Bitcoin: How these exchange metrics could affect BTC’s performance

- Bitcoin exchange outflows had not halted, hitting new highs since the past week

- Miners’ asset flow into exchanges could negatively impact investors’ expectations of recovery

Since Bitcoin [BTC] started trading below $16,000, there were several opinions about the condition of the king coin. For some, the bottom is in, and there is no going down anymore. However, others believe that investors cannot lay claim to being safe already.

Despite the back and forth, BTC seemed to have chosen its stance to remain above the aforementioned price in recent times. However, the basis for collision was not at an endpoint yet, especially with contrasting exchange data.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

First, it’s already down

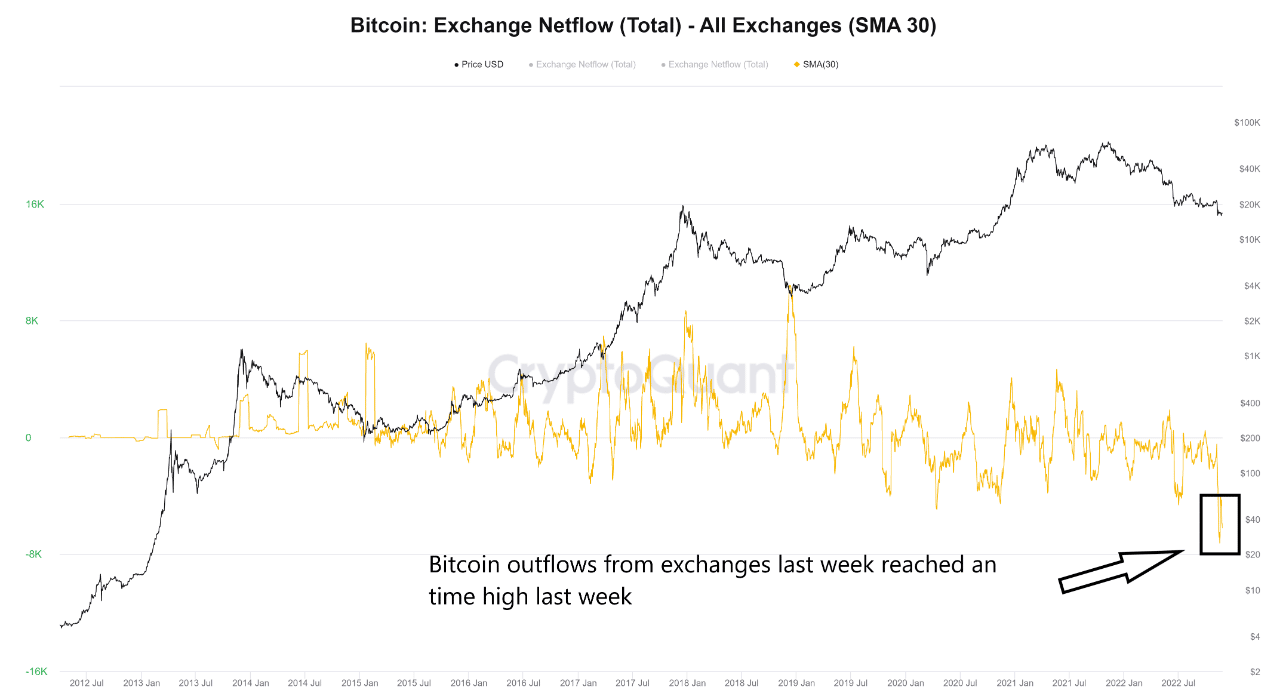

According to CryptoQuant analyst Ghoddusifar, the closeness to a market bottom was already within reach. The analyst, also a Bitcoin Author, defended his position with the condition of the exchange outflow. Ghoddusaifar noted that BTC outflows from exchanges hit an all-time high.

At one point, this was considered an exodus from custodial keeping. However, the consistency might indicate that the outflow status was more than that.

