Bitcoin losses mount, traders hit hard! – Is the worst yet to come?

- Bitcoin short-term holders faced steep losses, surpassing FTX levels, but without triggering full panic.

- Short-term BTC investors were experiencing prolonged losses, with market uncertainty fueling caution instead of capitulation.

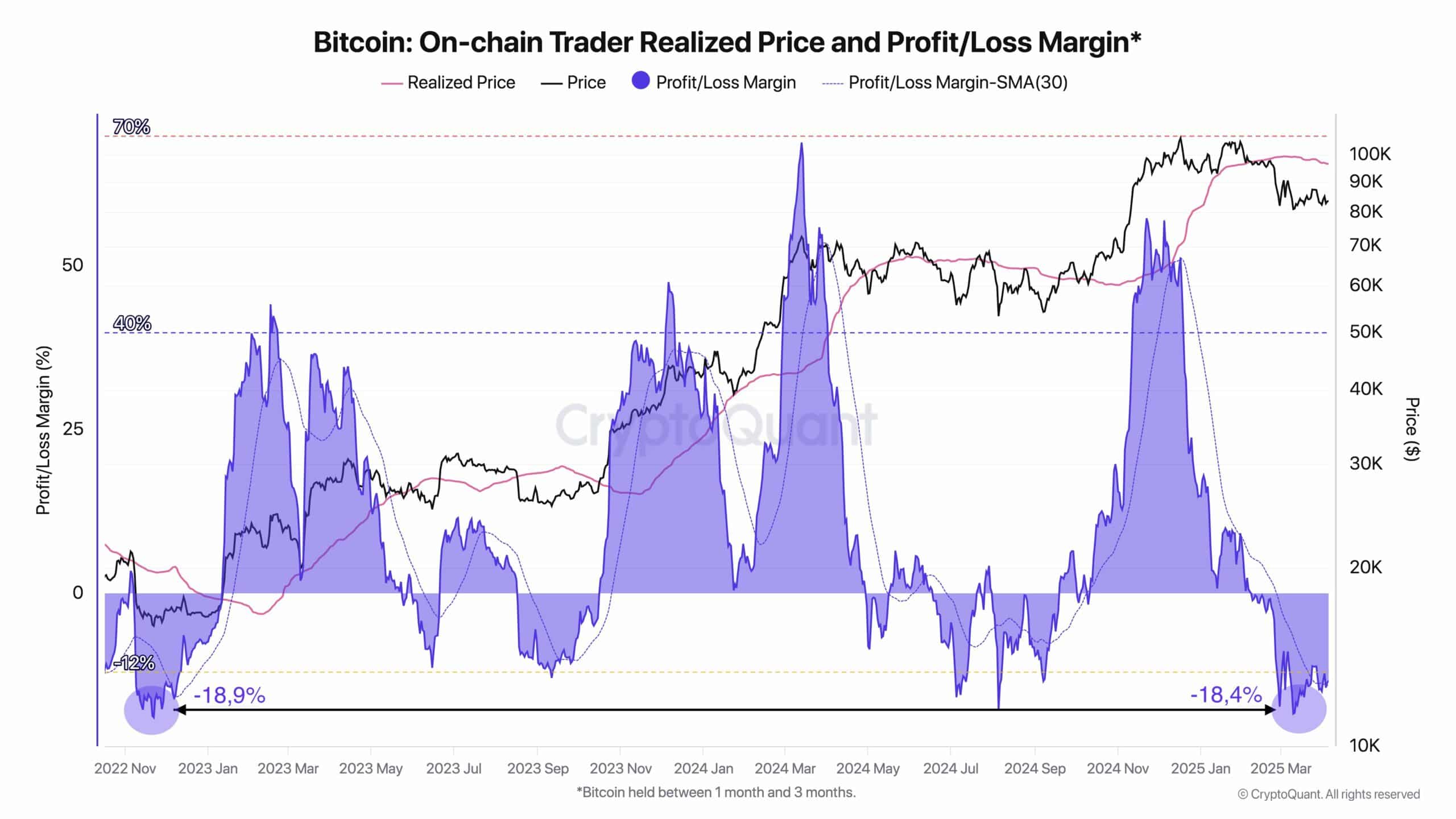

Since early February, Bitcoin [BTC] traders have been quietly nursing losses, with the current figures now surpassing even the chaos seen during the FTX crash and the 2024 market correction.

The pain is hitting short-term investors the hardest, particularly those holding BTC for just 1 to 3 months.

As market uncertainty continues to linger, this trend of growing short-term investor losses could indicate a deeper shift in sentiment, leaving many wondering if the worst is yet to come or if we’re simply stuck waiting for a breakout.

Pain, but not capitulation

Bitcoin’s short-term holders are deep in the red, with them now sitting on realized losses worse than anything seen since the FTX implosion.

