Bitcoin – Identifying the diversification opportunities in this ‘monster’

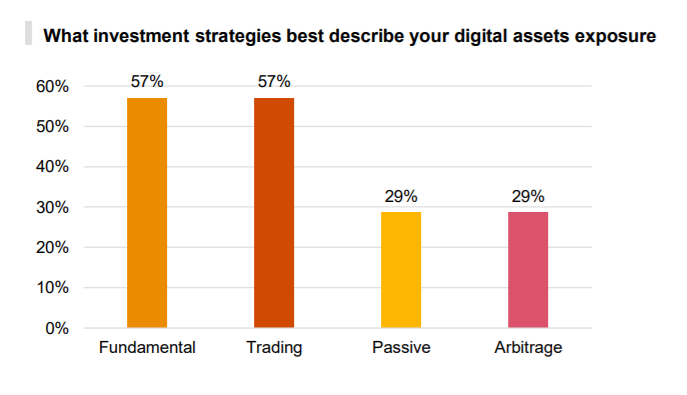

After breaching the $50,000-level, briefly, over the last 24 hours, Bitcoin was hovering near $48,700 at press time. Meanwhile, a majority of the hedge funds (57%) are trading in crypto or choosing the asset class as a fundamental investment strategy.

2021’s PwC study had also noted that 86% of hedge funds, which are currently investing in digital assets, intend to deploy more capital into the asset class by year-end.

Having said that, Fidelity Digital Assets’ Chris Tyrer also stated in an interview recently that “crypto-native assets such as Bitcoin will play a very prominent role in investment portfolios going forward.” He said,

“But then equally, I really believe that with Blockchain we are creating a new operating system for financial services.”

Many institutional investors look at Bitcoin to “risk-off” losses from other asset classes. Meanwhile, even retail investors have been looking at crypto as an inflation hedge like gold for years. In fact, Amy Arnott, a portfolio strategist for Morningstar, recently noted,

“Crypto is definitely becoming more established as a separate asset class and moving more into the investment mainstream.”

The key is diversification

Now, most advise investors that they should directly buy the asset from a crypto-exchange or platform. While that is all well and good, Arnott did caution investors about the asset’s high volatility, adding,

“Even a very small percentage of cryptocurrency can really spike up your portfolio’s risk profile.”

It is for this reason that several financial advisors recommend finding the right crypto-diversification. Ivory Johnson, Founder of Delancey Wealth Management, explained in a CNBC segment that the more volatile an asset class, the longer the timeframe it will need.

What this essentially implies is that risky investments might not be a desirable choice in the short run for non-professional investors.

Some like Jesse Proudman, Chief Executive of the crypto-platform Makara, recommend learning from wealthy “angel” investors to get their portfolios right. Recently, he told MarketWatch,

“When you’re angel investing, you make a lot of different investments, and many of them fail, some of them are moderately successful, and some of them are incredibly successful.”

He also added that diversification is important as it’s the combination that makes a “portfolio compelling.” With that, crypto-investors in many countries can passively invest in crypto-ETFs. In the U.S, for instance, investor exposure to funds is limited to Futures crypto-ETFs.

Having said that, Institutional Investor Hall of Famer Rich Bernstein is an exception and does find cryptocurrencies problematic. He told CNBC that crypto-interest is “becoming dangerously parabolic.”

“Cryptos are the biggest financial bubble ever in history… This is just a monster one.”