Bitcoin: How falling U.S. bank reserves might boost BTC price

- A temporal fall in US bank reserves expected could boost BTC.

- Price action looking good as BTC dominance continues.

Bitcoin [BTC] is poised for higher prices as market conditions indicate a potential boost to liquidity.

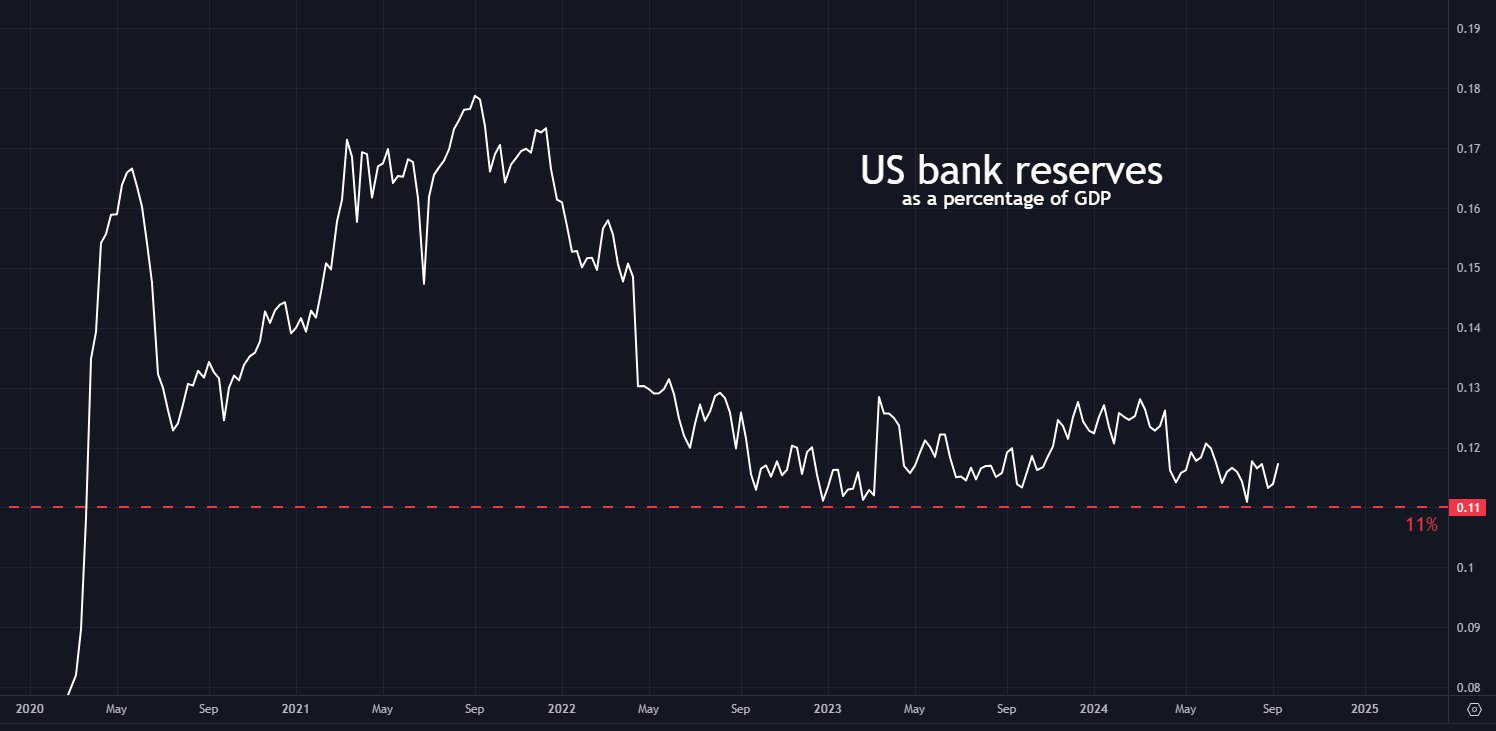

Analyst Tomas on X predicted a temporary fall in U.S. bank reserves to their lowest level in over four years, which could result in the Federal Reserve halting Quantitative Tightening (QT).

When QT stops, it is expected to lead to a significant liquidity increase that will likely benefit risk assets, including Bitcoin.

