Bitcoin holders refuse to panic sell – What this means for BTC’s 2025 outlook

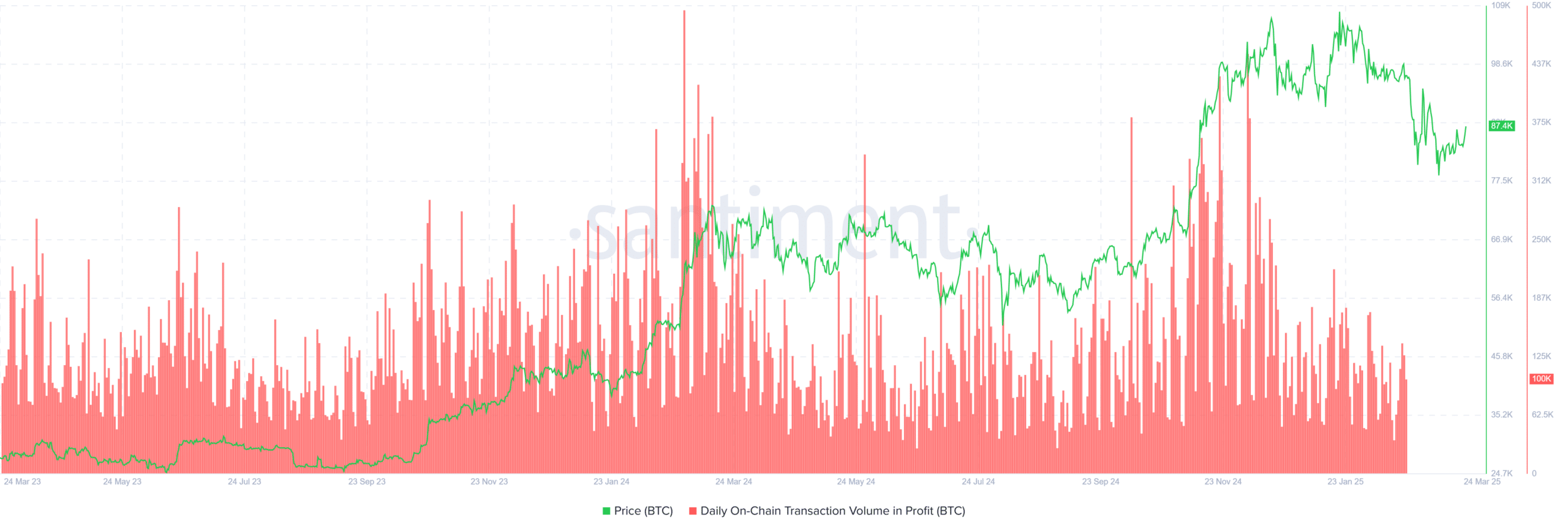

- BTC’s daily on-chain transaction volume in profit highlights investor behavior during price movements.

