Bitcoin is set for a pump to $60K if this happens

With Bitcoin’s price surging from $37.2K to $46.49K, one section of the market is rejoicing the rally, while the other is skeptical of the same being a pseudo rally. Keeping in mind the crypto market’s general fame for volatility, it’s no shock that the skeptics aren’t very bullish about the recent rally, but do the arguments have a thread of truth to it?

Net profit turns positive

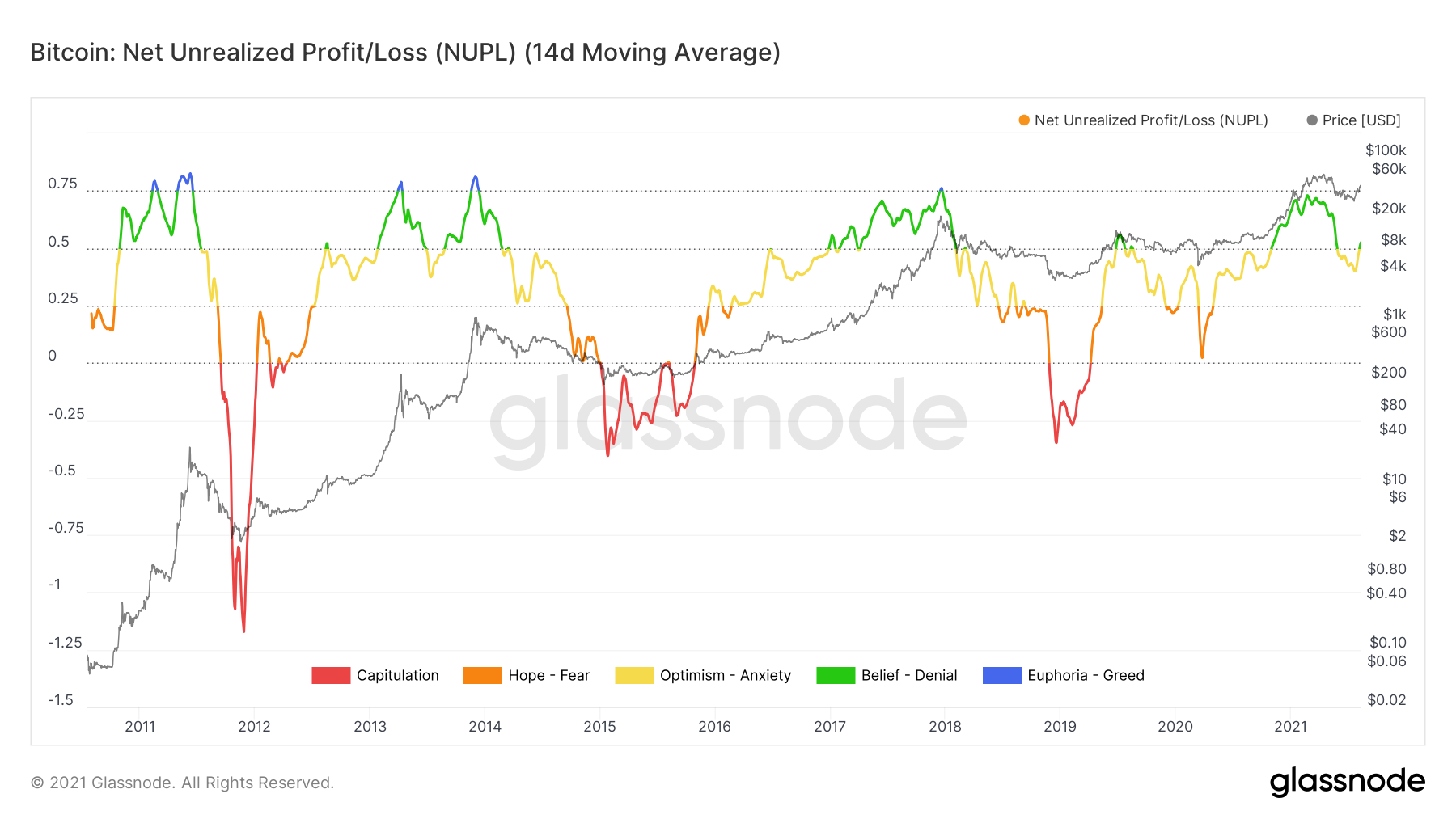

The net unrealized profit/loss (NUPL) finally moved above the 0.5 level (turned green), highlighting the continuation of the bull run. NUPL looks at the difference between the unrealized profit and unrealized loss to determine whether the network as a whole is currently in a state of profit or loss. From May end till August 6, NUPL indicated a total loss for the network as a whole.

The turning green of the NUPL came as a huge relief to the entire network, however, the indicator still read 0.52 at press time. Ideally, the indicator noting a higher value than 0.75 has indicated tops in the past, while values below 0.25 are generally the bottoms. Over the years, it is seen that a NUPL cycle in either of the sections (yellow or green) during a bull rally or bear market, has roughly lasted for a year since 2016.

This bull run, however, lasted just six months but now as the indicator has jumped above the 0.5 level, it highlighted a similar recovery from a short bearish market as seen in October 2012 and July 2013. At that time, the indicator pumped shortly afterward and proceeded to reach a new high of 0.8 by the end of the year. Now if a similar thing happened this time, BTC prices might pump to $60K, or make a new all-time high.

