Bitcoin is under $60,000, but should traders sell or hold now

Another curveball is being thrown at the crypto-industry right now, with Bitcoin and co. collectively bleeding on the charts. With Bitcoin dropping below $60,000, there might be a little bit of panic settling in.

However, it is important to analyze the market on a more structural and on-chain level to estimate the situation. This will be crucial to assessing whether it is a short-term anomaly or long-term correction.

A descending triangle breach for Bitcoin?

According to the 4-hour chart, Bitcoin’s descending triangle faced a breach, at press time, after the support of $60,000 was tested on three previous occasions. On the 18th, 23rd, and 24th, BTC bounced back from the immediate support.

However, this time, the support fell. With the next support range established between $58k-$55k, the possibility of a drop to $55,000 cannot be ignored.

Is it time to panic sell or hold tight?

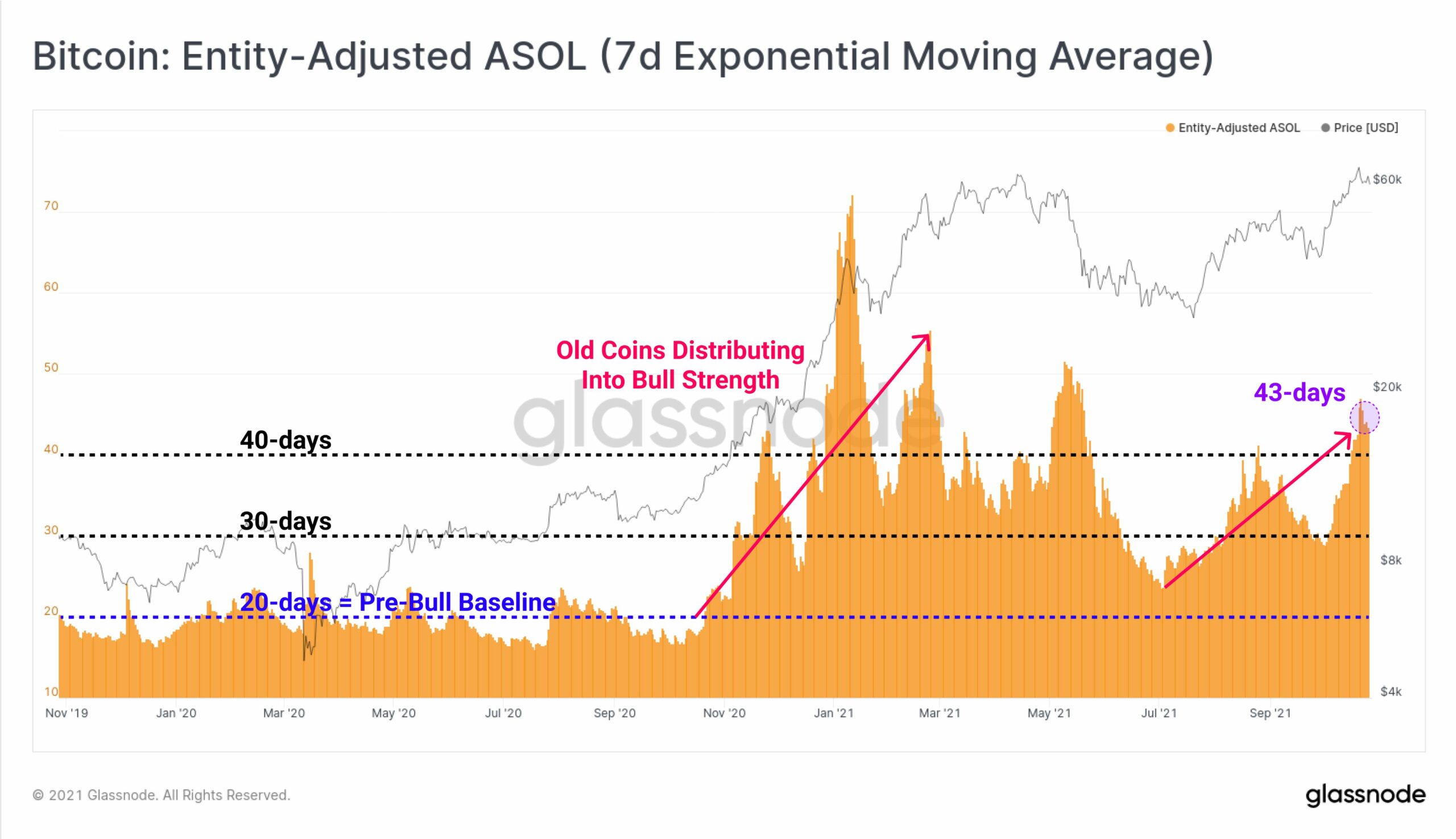

The on-chain analysis did suggest old coins were on the move since the Bitcoin ASOL spiked up to 43 days. It indicated that older coins held by long-term hodlers are getting distributed across the market.

