Why is XRP ‘uniquely positioned’ to hit $5.5 by 2025, $12.5 in 2028?

- StanChart projected that XRP could rally 600% to $12.5 in the next three years.

- The bank cited Ripple’s unique ‘cross-border payments’ positioning as a key catalyst.

According to Standard Chartered, Ripple [XRP] could rally 200% by the end of 2025 to $5.5 and cross above $10 in 2027.

In its report dated the 8th of April, the bank noted that XRP could extend its rise to $12.5 by the end of 2028. That would mean a +600% upswing from the current $1.7 value.

Key XRP catalysts

Interestingly, such a move would be similar to the sixfold returns XRP investors saw after President Donald Trump won November 2024’s elections.

According to Standard Chartered, the rally was due to the expected regulatory shift and dismissal of the Ripple lawsuit under the Trump administration.

In addition, the bank cited Ripple’s positioning as the next catalyst for XRP. Geoffrey Kendrick, StanChart’s head of digital asset research, noted,

“XRP is uniquely positioned at the heart of one of the fastest-growing use cases for digital assets – facilitation of cross-border and cross-currency payments.”

Kendrick added,

“XRPL is similar to the main use case for stablecoins such as Tether: blockchain-enabled financial transactions that have traditionally been done through traditional financial (TradFi) institutions.”

Interestingly, Ripple recently acquired Hidden Road, a traditional prime broker handling $10B a day in trades, to accelerate transactions via XRPL by leveraging XRP and its stablecoin RLUSD.

Ripple’s founder, Brad Garlinghouse, stated,

“Instead of waiting for <24 hours to settle trades through fiat rails, Hidden Road will be using XRPL for clearing a portion of trades, and using RLUSD as collateral across its prime brokerage services.”

For those unfamiliar with XPRL, it’s Ripple’s blockchain designed to advance cross-border payments.

While the acquisition fits Kendrick’s bullish call, XRP was under short-term pressure from macro uncertainty, like the rest of the markets.

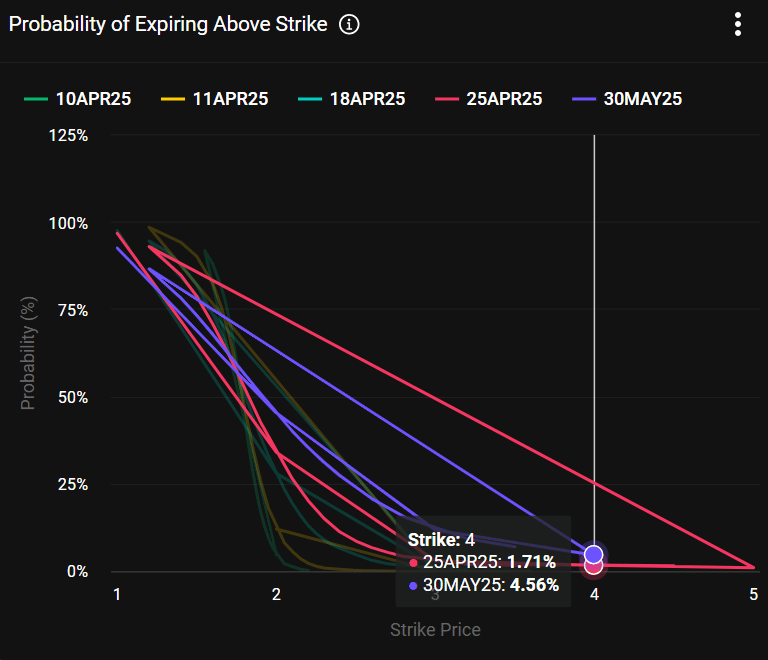

Source: Deribit

That said, the Options market priced only a 4.5% chance of XRP tagging the $4 level by next month.

However, the $4 call option was the top-traded volume in the past 24 hours, suggesting that some traders speculated that the altcoin could hit a new all-time high (ATH) by May.