Bitcoin lessons: What the past 48 hours taught us about whales

After a significant period of swing action, Bitcoin, at the time of writing, was finally consolidating near the $35,000-mark. This was a relief for many, especially since in the last 48 hours, the cryptocurrency’s price dropped from $41,000 to a lower range of $32,000. While some investors feared the worst, further drawdowns were not seen on the charts as Bitcoin recovered over the last 12 hours.

With Bitcoin’s short-term trading sessions riddled with uncertainty at press time, Glassnode identified a few key factors that might highlight a vital role going forward.

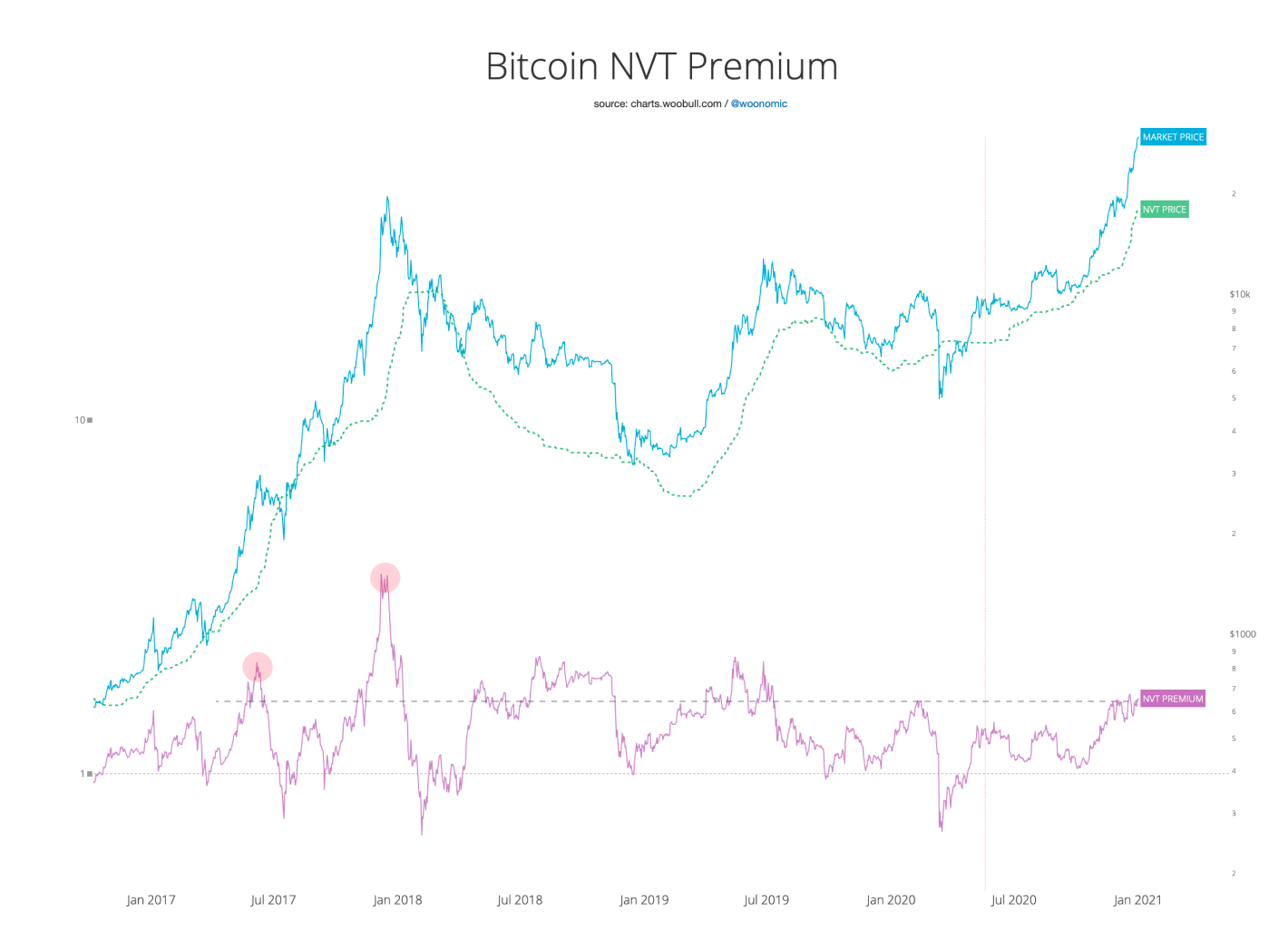

Bitcoin NVT Premium remains below 2019 levels

Source: Glassnode

Bitcoin NVT Ratio or Network Value to Transaction Ratio is key in identifying whether Bitcoin’s price is overvalued or undervalued. Based on Glassnode’s findings, the NVT premium is currently