However, there are other long-term narratives that should be kept in mind.

Glassnode revealed that the spent volume age bands still represent insignificant Bitcoin on-chain movement, as older coins were only 6% at press time.

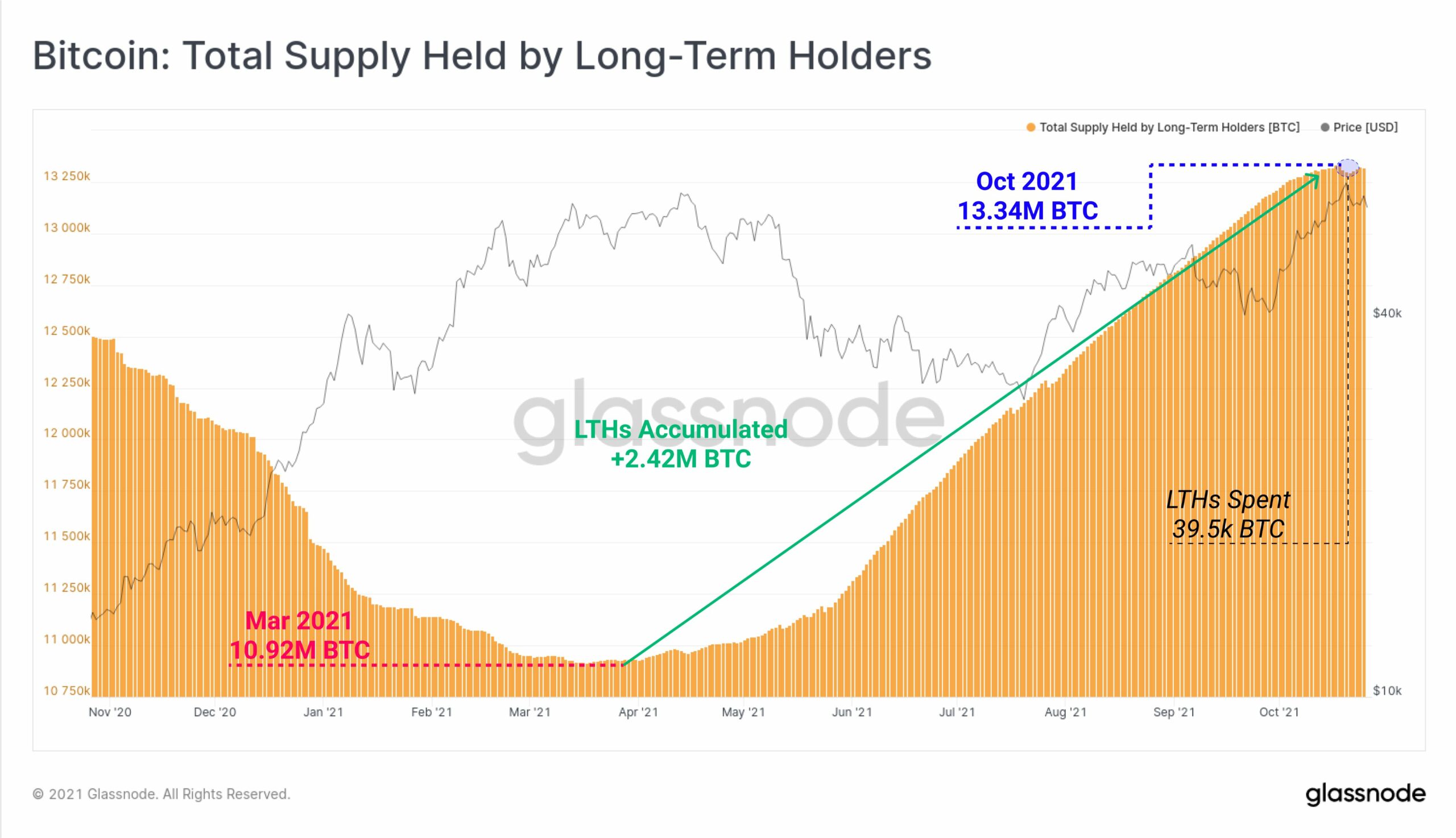

Additionally, the actual coin volume spent by LTHs was less than 3% of the accumulated balance since May 2021. This means that even though LTHs are taking out profits, it is not a mass exodus.

What should investors look out for?

During every bullish cycle, these profit-taking windows are a natural occurrence. It was observed during the beginning of January, middle of February, and the 3rd week of April. Therefore, it isn’t the time to panic sell any assets brought over the past week or month.

For Bitcoin to undergo a bearish reversal, a daily candle has to close below $50,000 to revise the market structure and evaluate the following direction.

At the time of writing, the long-term bullish narrative for Bitcoin seemed firmly intact. Buying pressure may push the price back up over the next week.

![Three days ago, Uniswap [UNI] attempted a breakout from a parallel channel, surging to hit a local high of $7.6. However, the altcoin faced strong rejection.](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-83-400x240.jpg)