Bitcoin: How long-term holders’ capitulation can signal a potential bull run for BTC

Bitcoin [BTC], the largest cryptocurrency has finally ended its bearish streak after recording nine weekly red candles. At press time, BTC surged by more than 6% as it traded at the $31.5k mark. But that doesn’t fade the fact BTC remains down by 32.5% since the start of the year. Also, HODLers have suffered immense losses. Thus, considering this scenario, can BTC continue the uptrend?

Burning the midnight oil

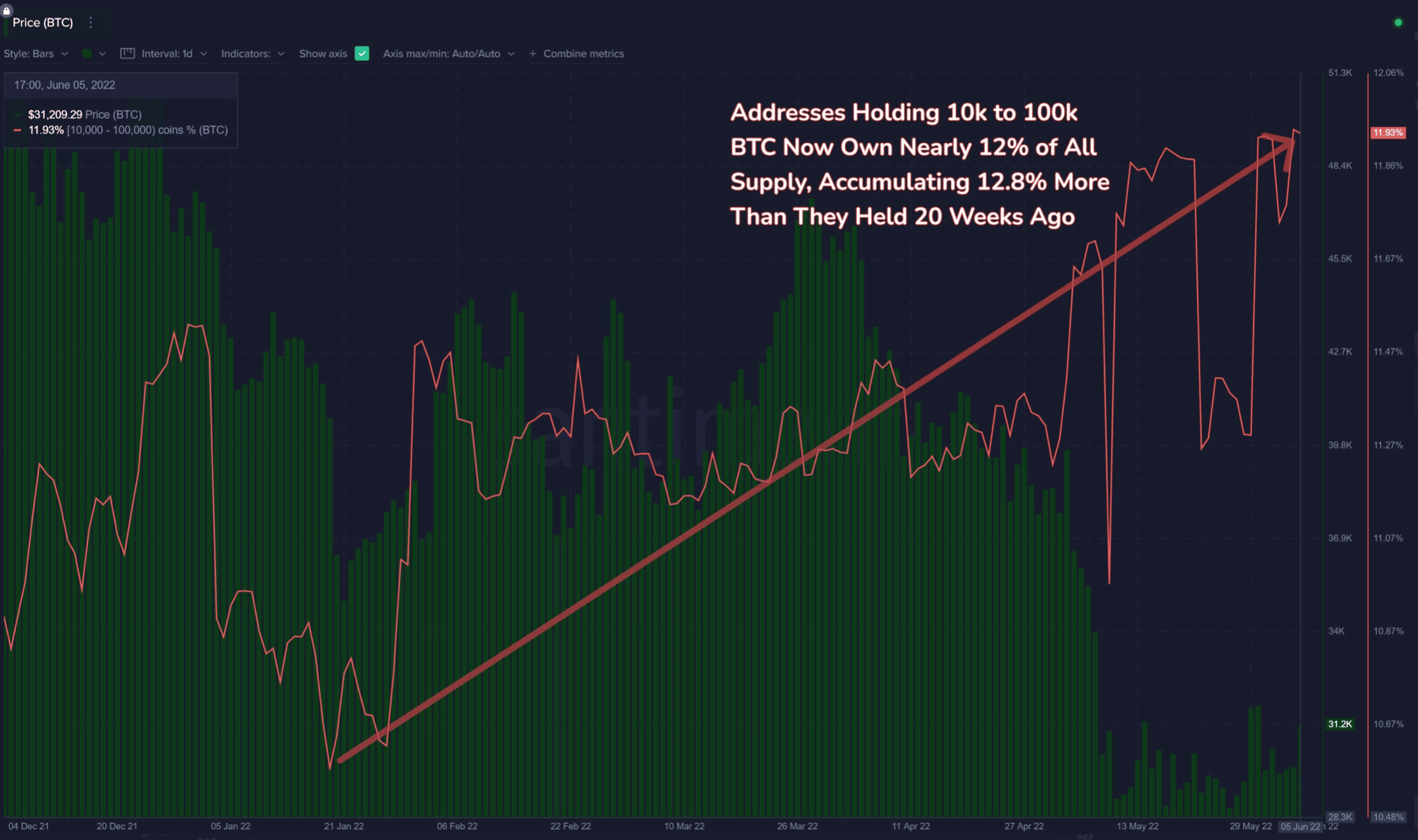

BTC witnessed the first-ever positive close over the last ten weeks. Following this, on-chain data provider Santiment highlighted that the total BTC whale holdings reached a one-month high.

