Bitcoin holders shouldn’t fear the fall below $20k as mean reversion…

With the recent performance of Bitcoin [BTC], it seems that the king coin does not have much to give to the advancements that are expected in the crypto space and Web3. However, it does hold the title of being a “store of value” asset as well as an inflation hedge, but lately, the token has been losing that as well.

Is this Bitcoin’s lowest?

Well, this is not the token’s lowest in terms of price, but in terms of value, this could be becoming Bitcoin’s reality. The asset that was set to hit $100k by December 2021 hit $67.5k in November and began falling on the charts. Seven months later, on 18 June, it was still falling after plummeting below the $20k mark.

ApeCoin price action | Source: TradingView – AMBCrypto

While the crash of May 2021 is regarded as one of the worst crashes in crypto history, this month’s crash topped it by a mile. After already declining by 30% earlier last week, the king coin plunged by another 10% on 17 June, bringing the coin to trade at $19,162 at press time.

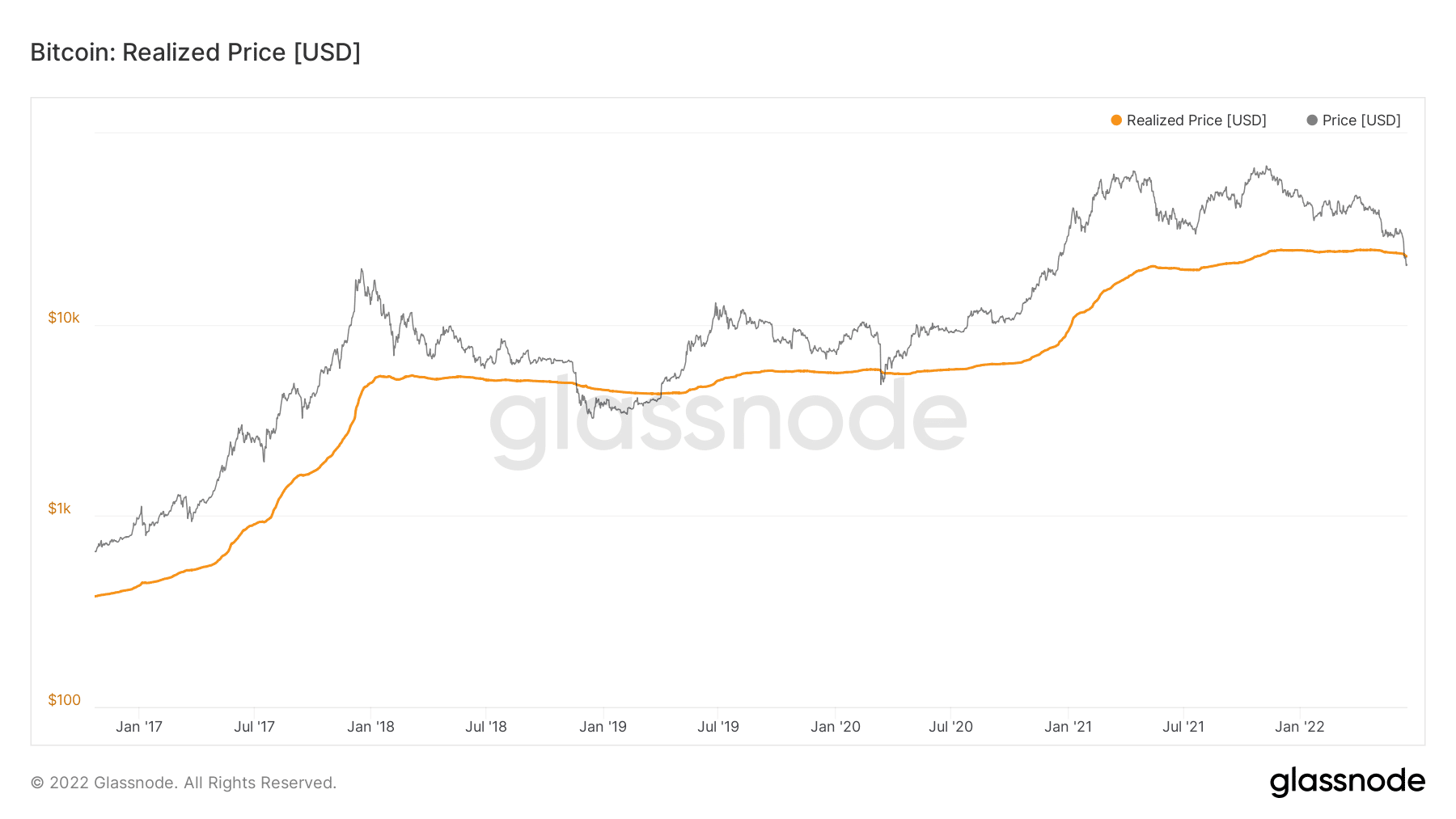

Consequently, the trading price of Bitcoin slipped below the realized price. The realized price is the average price at which each BTC was last moved.

In most cases, the last moved price is the average price at which every BTC was brought. Put simply, this slip below the realized price places the aggregate market in losses.

