Bitcoin is due for a breakout but will it favor bulls or the bears

Bitcoin’s [BTC] retest of sub-$20,000 levels this week came as a surprise to many traders because the market outlook was in favor of an upside. On the plus side, the dip confirmed support and that there is strong demand between the $19,000 and $20,000 range.

The same support zone underscores an upcoming squeeze zone with a long-term descending resistance line. Zooming out thus reveals that Bitcoin is in a triangle pattern and the current structure suggests that it is a bearish triangle.

If Bitcoin moves as per the bearish triangle pattern, then traders can expect another retest of sub-$20,000 price levels. However, this does not necessarily have to be the outcome.

Bitcoin’s downside this week reflects its correlation with the S&P500.

After the recent stock market crash, the price of BTC moved in step with the S&P500 index, and its correlation reached the highest level since the beginning of summer. pic.twitter.com/ErHjGIahlL

— Ling (@xumeiling15) September 2, 2022

Well, the king coin’s correlation with the S&P500 is important because it makes it easier to predict Bitcoin’s behavior with regard to economic policy. A perfect example of this is the bearish performance this week.

It happened after the Federal Reserve chair Jerome Powell’s remarks about the increasing interest rates. He highlighted the need to increase quantitative tightening to mob up inflation and the S&P500 reacted with some downside.

⚠️BREAKING:

*DOW, S&P 500 CLOSE HIGHER AS STOCKS SNAP 4-DAY LOSING STREAK TO START SEPTEMBER

???? pic.twitter.com/tWQtrW8RAv

— Investing.com (@Investingcom) September 1, 2022

Bitcoin’s slight upside since the start of September trails the S&P500’s slight upside. Powell’s statements may have also shifted the market sentiment and it is clear that investors are now starting to expect more “pain.”

