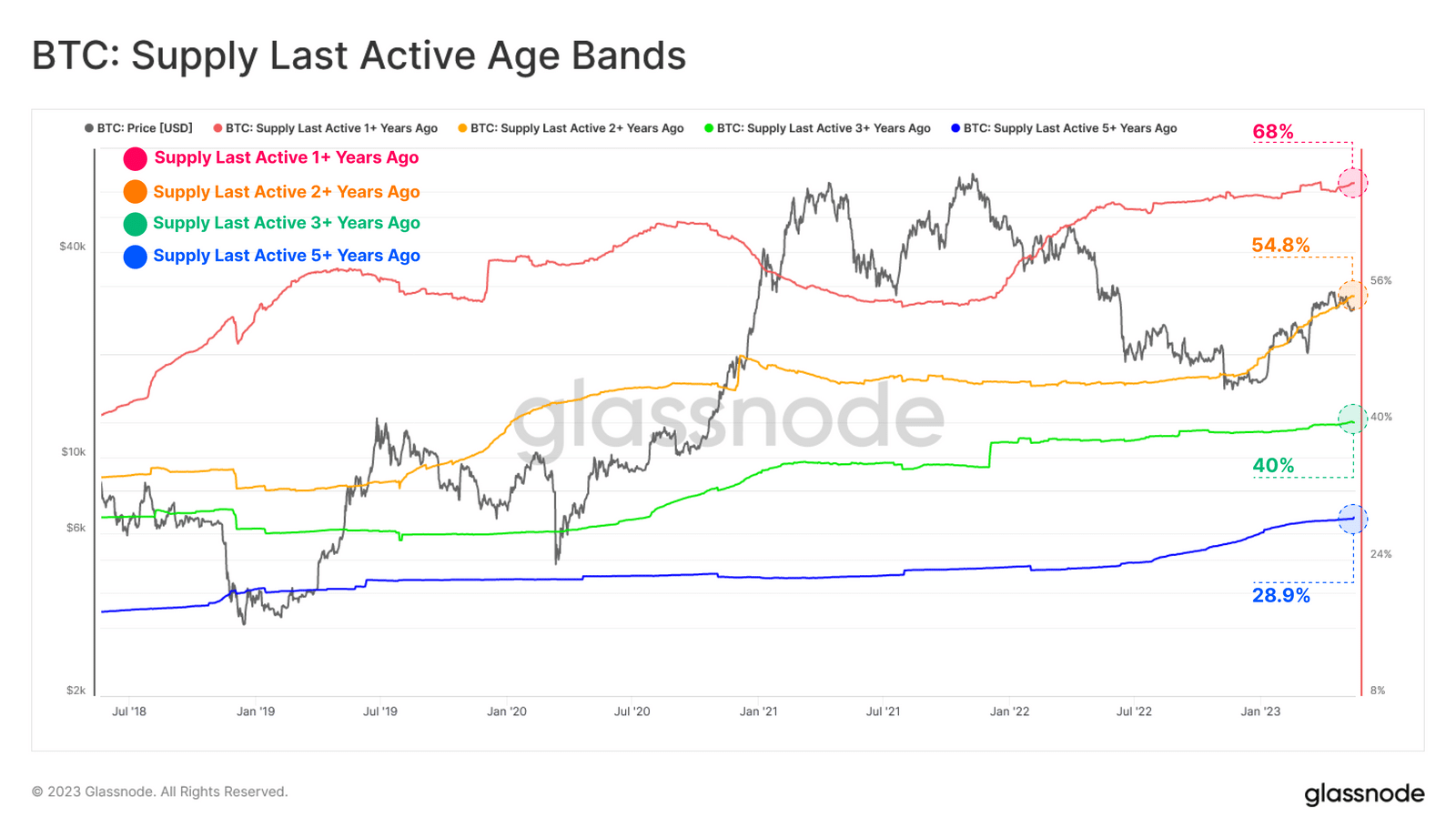

Investors’ lack of willingness to sell was demonstrated by BTC’s growing dormant supply. The percentage of supply held for longer than a year climbed to record highs. Most age bands recorded an uptick in hodling activity.

