Bitcoin: Longs erase $100M in 1 day, more to come for BTC’s price?

- Bitcoin has dropped below the $60,000 price range.

- More long positions have been liquidated in the last 48 hours.

The recent downturn in Bitcoin’s [BTC] price has left traders in long positions vulnerable. With BTC’s price declining further and crossing critical thresholds, many holders are liquidating their positions.

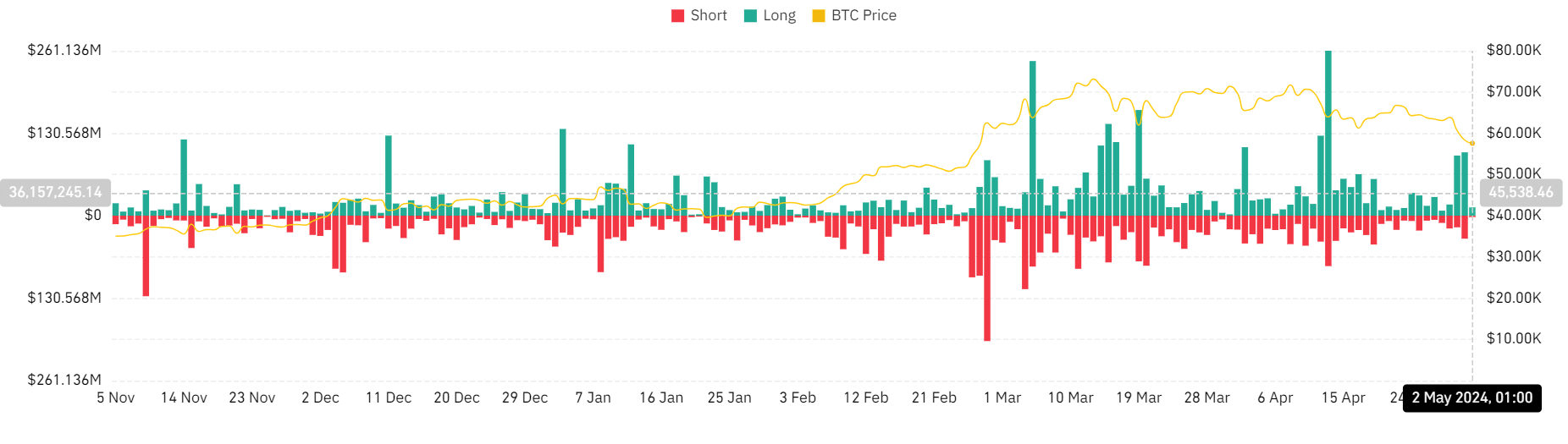

Bitcoin sees over $100 million in liquidations

According to data from Crypto Rank, the cryptocurrency market experienced liquidations totaling over $464 million on the 1st of May, and Bitcoin accounted for over $136 million of this outflow.

AMBCrypto’s analysis of the Bitcoin liquidation chart on Coinglass indicated that long positions bore the brunt of the liquidations, with approximately $100.3 million being liquidated on the 1st of May.

Conversely, short liquidations amounted to around $36.4 million.

On the 30th of April, long positions also faced more liquidations, with over $95 million being liquidated compared to approximately $18.4 million in short liquidations.

According to Crypto Rank’s data, long liquidations represented over 80% of the total liquidations recorded on the 1st of May.

As of the time of this writing, nearly $13 million had been liquidated in long positions, while short liquidations amounted to around $2 million.

