Bitcoin is $300 away from hitting $1 Trillion in market capitalization

Bitcoin’s vertical price rally has taken it to a new ATH of $53379 based on data from coinmarketcap.com. After hitting a new ATH barely minutes ago, Bitcoin is only $300 shy of becoming a trillion-dollar asset!

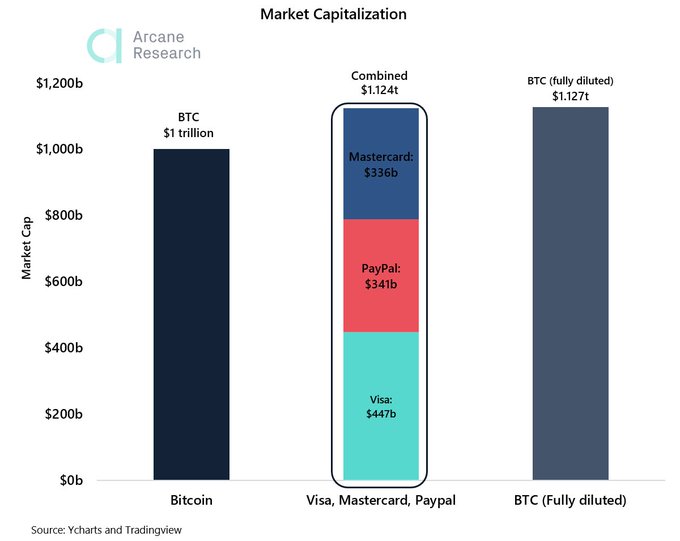

Additionally, when Bitcoin’s market capitalization hits $1 Trillion, its fully diluted market capitalization will surpass the combined market cap of Visa, Paypal, and Mastercard, based on data from Arcane Research.

Source: Arcane Research

This is happening in real-time, as the asset’s price has gained over 3 percent in the past 24 hours alone, and on-chain analysis suggests that the sentiment is bullish currently. The price is fluctuating between $52926 and $53313 for the past hour or so, based on data from coinmarketcap.

What would a trillion-dollar market capitalization mean for the future of retail traders and their portfolios?

One thing is for sure, after hitting a trillion dollars, Bitcoin would set a standard for itself and the price rally would get a boost for the rest of the bull season. What the market has witnessed is demand that is currently driven by institutions and whales, but what we can expect is a rise in the number of retail traders and the trade volume on spot exchanges.

This is critical at the current price point in the rally, as demand from retail traders has an influence on the price on most spot exchanges. With the exception of Binance, OKEx and other top exchanges, most exchanges that have fiat on-ramp have Bitcoin trading at a premium, and the increase in demand will ensure that volatility goes up.

The price volatility that is currently less than 15% for Bitcoin, needs to hit higher for the asset to hit the target for the season set by the S2F and S2Fx model predictions by Plan B.

If Bitcoin’s price is to hit $100000 by the end of 2021, hitting $1 Trillion in market capitalization is critical, giving a massive boost to returns on existing retail trader portfolios. The shrinking supply on spot exchanges has its own part to play here, as does the stablecoin inflow and the growing OI on exchanges like CME, which represent the sentiment of institutional investors. Few hundred dollars away from $1 Trillion, can change the returns on your portfolio soon enough.