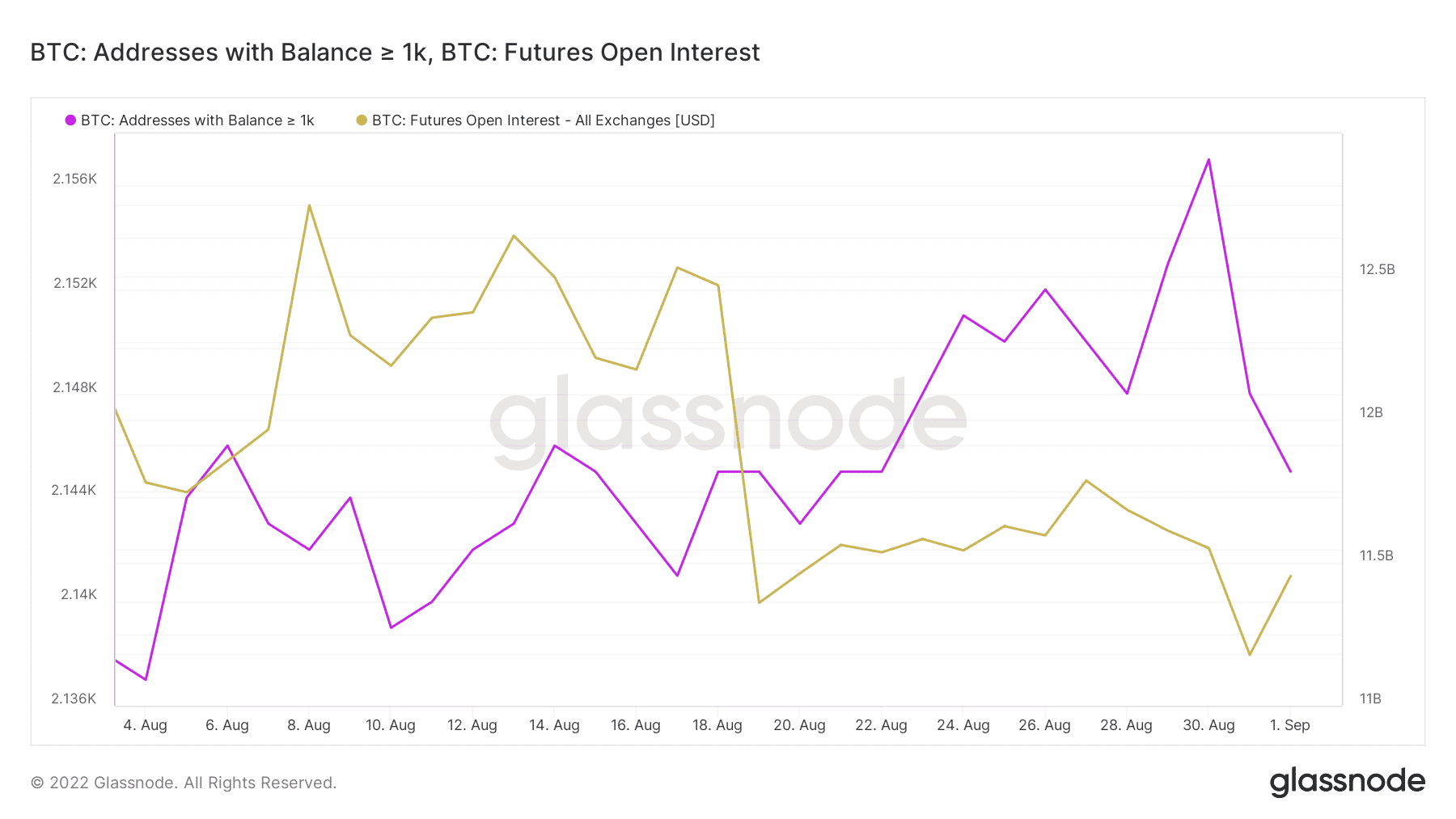

Bitcoin addresses with more than 1,000 BTC dropped significantly since 30 August. This is confirmation of the shifting market sentiment as investors anticipate more downside.

Bitcoin’s open interest metric also registered a shift in open interest as the balances were reduced. This suggests a potential increase in short positions. A look at Bitcoin’s supply distribution reveals mixed results regarding its flows.

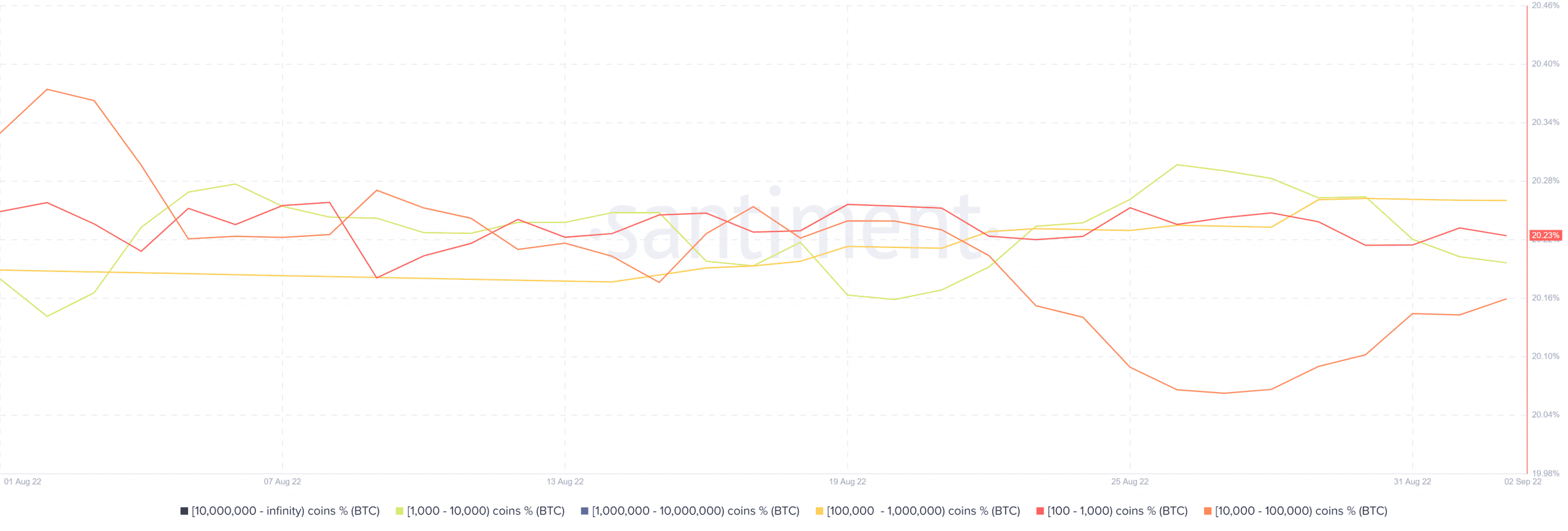

It turns out that addresses holding more than 10,000 BTC have been accumulating since 27 August. On the other hand, addresses holding between 1,000 and 10,000 BTC have been selling.

This category currently controls the lion’s share of Bitcoin’s supply and thus, the bearish outcome in the last days of August.

The observations in the market confirm that investors are currently confused about September’s outlook. In other words, the potential outcome is still a toss-up, especially after Powell’s latest statements.