This possibility has sparked optimism, with many expecting BTC to move higher as the Federal Reserve adjusts its policies in response to economic shifts.

Examining the shorter timeframes, such as the 15-minute chart, Bitcoin continue to show mixed signals.

The TD Sequential indicator has flashed a sell signal for BTC/USDT, while the Relative Strength Index (RSI) and Stochastic RSI are displaying overbought conditions.

This suggests that while a potential correction may be imminent, Bitcoin may still find support if it can close and stay above the $60K level.

The recent range between $53K and $62K highlights the volatility in BTC’s price movement over the past six weeks. Traders are watching for a sustained breakout that could push the price of Bitcoin higher.

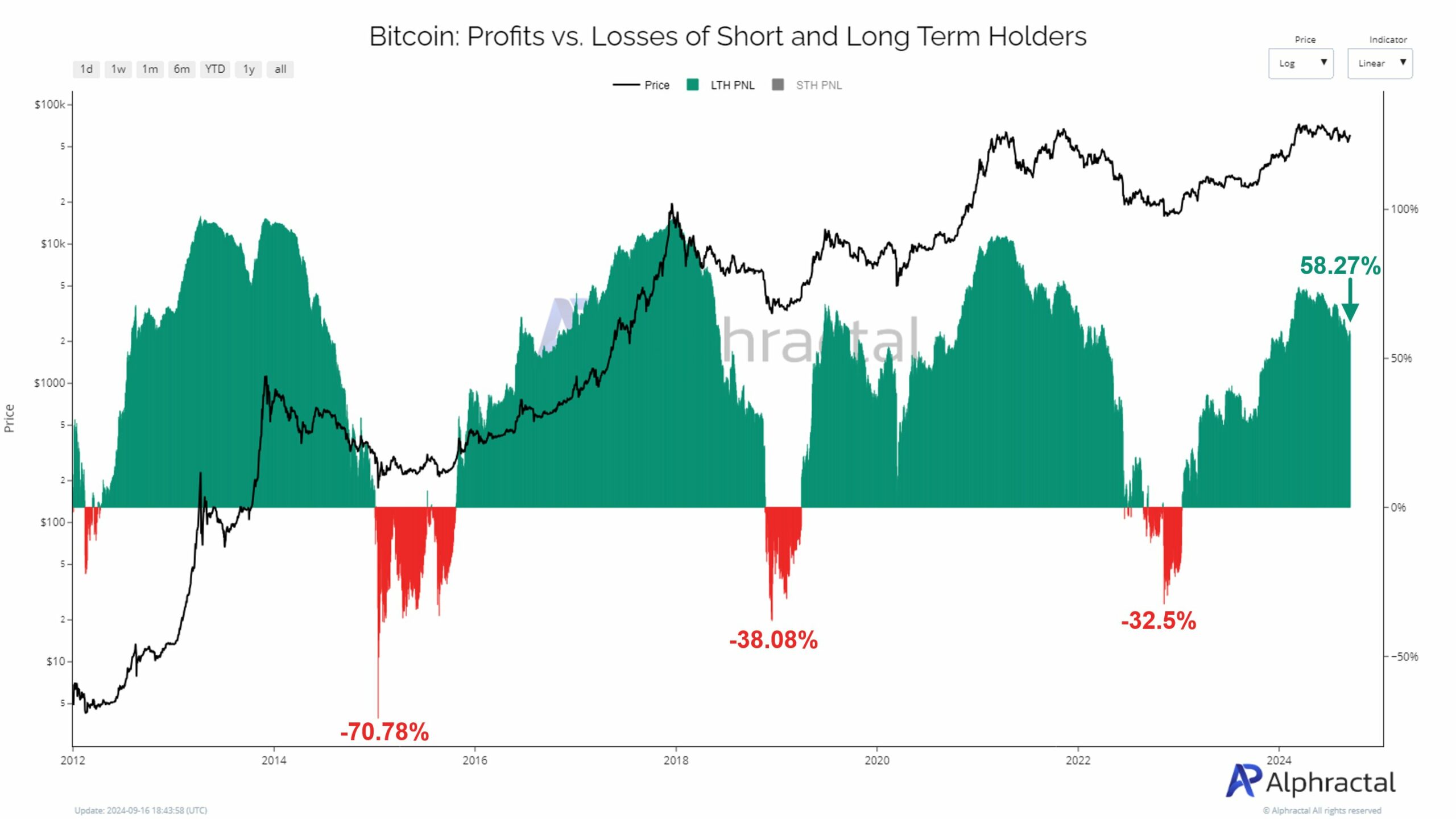

Profits vs losses of short and long term holders

Additionally, Short-Term Holders currently show resilience, with only 4.46% in loss, suggesting no signs of immediate capitulation in the market.

