Bitcoin: How retail demand is shaping BTC’s price surge

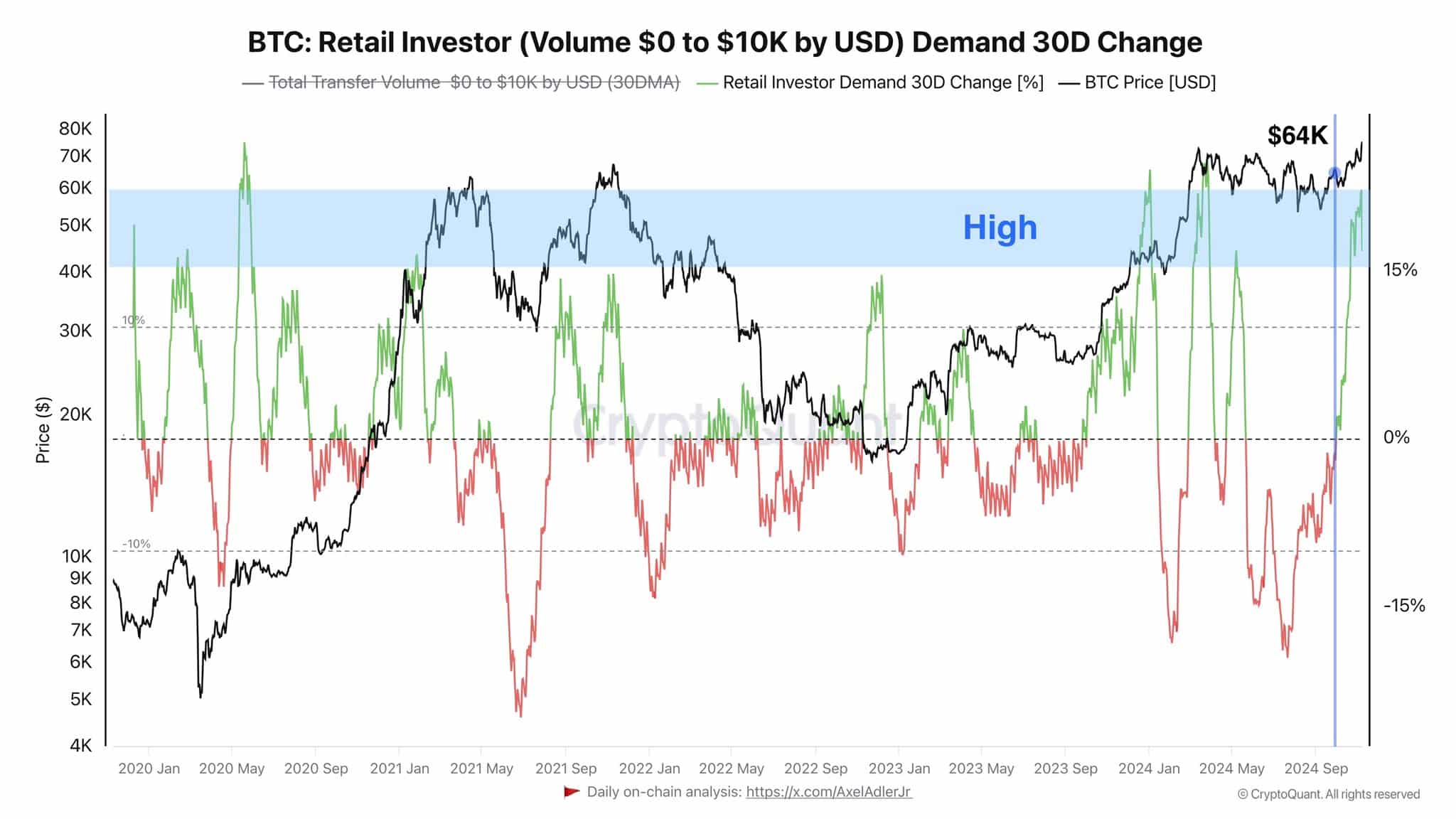

- Bitcoin retail investor volume alongside its price rising.

