Bitcoin holds ground at $30,000: Traders find solace in patience

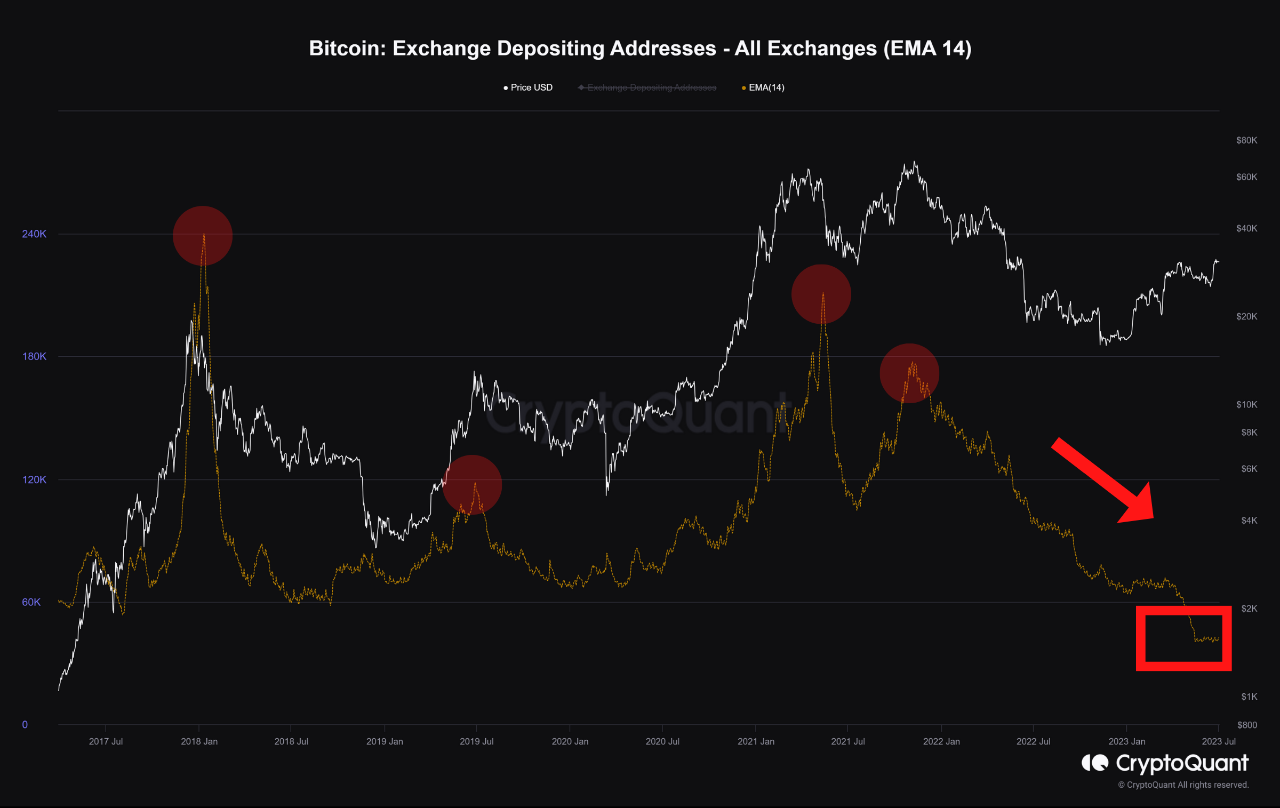

- BTC’s Exchange Depositing Addresses indicator has trended downwards in the past few weeks.

- Investors were not interested in selling their BTC holdings.

As Bitcoin’s [BTC] price lingers in the $30,000 region, the downtrend in the coin’s deposits on cryptocurrency exchanges hints at a decline in interest in selling the leading crypto asset, pseudonymous CryptoQuant analyst Tarekonchain, found in a new report.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Tarekonchain assessed BTC’s Exchange Depositing Addresses indicator and found that since the peak of the last BTC cycle, the indicator has trended downwards. This indicator is commonly used to assess the activity and liquidity of assets on exchanges.

When an asset’s Exchange Depositing Addresses indicator trends upward, it suggests that more participants in the market are actively depositing and trading the cryptocurrency on exchanges. Conversely, a fall indicates a decreased interest in trading that particular asset.

In the current BTC market, Tarekonchain noted:

“Exchange Depositing addresses indicator has reached its lowest bottom level, indicating that investors are showing minimal interest in moving their Bitcoin assets to exchanges. This behavior can be interpreted as a sign that investors perceive the current price as favorable for holding and accumulating Bitcoin in their wallets.”

Hold on, soldier!

A look on-chain at BTC’s exchange activity confirmed Tarekonchain’s position. According to data from Santiment, in the last 90 days, BTC’s supply on exchanges has decreased by 6%. Conversely, the leading coin’s supply held off exchanges has grown by 1%. This showed that while the past three months have been marked by severe volatility in BTC’s price, many have remained steadfast in their decision to hold on to the crypto asset.

During that period, BTC whales increased their holdings. Per Santiment, the count of BTC whales holding between 1 to 1,000,000 BTCs has grown from 1%. This growth happened amid significant price oscillation.

Is your portfolio green? Check out the Bitcoin Profit Calculator

While the general lack of desire by many to sell might be good for BTC’s price, when investments become dormant over an extended period of time, it might be hard for the price to grow. A look at BTC’s Mean Dollar Invested Age indicator (MDIA) confirmed that this might be the case here.

According to Sanbase, this metric is defined as the average age of all coins/tokens on the blockchain weighted by the purchase price.

While it is common for the MDIA to grow as investors HODL, if this metric continues to rise for an extended period, typically months, it suggests a concerning level of stagnancy within the coin’s network. This type of stagnancy often makes it hard for a coin’s price to break any psychological price points.