Historically, local bottoms in Bitcoin’s price tend to occur when this percentage reaches around -60%.

The low percentage of loss among Short-Term Holders points to market stability without panic or forced selling.

On the other hand, Long-Term Holders have seen a decrease in their overall profit margin, with 58.27% still in profit, down from a peak of 74% in March.

This drop may indicate that while Bitcoin remains profitable for many but a potential bearish trend could emerge in the future if profit margins continue to weaken.

Bitcoin base cost analysis

In terms of market participants, new whales and Binance traders have been actively buying Bitcoin, while older whales remain holders.

The buying interest from new investors and old whales suggests the market is positioned for potential price growth.

A potential slip in bank reserves may result in a liquidity pump, benefiting Bitcoin and similar risk assets. This combination of factors points to a favorable environment for Bitcoin’s future growth.

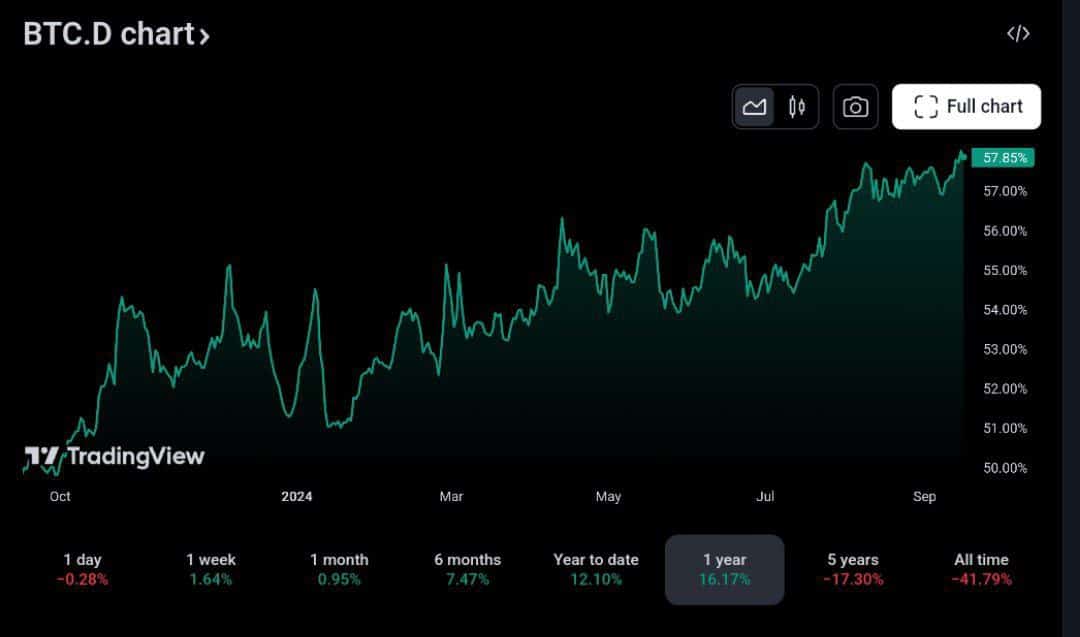

Bitcoin dominance continues to rise

Bitcoin’s dominance in the cryptocurrency market has surged to over 57.86%, marking its highest level since April 2021.

This increase in dominance is a strong indicator that BTC is leading the market and may be poised for a significant rally.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As Bitcoin continues to outperform other cryptocurrencies, this shift could also significantly impact the broader crypto ecosystem long-term.

Investors are closely monitoring this pivotal moment for signs of further movement in Bitcoin’s favor. Bitcoin’s growing market share might set the stage for future gains and drive prices higher soon.