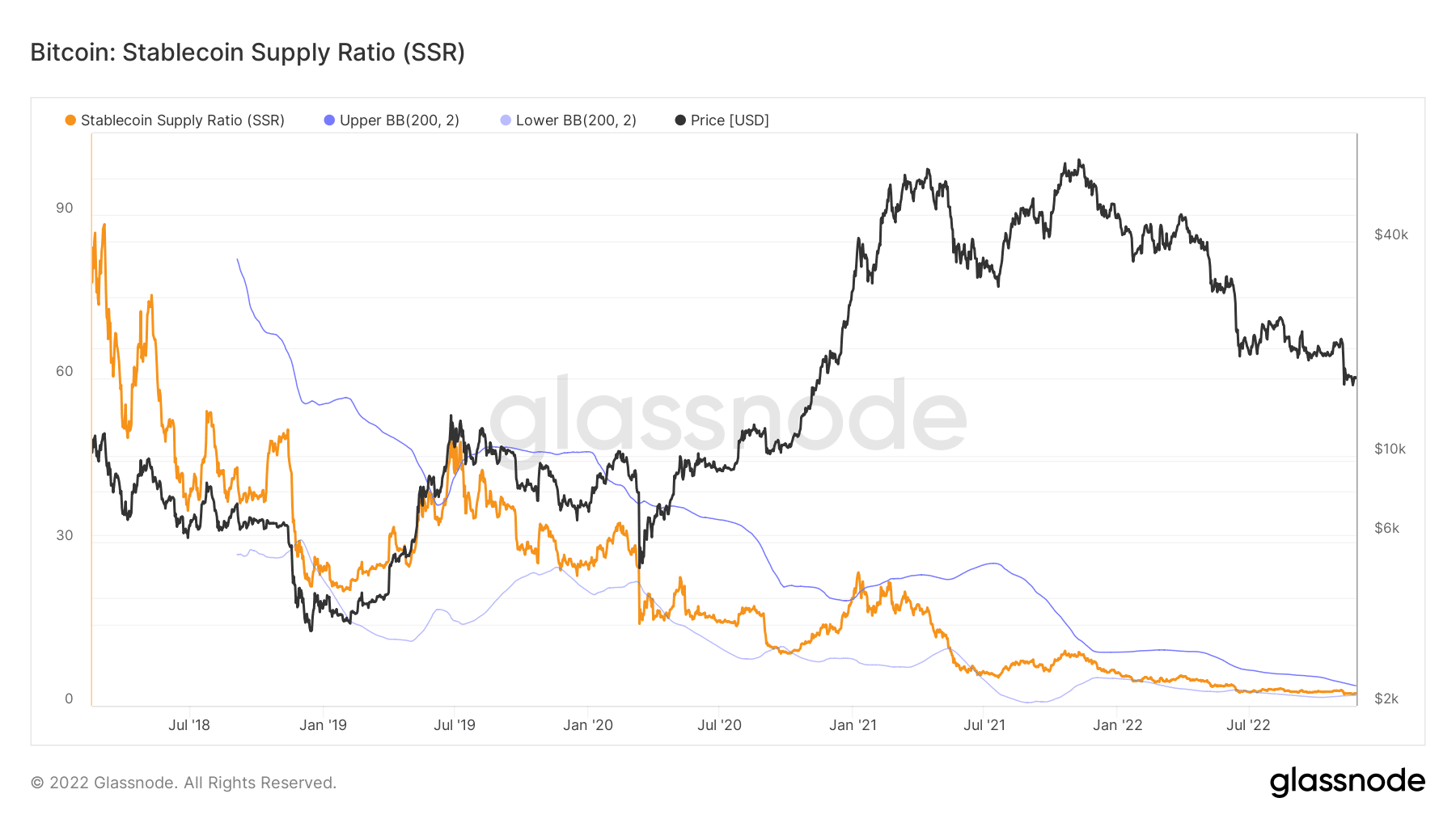

If this was the case, investors might be prepared to accumulate. This was because the Bitcoin Stablecoin Supply Ratio (SRR) was low. The metric, which shows the relationship between the Bitcoin supply and stablecoin market capitalization, was 2.21, based on Glassnode data.

With the value in a tough position, the investors seemingly had enough stablecoin supply power to accumulate BTC. This stance had already begun as the Bitcoin realized cap UTXO had recently started an uptrend in the past week. This implied that investors had purchased a significant number of coins. Thus, massive accumulation was ongoing.

