Bitcoin: Long-term holders in no mood to sell

- Most holders, on average, were in a state of profit but were strongly resisting the urge to sell.

- Long-term holder supply increased from 75% to 78.62% since the low volatility phase kicked in.

The intense pressure exerted by U.S. regulators on major crypto entities has fueled substantial FUD among market participants. Coupled with May’s extended period of low volatility, there has been little to cheer for these players lately.

Read Bitcoin’s [BTC] Price Prediction 2023-24

But despite the odds, long-term holders (LTH) continue to show faith in the market’s potential, especially in king coin Bitcoin [BTC].

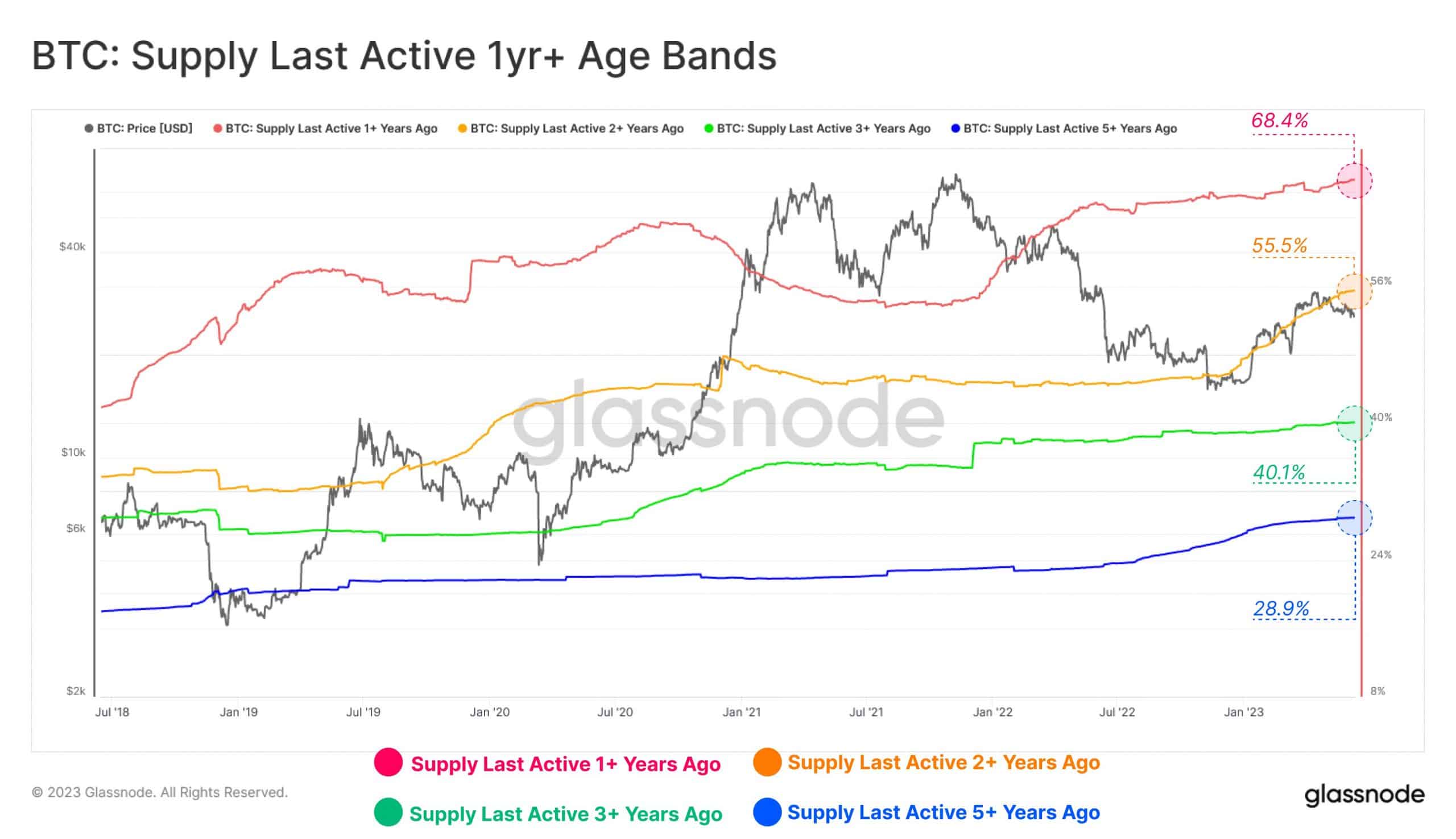

According to on-chain analytics firm Glassnode, the percentage of supply held for longer than a year climbed to an all-time high (ATH) of 68%, revealing investors’ lack of willingness to sell.