below the levels attained in 2019, and largely below January 2018. What does this mean? Well, it means that the rally is far from being overheated and as Willy Woo suggests, bullish capital flows into the market remain strong following the massive dip.

In fact, short-term investment flows taking place on spot exchanges remain bullish, with investors heavily buying at this all-time high range.

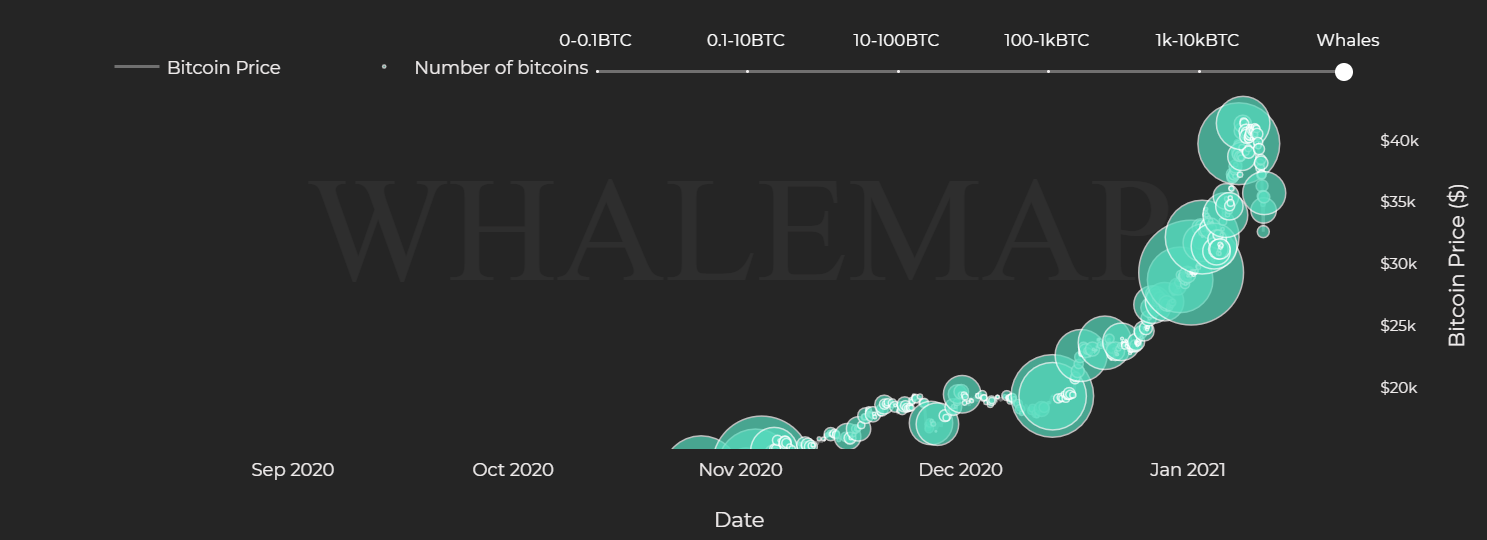

Are Whales actually active?

Source: WhaleMap

In order to validate whale interest, we tracked down whale movements over the last 24 hours, and certain confirmations were identified. According to the chart above, after the decline from $41,000, a total of 13,193 BTC was accumulated at approx. $35,000 and a further 1,017 BTC were picked up at $32,600.

While these data sets are not significantly high, it is notable that whales are continuing to remain active despite bouts of bearish pressure.