The chart shows the profit/loss margin plunging to -18.4%, eerily close to the -18.9% levels of late 2022.

Yet interestingly, this isn’t triggering full-blown panic. While the market’s bleeding, there’s little sign of a mass exodus – just traders biting their lips and waiting it out.

The mood? Less “get out now,” more “this better be worth it.”

Bitcoin: Why this time feels worse for short-term holders

Unlike long-term hodlers who’ve weathered bear cycles before, STHs tend to enter near local tops — right when hype is peaking.

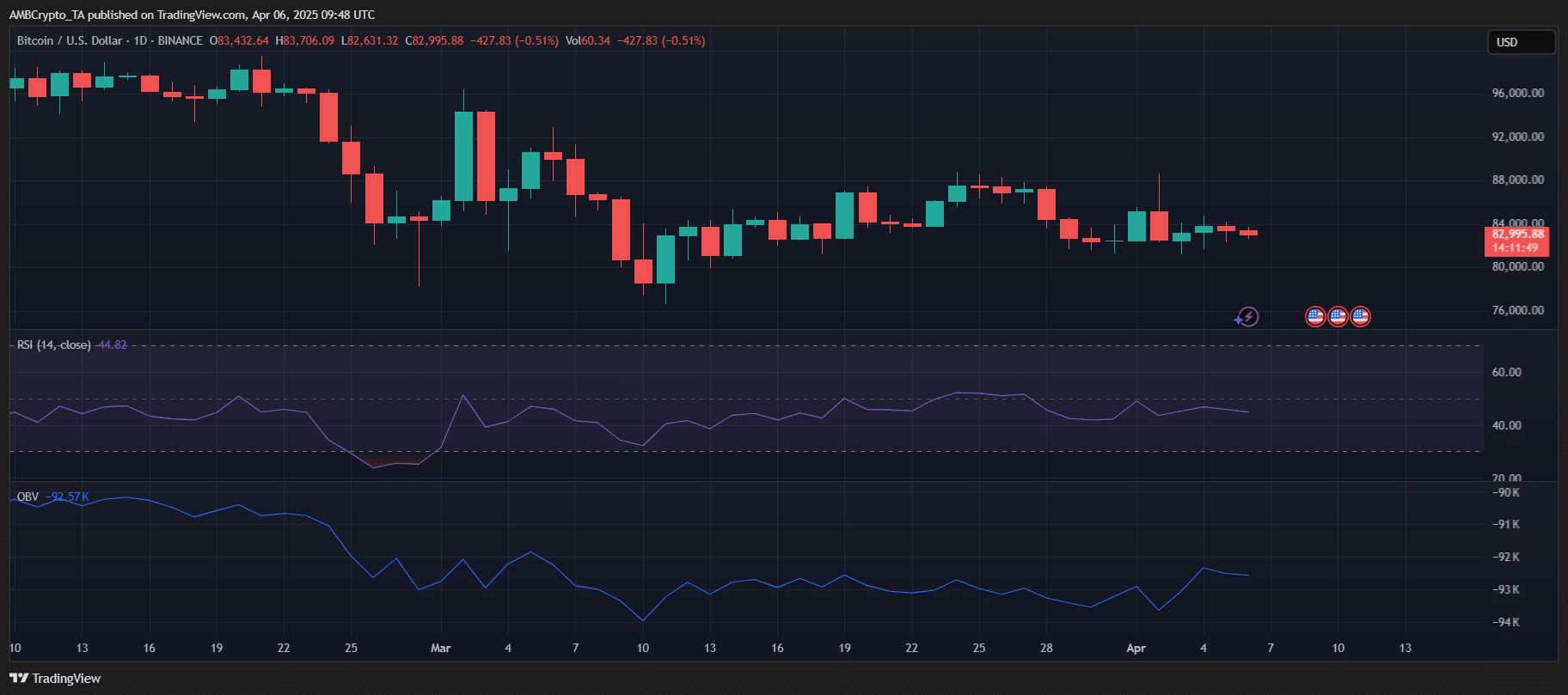

As BTC flirted with highs around $84K in early March, many of these traders piled in, only to be caught in a slow bleed rather than a dramatic crash.

It’s the worst kind of loss: dragged out, confidence-chipping, and murky in direction. The data shows this group is now shouldering the brunt of realized losses – a clear reminder that FOMO buyers still learn the hard way.

Echoes of FTX

The current drawdown mirrors the FTX crash in magnitude, but not in mood. Back then, the losses were driven by panic, contagion, and vanishing liquidity.

Today, markets are hesitant, liquidity is decent, and BTC is still holding above $80K.

The pain, however, is real. Market watchers are observing past patterns closely, and with loss levels now breaching 2024’s correction, comparisons to November 2022 are becoming harder to ignore.

If history rhymes, then short-term capitulation could still be lurking just around the corner.

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-8-400x240.jpg)