BTC’s mega whales now own the largest percentage of the asset’s supply in over one year as evident in the graph above.

“The mega whale addresses of Bitcoin, comprised partially of exchange addresses, own their highest supply of BTC in a year. We often analyze the 100 to 10k $BTC addresses for alpha, but accumulation from this high tier can still be a promising sign.”

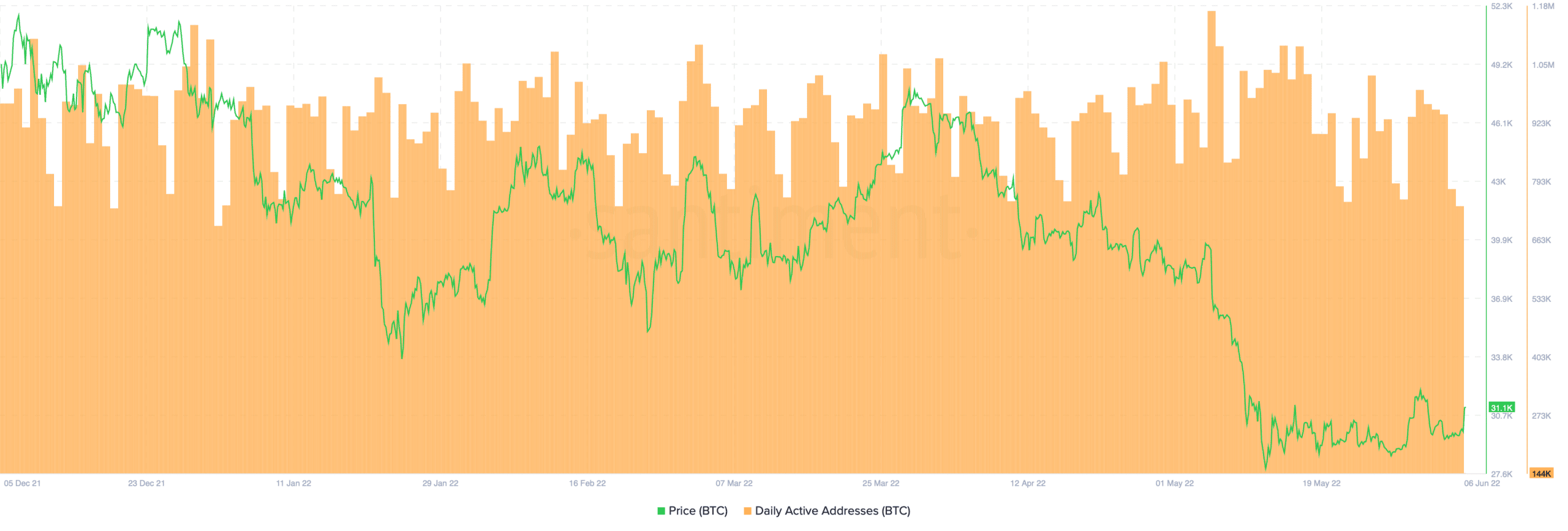

The largest crypto showcased similar signs that could help BTC continue the trend. For instance, one of the more positive trends is that the number of daily active addresses is on a steady rise as visible in the graph below.