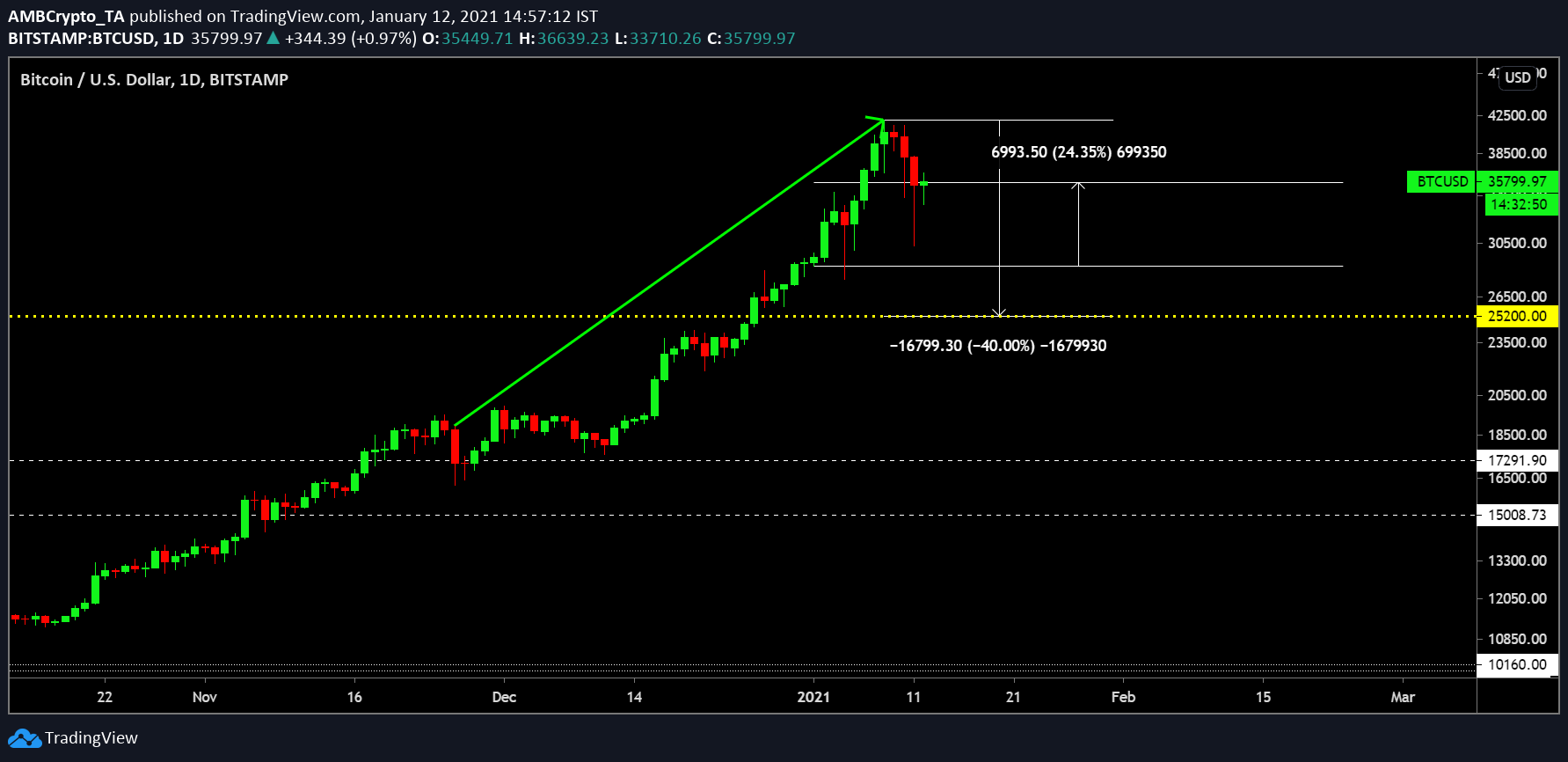

Bitcoin recovery and 40% drawdown chances

Source: BTC/USD on Trading View

While the market continues to remain bullish, it is noteworthy that a drawdown of 40% should be expected during such a rally. While it may not manifest over the next few weeks, a possible drop down to $25,200 will not be a surprise.

With respect to 2021, the crypto-asset was still up by ~25%, at press time, highlighting the positive nature of the Bitcoin market. The recent pullback is healthy, according to market structure, otherwise, the decline would have come later and been even greater, in the coming weeks.