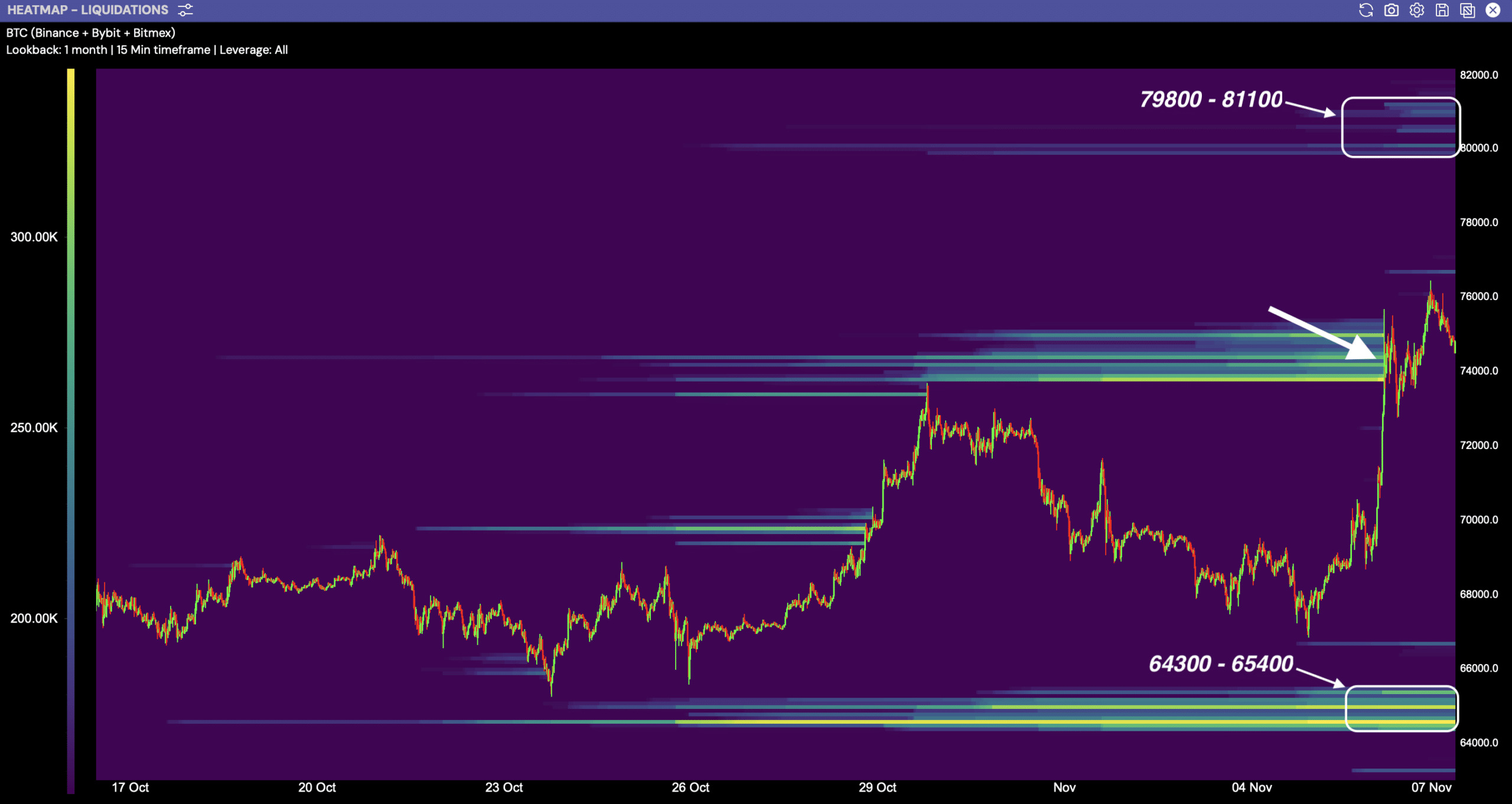

- BTC perfectly swept liquidity triggering high slippage.

The Bitcoin [BTC] retail investor volume has been rising alongside its price, showcasing a clear relationship between increased retail activity and price movements.

Notably, since BTC reached the $64K peak, there has been a significant resurgence of retail interest, particularly as retail demand change surged above 15%.

This indicated that retail investors have been capitalizing on price dips, contributing to buying pressure that often precedes price recoveries.

The spikes in retail demand change correlated with periods where the price of Bitcoin stabilized or increased, suggesting that active retail participation is a bullish signal for Bitcoin’s price trajectory.

As retail investor activity continues to rise above these levels, it could potentially lead to sustained upward pressure on Bitcoin’s market price.

Peak in slippage

Following this price surge, high slippage in Bitcoin trading on perpetual futures market were experienced. BTC price swiftly moved up, coinciding with a sharp peak in slippage, which suggested a rapid execution of trades at varying prices due to sudden liquidity changes.

Retail volume has been increasingly influencing Bitcoin’s price, pushing it higher and this particular instance of slippage likely resulted from BTC “sweeping” available liquidity at lower price levels before abruptly moving higher.

Historically, periods of high retail interest, have contributed to price volatility as seen in the sharp uptick and subsequent price corrections.

Next liquidity clusters to influence BTC next move

The liquidity heatmap for Bitcoin revealed crucial clusters around $64K and $79K, highlighting areas where substantial transaction volumes are likely to occur.

Recently, retail investors have propelled Bitcoin towards these higher prices, and now BTC appeared poised to target the $79K cluster due to its proximity and recent formation.

As Bitcoin approaches this critical level, the potential for another rally increases. The ability of retail investors to continue driving the price higher may hinge on their confidence and market sentiment.

Should Bitcoin maintain positive momentum, it could successfully breach the $79K barrier and potentially reverse to test the $64K level again.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

However, if fear and uncertainty creep into the market, the newfound enthusiasm might wane, causing BTC to stabilize or even retreat from these levels.

Soon, it will be determined if retail investors have enough influence and resilience to push Bitcoin to these ambitious price targets, or if market fears will temper their bullish drive.