Bitcoin L2: Stacks’ latest upgrade causes a stir among STX holders – Why?

- The price of the token and TVL increased after the community agreed to the proposal.

- Users would be able to access the Nakamoto Testnet by the 25th of March.

After a long time of waiting, the Stacks [STX] community has agreed to the deployment of the Nakamoto Upgrade. According to the voting results, no STX holders voted against the proposal.

However, Stacks also allowed non-STX holders to participate in which 99.98% clicked ‘yes’ to the approval.

Interestingly, the value of STX jumped moments after the result went public. At press time, AMCrypto observed that STX’s price had increased by 17.34% in the last 24 hours. This performance was better than Bitcoin’s [BTC], despite being a Layer-2 on the network.

Does this mean no exploit?

Stacks proposed the Nakamoto Upgrade as a way to bring improvement to the network. One of the potential improvements includes faster transactions in Bitcoin block time. Another one is to decrease the Maximum Extractable Value (MEV) linked with Bitcoin transactions.

The MEV is the maximum potential profit that a miner or validator can derive by manipulating transactions. Therefore, the upgrade, when implemented, might reduce these occurrences. Also, validators and miner can get their standard rewards without issues.

However, STX price was not the only metric affected by the development. According to AMBCrypto’s analysis, growth also spread to its Total Value Locked (TVL).

At press time, DeFiLlama data showed that the TVL had climbed to an all-time high of $156.52 million. The more the TVL increases, the more secure and valuable the network is perceived to be.

Metrics concur with the direction

The increase in the metric also meant that market participants trust that Stacks would produce more yields. Coincidentally, Stacks’ co-creator Muneeb Ali posted on X about the potential effect of the upgrade on the ecosystem.

Ali, in his post, explained that Stacks users can earn more BTC yield. He also mentioned the growth in network usage would create a “positive economic loop.”

The development has also caused discussion on several social platforms. Based on our perusal, we found that participants have started comparing to Ethereum [ETH] and Solana [SOL].

This was because some of the transaction speed, security, and decentralization offered by Nakamoto might make Stacks’ adoption climb.

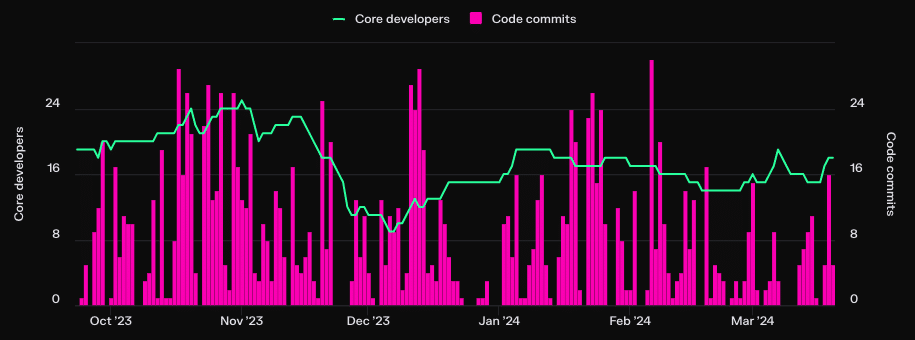

In the meantime, Token Terminal revealed that core developers and code commits on Stacks have been increasing.

Is your portfolio green? Check the Stacks Profit Calculator

The surge in these metrics implies that developers are bullish on the L2. It also suggests that the project might ship out new features soon.

Besides that, Stacks gave a timeline for the completion of the upgrade. According to the project, the Testnet will be live on the 25th of March. It also mentioned that it would activate the Mainnet between the 15th and 29th of May.