BTC miners’ exchange action on opposing sides

In a turn of events, miners’ profitability seemed to have affected their position on exchanges. According to Glassnode, the BTC miner to exchange inflow reached the highest value in the last ten months.

? #Bitcoin $BTC Miners to Exchange Flow (7d MA) just reached a 13-month high of 16.107 BTC

Previous 13-month high of 14.484 BTC was observed on 19 January 2022

View metric:https://t.co/WwBf5cbKSB pic.twitter.com/wqu252gqTX

— glassnode alerts (@glassnodealerts) November 26, 2022

While this might not be a surprise, considering the recent miners’ status, it could tell on the BTC price trend. This was because the miners’ assets flowing into exchanges meant a bid to sell.

Furthermore, miners’ sell-off usually involves large assets. Hence, BTC was caught in between nearing its bottom and a miners’ attempt to sell, which could further draw down the price.

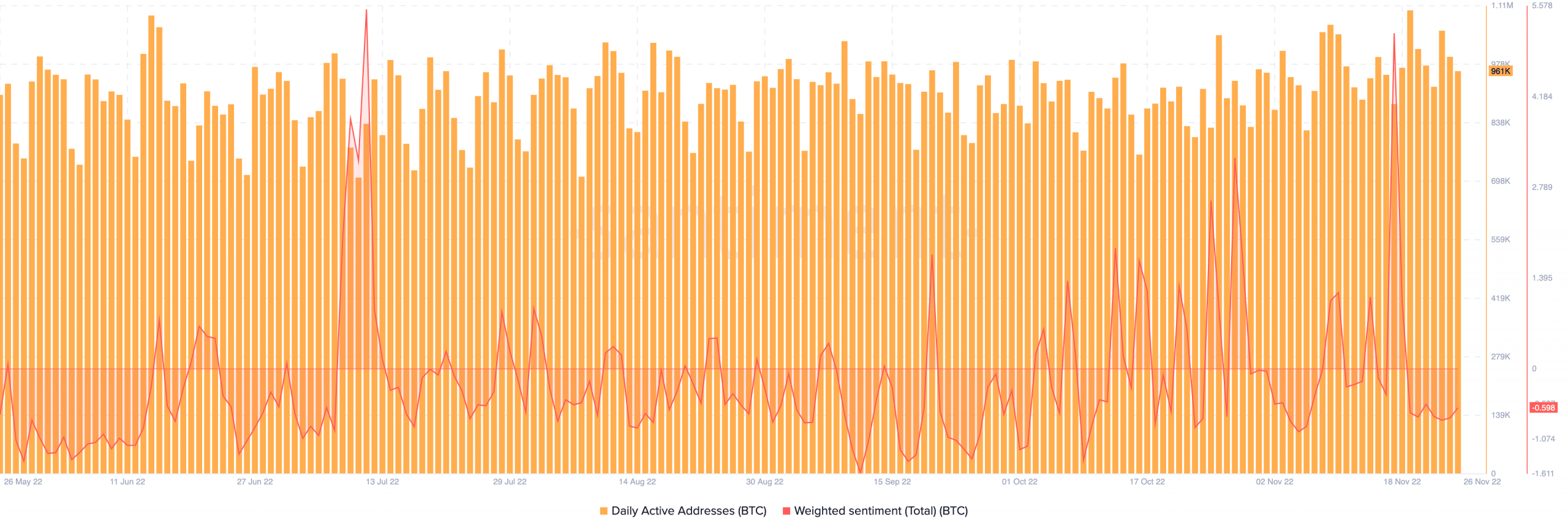

Nevertheless, BTC’s active addresses remained in a positive light. According to Santiment, the daily active addresses, at press time, were 961,000. Although it represented a decrease from the high of 23 November, it still maintained that a good number of unique deposits were happening on the Bitcoin blockchain.

However, with its weighted sentiment at -0.598, there did not seem to be confidence that BTC could register an uptick in the short term.

![Story [IP] price prediction - Traders, look out for this key divergence!](https://ambcrypto.com/wp-content/uploads/2025/06/Story-IP-Featured-400x240.webp)