Bears or bulls, who’s winning?

While NUPL highlighted a general bullishness, it’s important to note that even if this rally is here to stay the slight uptick in the indicator is just the beginning of the same. Notably, it was seen that the short-term holder NUPL (STH NUPL) also traded back to positive values after a long time.

A post by analytics platform Glassnode noted that STH NUPL turning green meant that on aggregate, STHs are in a ‘slight profit relative to their on-chain costs basis.’ However, the post also highlighted that such a rapid recovery is common in two cases:

“The first one is in the case of a bear market relief rally while the second is the disbelief phases of a bull market.”

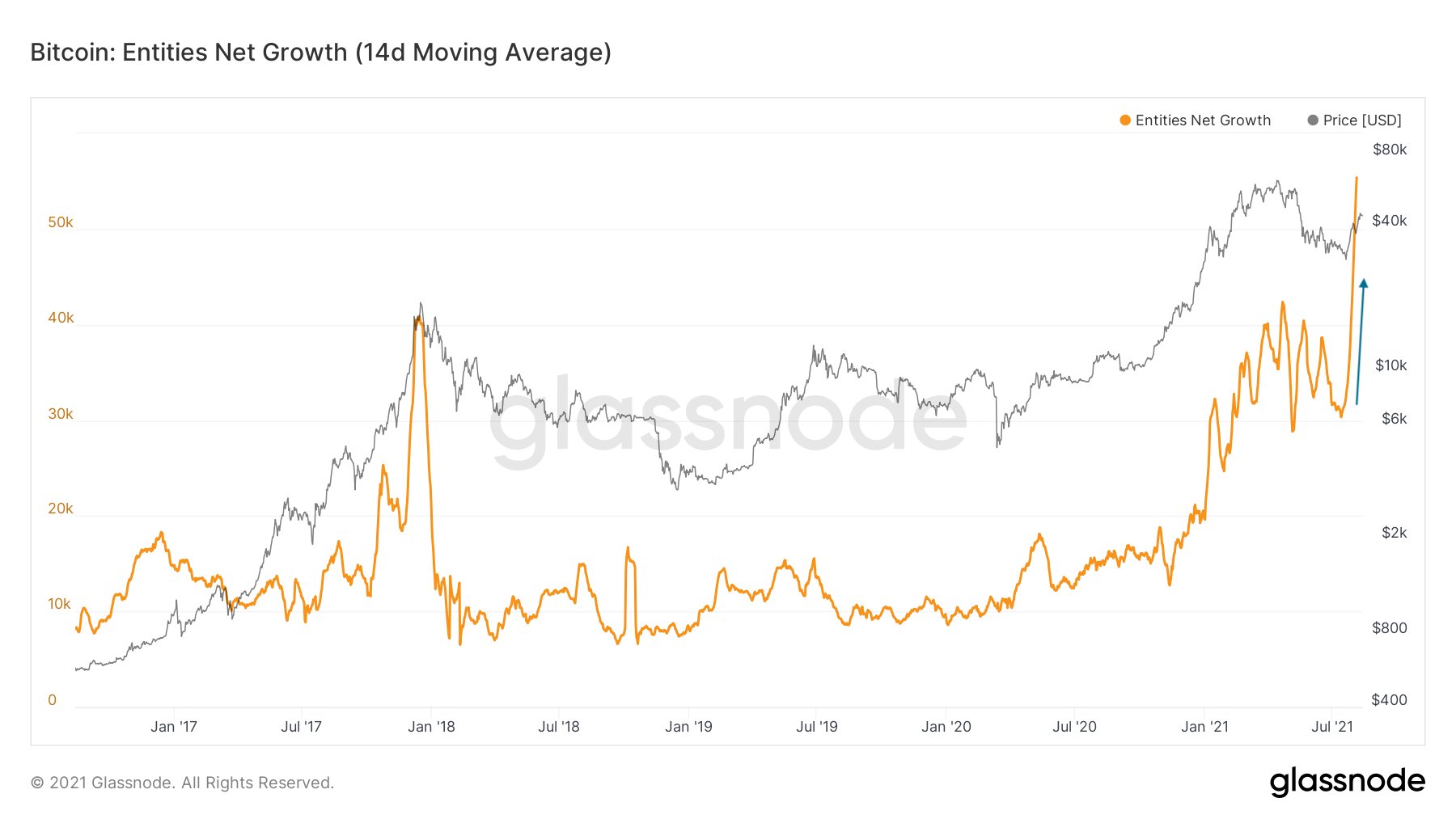

As seen in the above chart this rally could either be a mini-bull rally or an actual rally to an ATH but that depends on various other factors too. As highlighted in a previous article certain metrics need to reach their old ATHs for BTC to reach its own. That being said, in the light of NUPL, it is also interesting to see an influx of new entities in the market.

Analyst, Lex Moskovski, also highlighted that, ‘Bitcoin network participants continued to awaken at a record pace,’ underlining the rise in net entities growth. In hindsight, it is important to note that whenever new entities have come into the picture, Bitcoin’s price has substantially rallied.

![Cardano [ADA] price prediction - 8% rally next, but here's why you should be careful!](https://ambcrypto.com/wp-content/uploads/2025/07/ADA-price-prediction-Featured-400x240.webp)