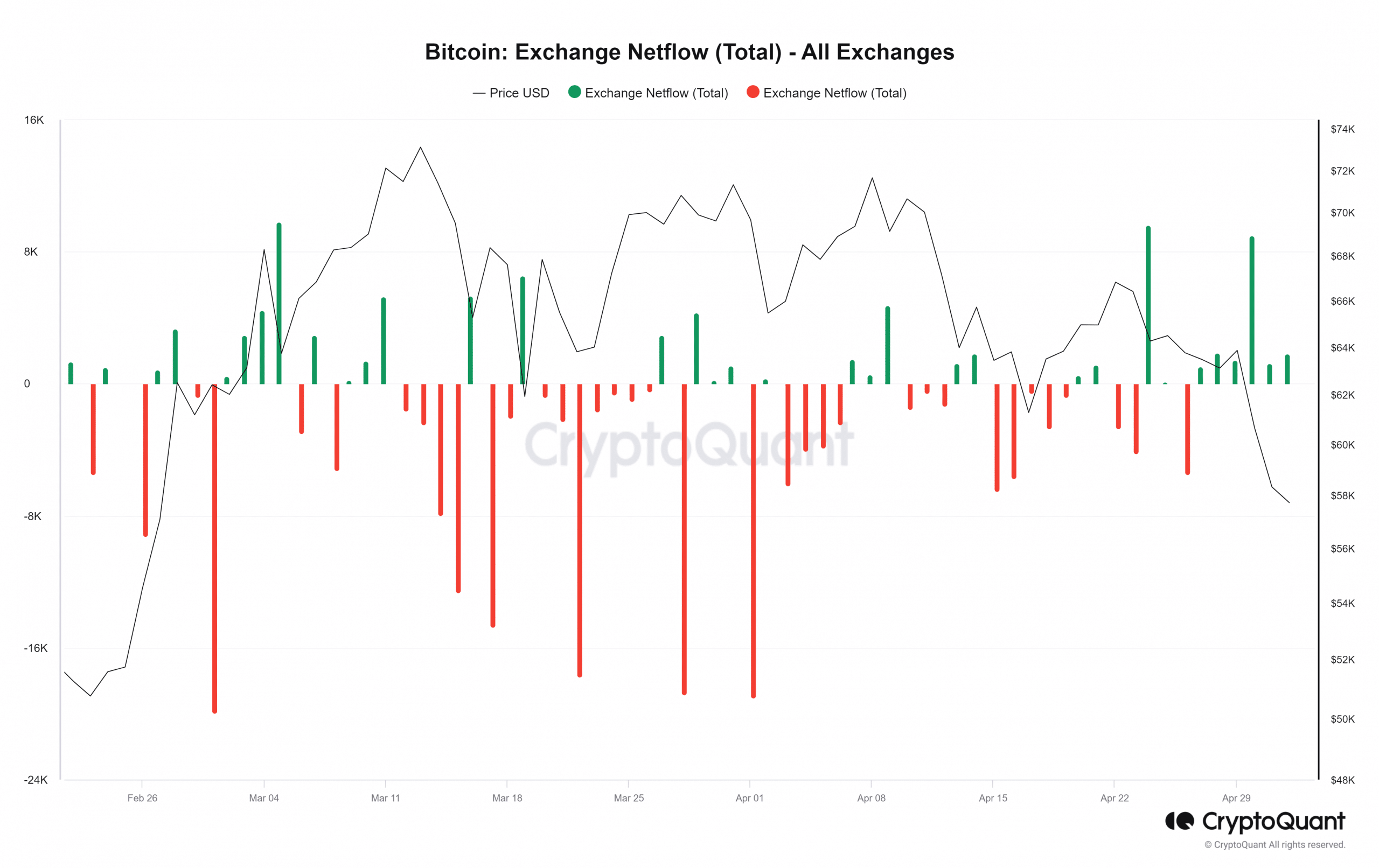

More Bitcoin hits exchanges

AMBCrypto’s look at the Bitcoin Exchange Netflow indicated a notable increase in the number of assets being sent to exchanges, suggesting increased selling activity. The number stood at 1200 on the 1st of May.

Further analysis of the BTC flow revealed an inflow of over 32,300. These figures suggested an ongoing trend of increased BTC being sent to exchanges.

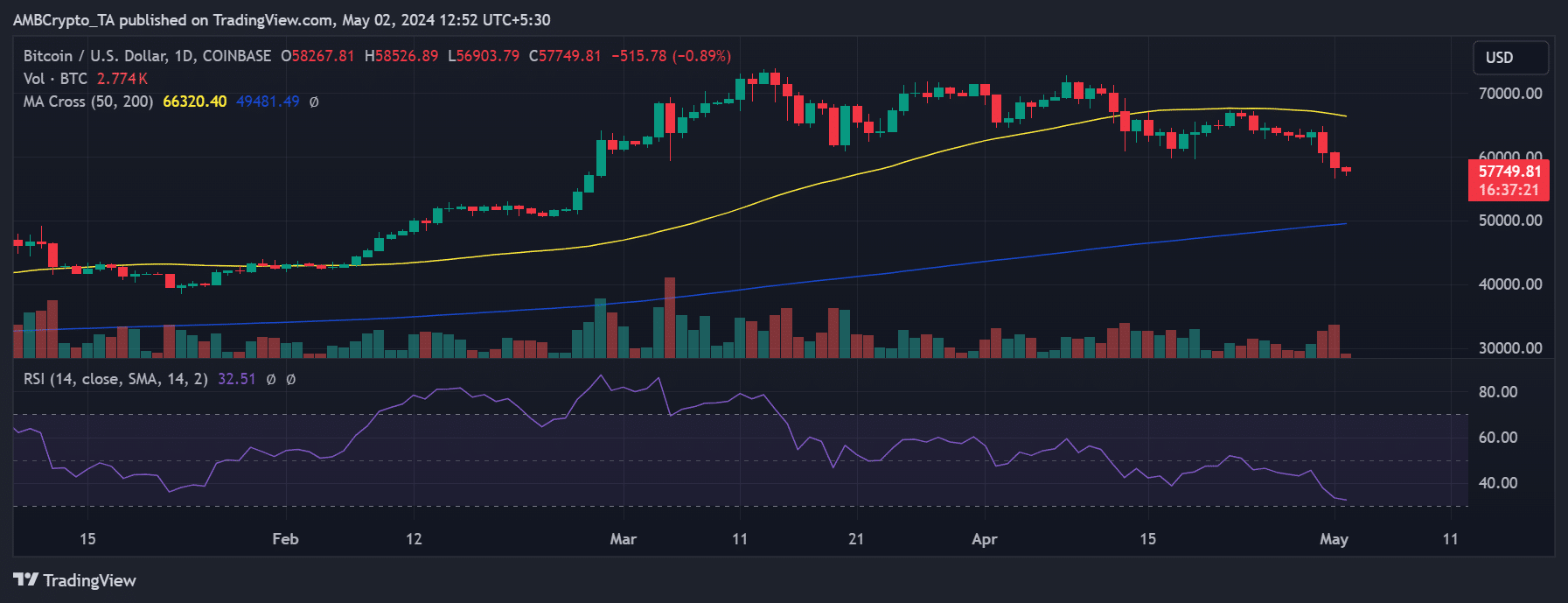

BTC in free fall

AMBCrypto’s look at Bitcoin’s daily chart analysis revealed a continuous decline in price over the past three days. On the 1st of May, BTC experienced a loss of 3.89%, with the price dropping to around $58,260.

This marked the first time it fell below the $60,000 price range since its March surge.

Read Bitcoin’s [BTC] Price Prediction 2024-25

At the time of writing, BTC was trading at approximately $57,740, showing a less than 1% decline. This prolonged price decline has further entrenched a bearish trend, as indicated by its Relative Strength Index (RSI).

The downward trajectory in price is also contributing to increased exchange inflow and liquidation of long positions.