Resilience on display

Long-term holders are the participants who keep possession of coins for more than 155 days. Popularly referred to as “diamond hands”, this cohort is thought to have a high-risk tolerance and will not sell despite protracted losses.

As indicated in the above graph, BTC’s dormant supply across most age bands has increased significantly since the start of 2023. However, the most striking trend was the growing supply in the 2+ years band.

This cohort of investors brought the coins doing the Great Miner Migration of 2021 when mining activities moved out of China after the government’s crackdown and BTC crashed. As prices are yet to recover, these players are holding the coins, anticipating a bullish surge.

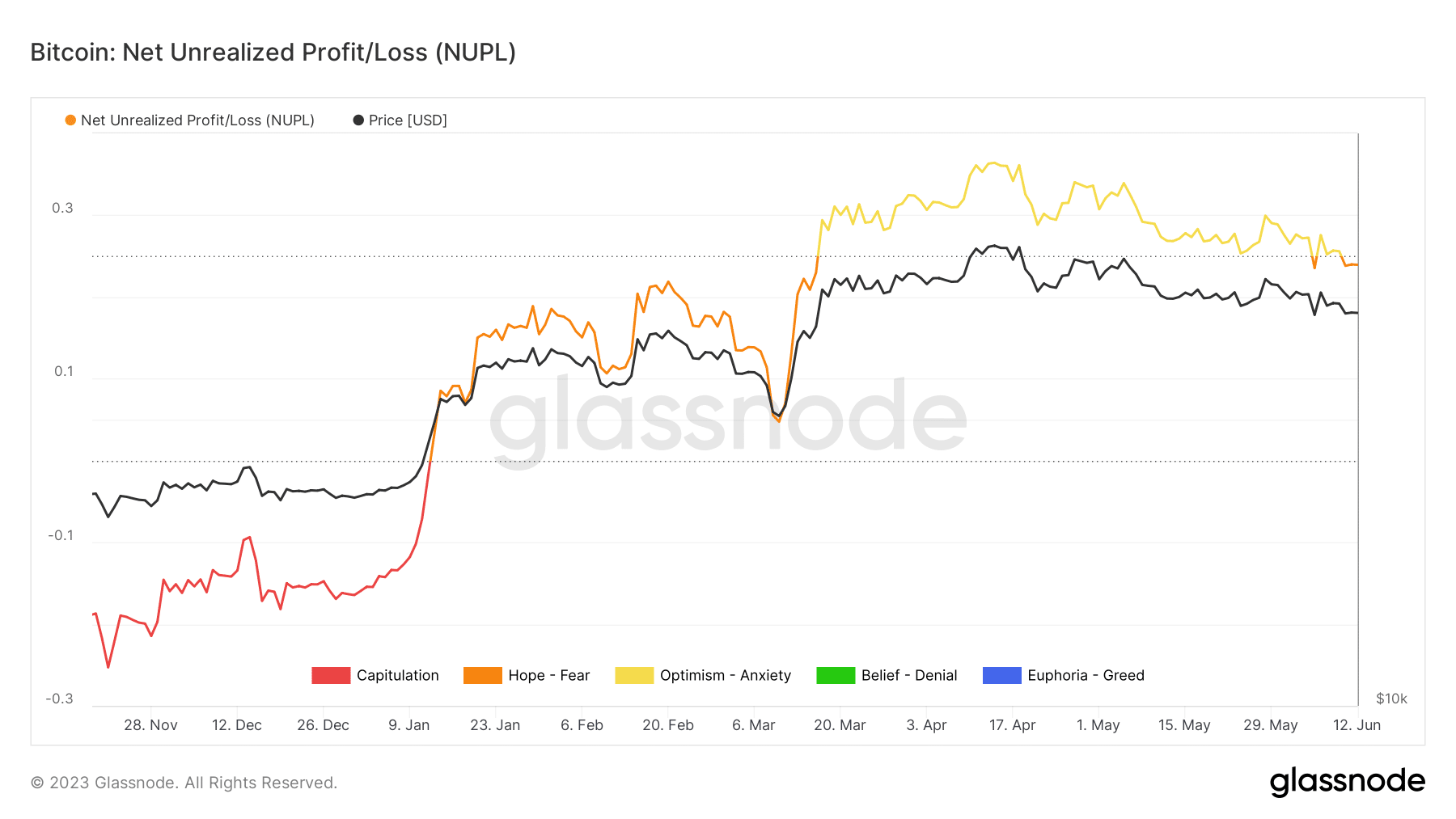

However, Bitcoin’s Net Unrealized Profit/Loss indicator at the time of publication gave a reading of 0.23. This indicated that the most holders, on average, were in a state of profit but were strongly resisting the urge to sell.