Bitcoin’s realized price | Source: Glassnode – AMBCrypto

Thus, its store of value characteristic is taking a severe hit for the fifth time in the last 12 years.

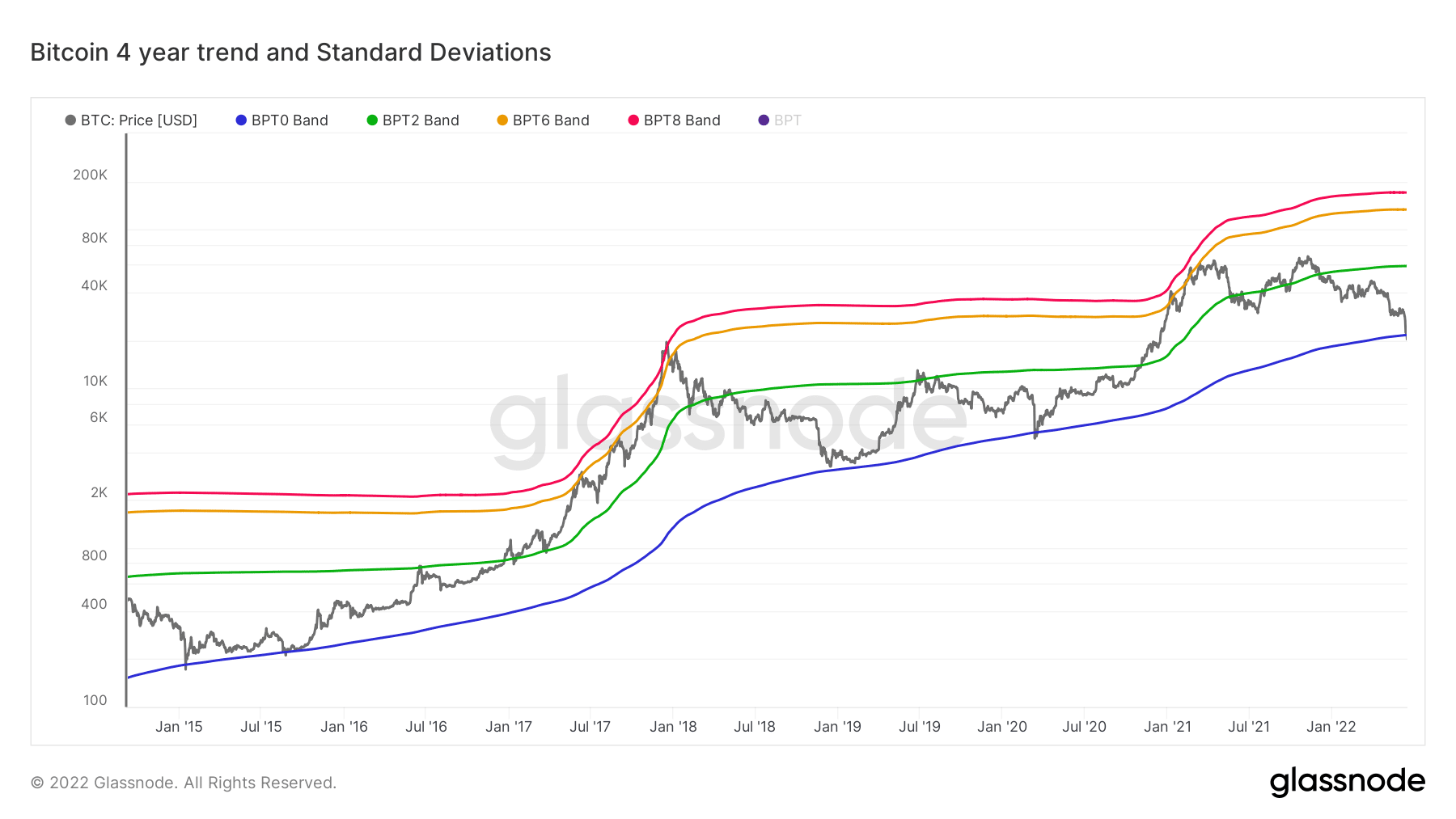

Although this isn’t the only indication of Bitcoin’s lows, the king coin also slipped below its four-year trend for the third time in history. The last time market witnessed this was in 2015 during the bear market and in March 2020 when the COVID-19 induced an economic crash across the globe that led to Bitcoin’s liquidation.

Bitcoin’s 4-year trend | Source: Glassnode – AMBCrypto

However, investors must not lose hope- even though this might be Bitcoin’s lowest point, it can only go up from here.

Improvement on the charts?

This is backed by the fact that Bitcoin’s deviation from the 200-day moving average, the third-lowest in the last ten years, indicates that the king coin is facing oversold conditions. This will create an atmosphere for mean reversion, leading BTC back to its average levels.

Bitcoin’s Mayer Multiple | Source: Glassnode – AMBCrypto

While it could take a while, until then, holders can cherish the fact that Bitcoin is keeping itself above $15k despite the bearishness.