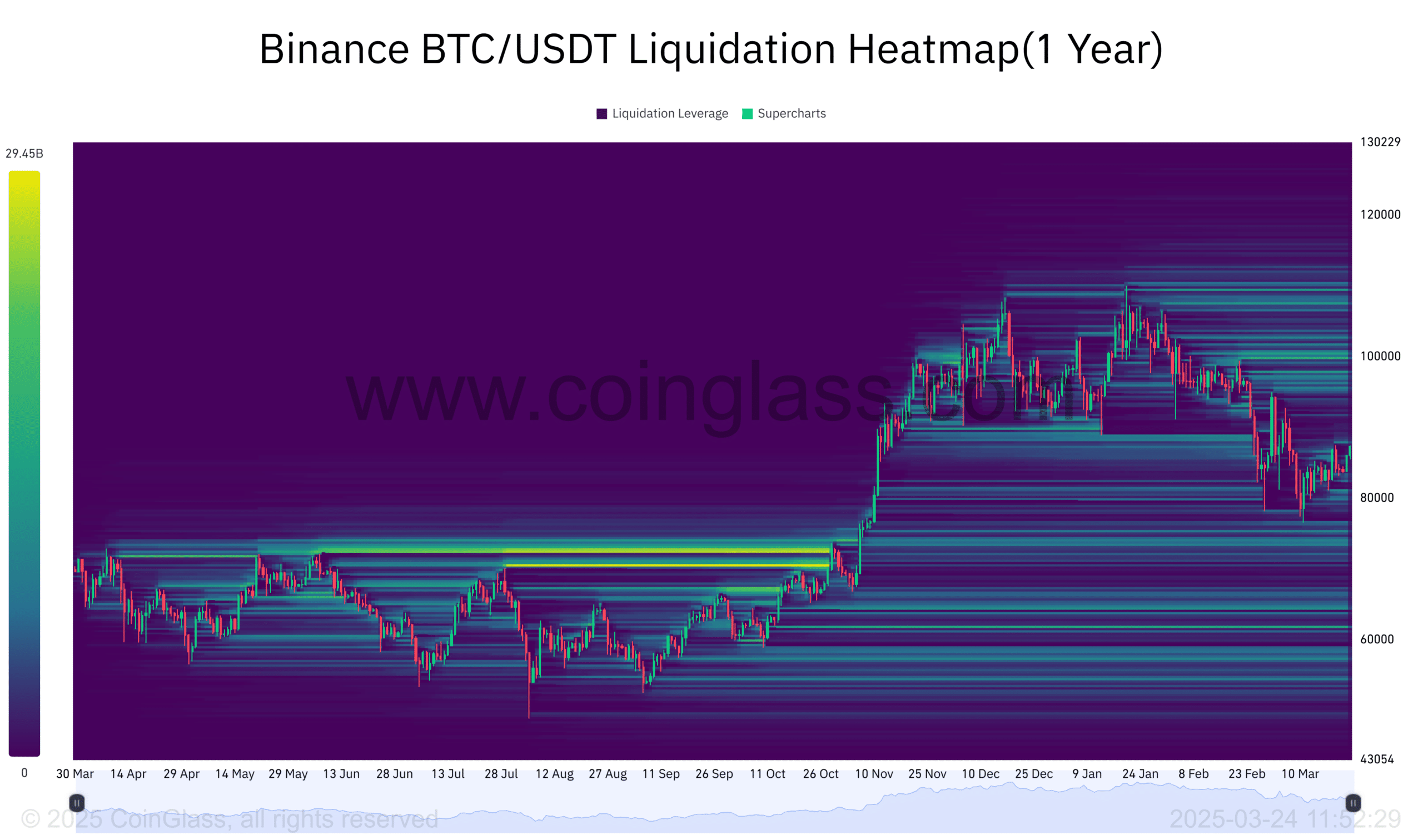

- BTC liquidation heatmap on Binance provides insights into leveraged positions and market stability.

Bitcoin’s [BTC] supply in loss (%) offers critical insights into market sentiment and price behavior.

In early 2022, the supply in loss peaked at 21.9% as Bitcoin dropped below $20K, reflecting strong selling pressure during a bearish phase.

As the price fluctuated between $20K and $30K throughout 2022 and 2023, the supply in loss stabilized between 10–15%, indicating reduced but persistent selling pressure.

By mid-2024, as Bitcoin surged toward $70K, the supply in loss declined steadily, falling below 5% by early 2025 as the price reached $94K.

This downward trend suggested decreasing selling pressure, as fewer holders remained at a loss. The correlation between a shrinking supply in loss and rising prices pointed to increasing investor confidence.

As more market participants held onto their assets in anticipation of further gains, the likelihood of panic selling diminished, reinforcing a bullish outlook for 2025.

BTC’s daily on-chain transaction volume in profit

Further, Bitcoin’s daily on-chain transaction volume in profit highlights investor behavior during price movements.

In early 2024, with BTC trading around $60K, profit-taking remained low, indicating cautious market sentiment.

As Bitcoin climbed to $87K by late 2024, transaction volume in profit spiked, reflecting increased profit realization as investors capitalized on the rally.

However, by early 2025, as Bitcoin corrected to $77K, transaction volume in profit declined. This suggested that fewer holders were actively selling, aligning with the decreasing supply in loss.

Thus, investors in profit opted for selective profit-taking rather than mass liquidation, contributing to price stability.

This trend reinforced the broader market sentiment that confidence in BTC’s long-term value remained strong despite short-term corrections.

Market stability or instability?

The BTC liquidation heatmap on Binance provides insights into leveraged positions and market stability.

High liquidation zones around $60K–$70K in mid-2024 indicated excessive leverage, leading to forced liquidations during price volatility.

As Bitcoin rallied to $87K by late 2024, liquidation levels decreased, suggesting more balanced leverage usage among traders.

By early 2025, with Bitcoin consolidating around $77K, liquidation activity remained low. This aligned with the declining supply in loss, as fewer underwater positions reduced forced liquidations.

Lower liquidation risks contributed to a more stable market, allowing Bitcoin’s price action to be driven by organic demand rather than excessive leverage.

This environment positioned Bitcoin for potential continued growth in 2025, with reduced downside risk from forced selling.

Therefore, as BTC adoption grows and institutional interest strengthens, market participants may see continued price appreciation, driven by long-term confidence rather than short-term speculation.