Long-term supply vs short-term supply

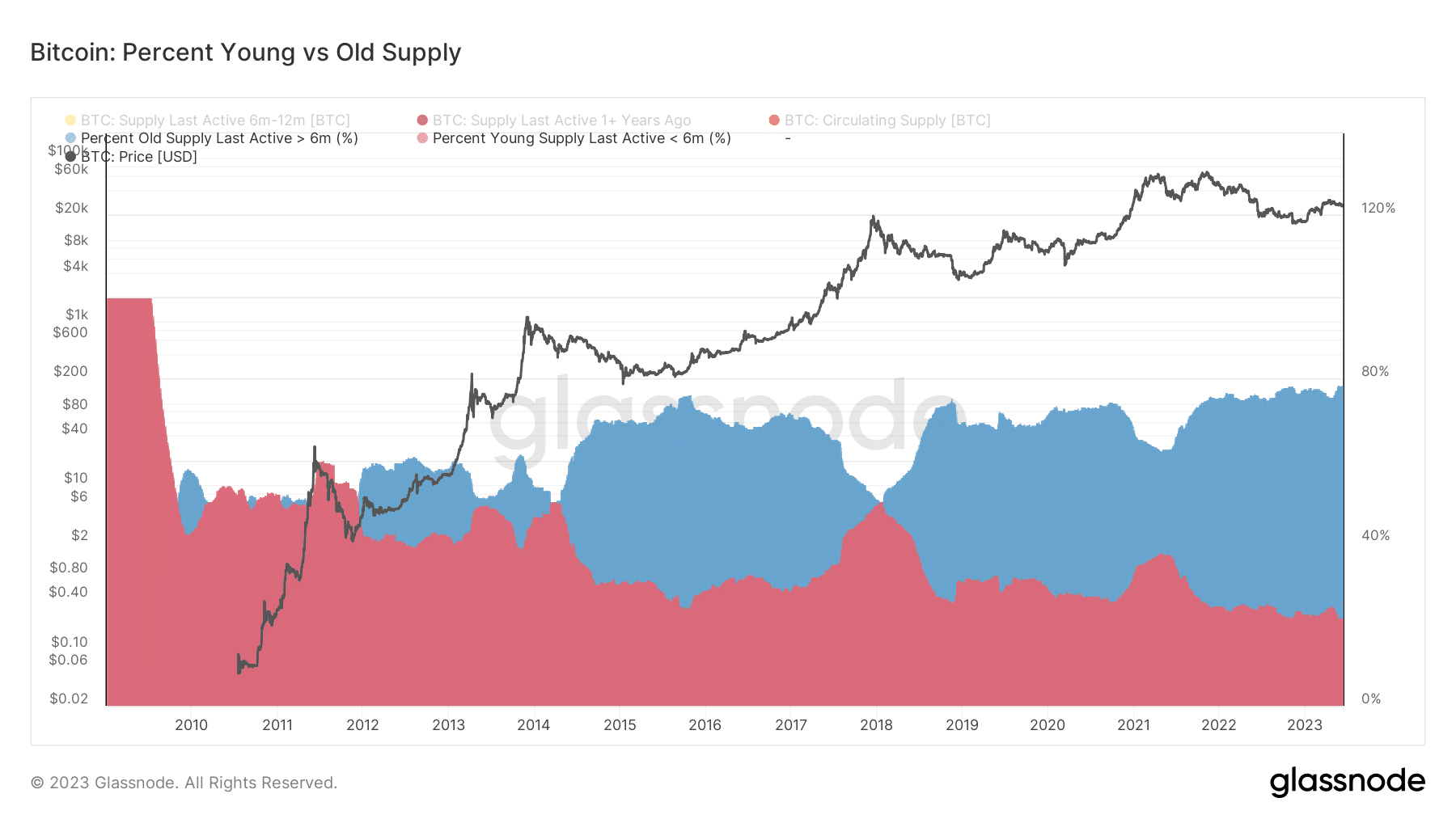

Another fascinating trend regarding Bitcoin HODLing is the comparison between long-term holders and short-term holders, the participants who keep possession of coins for less than 155 days.

Since the low-volatility phase kicked in, LTH supply increased from 75% to 78.62% at the time of writing. The STH, or “weak hands,” on the other hand, have sold significant amounts of BTC from their portfolios.

Is your portfolio green? Check out the Bitcoin Profit Calculator

At the time of publication, BTC exchanged hands at $26,065.66, as per CoinMarketCap. The market forces were looking towards the U.S. Federal Reserve’s meeting on 14 June as a trigger for vertical price action.

The market mood was balanced between greed and anxiety at the time of writing.

Bitcoin Fear and Greed Index is 45 ~ Neutral

Current price: $25,899 pic.twitter.com/zuYJ4pjcEy— Bitcoin Fear and Greed Index (@BitcoinFear) June 13, 2023