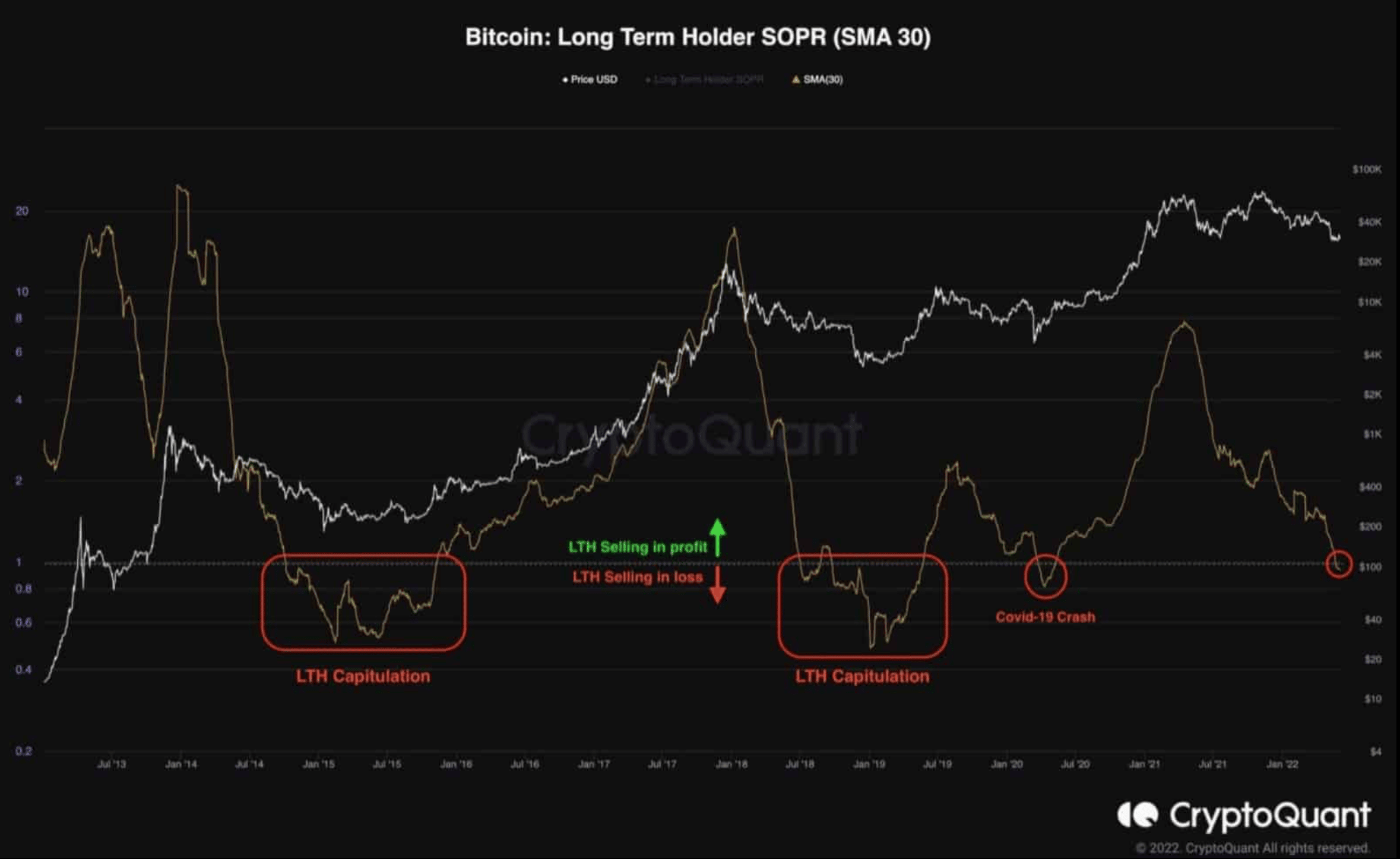

In addition to this, here’s another interesting narrative. The capitulation of long-term holders throughout this bear market has begun. But here’s the question. Given BTC’s past, long term holders at press time are selling their shares at a huge loss yet this may resemble a positive scenario for the king coin.

Markets usually tend to put in a bottom, when massive losses are inflicted on the market participants, an event which is known as “capitulation”. In bear markets, long-term holders’ capitulation usually marks a multi-year bottom. This may not be a one-off event, and it could take weeks or months for long-term holders to capitulate definitively.

Here’s the Spent Output Profit Ratio stats:

Considering the graph, the blog post added:

“The long-term holders’ SOPR is a metric which measures the amount of profits/losses which are realized by this (LTH) cohort. It is evident that during previous bear markets, a lengthy period of long-term holders’ capitulation occured as these participants exited the market at a loss and selling their unervalued coins to new participants or smart money.

They are happy to buy an undervalued asset in huge chunks and hold for extraordinary returns in the future bull market.”

Overall this could play a bullish development for BTC.

Is there a catch here?

Although BTC showed some incline, considering the past performance of the king token, this incline could fade away. On 1 May, the largest cryptocurrency spiked to $32,375, which was the highest level in three weeks. But it ended up erasing its gains the following day and then came perilously close to scoring yet another week in the red.