This behavior was also seen in Long-Term Holder Supply, or BTC held for over 155 days, which hit a new all-time high of 14.46 million.

Interestingly, the hodling narrative grew despite BTC accumulating massive gains in 2023, nearly 64% on a year-to-date (YTD) basis.

Furthermore, the Bitcoin Liveliness metric. which compares hodling and spending patterns, plunged to its lowest level since December 2020. This implied that holding was the dominant narrative in the market at the time of writing.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Sluggish growth in Open Interest

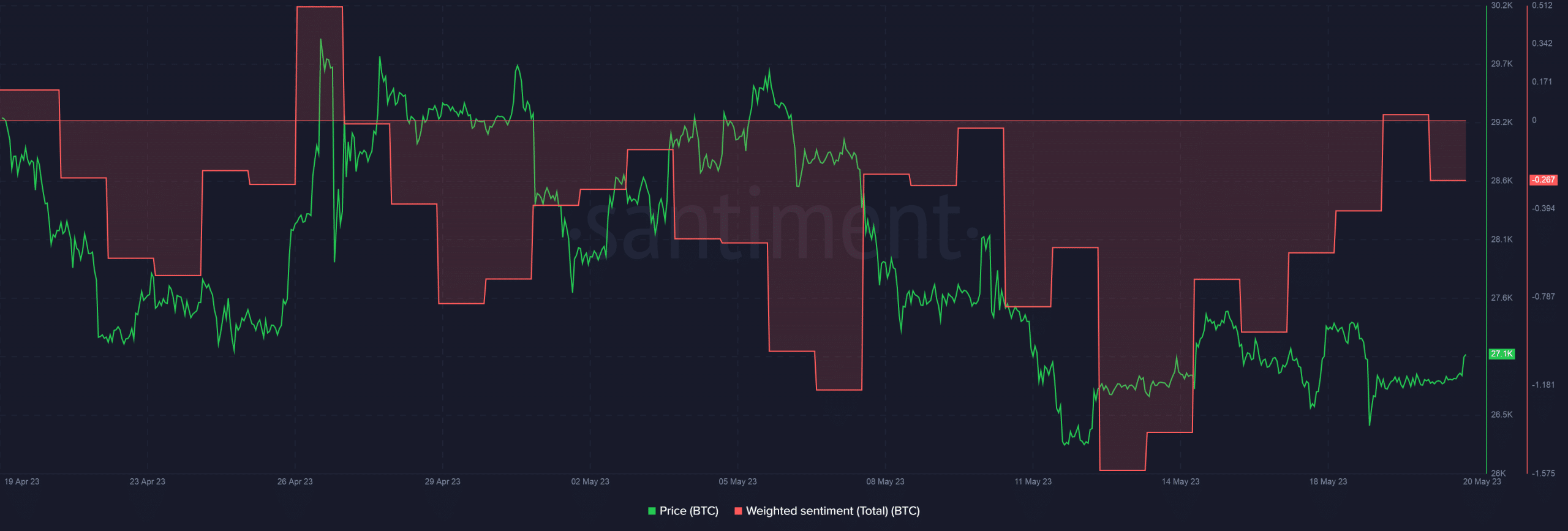

Bitcoin continued to move in the aforementioned range at the time of writing. The coin was back above $27,000, rising 1.6% in the 24-hour period, data from Santiment showed. Investors’ sentiment was tilted towards the negative side, which was in sync with the low volatility phase.

Since mid-April, the Open Interest (OI) in Bitcoin futures has declined notably, reflecting a lack of speculation demand for the coin. This supported the notion that major participants were adopting a wait-and-see strategy because the market was not providing unambiguous buy or sell signals.