Bitcoin: Japan banking crisis to aid BTC? Arthur Hayes predicts big moves

- Hayes put a buy call for BTC in anticipation of US dollar liquidity as Japanese banking crisis worsens.

- However, another analyst suggests that BTC headwinds will only end if the miner crisis ends.

Japan’s banking crisis is reportedly on the brink of exploding and could inject US ‘dollar liquidity’ and boost Bitcoin [BTC] and the overall crypto market.

In a new blog post on 20th June, BitMEX founder Arthur Hayes, viewed the potential impact of the Japanese banking crisis as a ‘pillar’ for the sector.

‘This is just another pillar of the crypto bull market.’

According to Hayes, the fifth-largest Japanese bank, Norinchukin is already under strain and plans to sell $63 billion of its US and European bonds.

The BitMEX founder added that the US may be forced to intervene to salvage the crisis, which could drive a ‘stealth dollar liquidity’ injection.

How will Bitcoin benefit?

Per Hayes, the Norinchukin’s US Treasury (UST) sell-off could tip other mega banks to follow suit.

‘All the Japanese megabanks will follow in the footsteps of Nochu (Norinchukin) and dump their UST portfolio to make the pain go away. That means $450 billion worth of USTs will hit the market quickly.

However, per Hayes, the US might not allow the above scenario because ‘yields would spike higher,’ making the federal government extremely expensive to fund.

In response, the US could convince the Bank of Japan (BoJ) to use a repurchase facility program to ‘absorb the UST supply.’ In return, the US will hand over ‘freshly printed US dollars’ to the BoJ, spiking dollar liquidity.

The executive also noted that a similar situation occurred in Q4 2023, and ‘it was off to the races for all risk assets, crypto included.’ Additionally, the US banking crisis in March 2023 tipped BTC to surge +200% after a bailout was announced, Hayes expounded.

To the BitMEX founder, the November US election was another play that could force the US to intervene in the Japanese banking crisis.

‘In an election year, the last thing the ruling Democrats need is a massive rise in UST yields, which affect major things their median voter financially cares about’

As a result, the next US liquidity injection was likely to come from the Japanese crisis, which was a boon for crypto investors. If so, Hayes nudged investors to ‘buy the f**king dip.’

BTC dilemma

Despite the above macro buy signal for BTC from Japan woes, the Bitcoin miner crisis was not over to confirm the buy call.

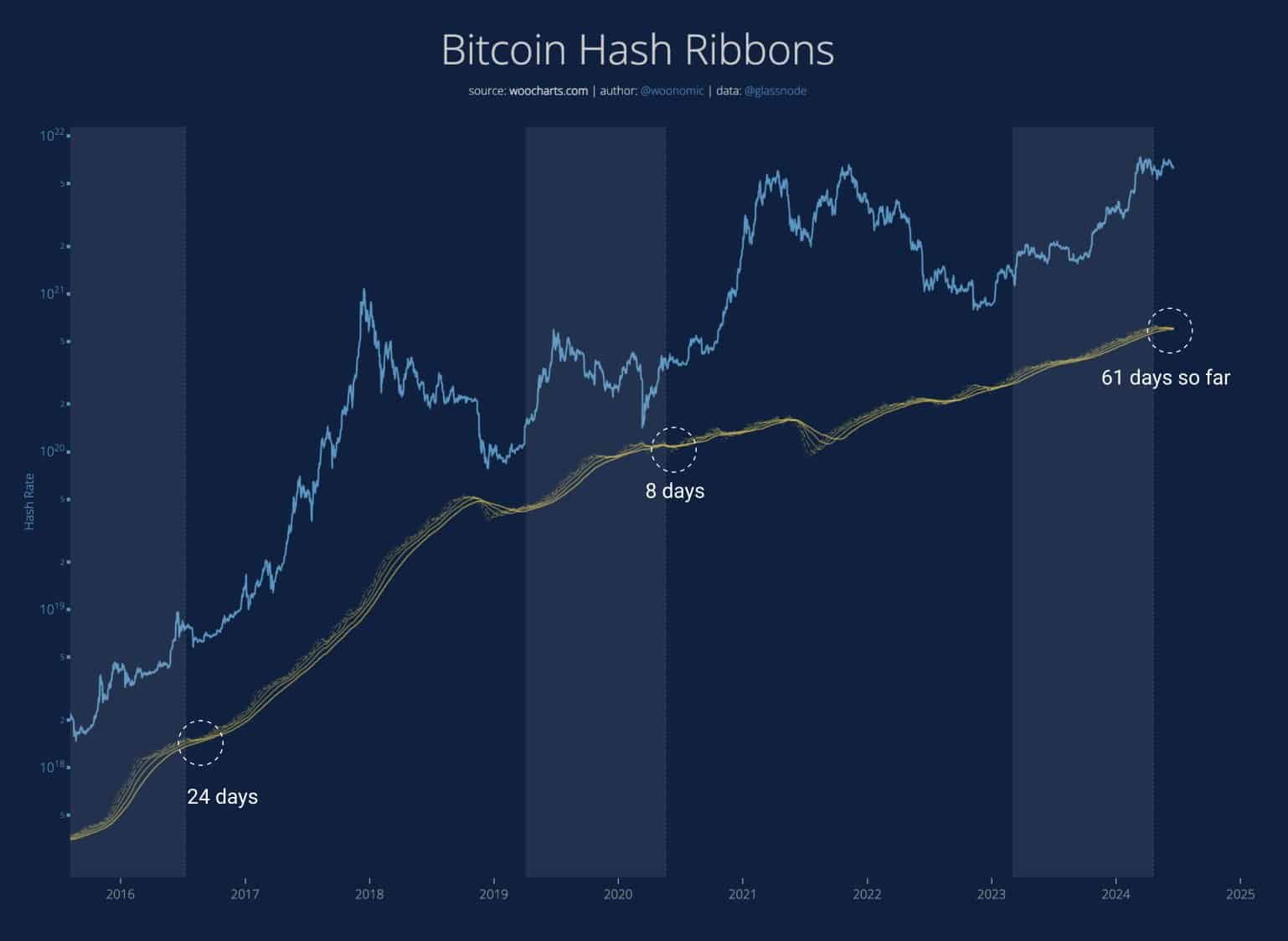

According to Willy Woo, a renowned BTC analyst, the BTC miner crisis was taking longer, and BTC will only improve over.

‘When does #Bitcoin recover? It’s when weak miners die and hash rate recovers.’