Bitcoin: Major investors on the move – What does BTC’s future hold?

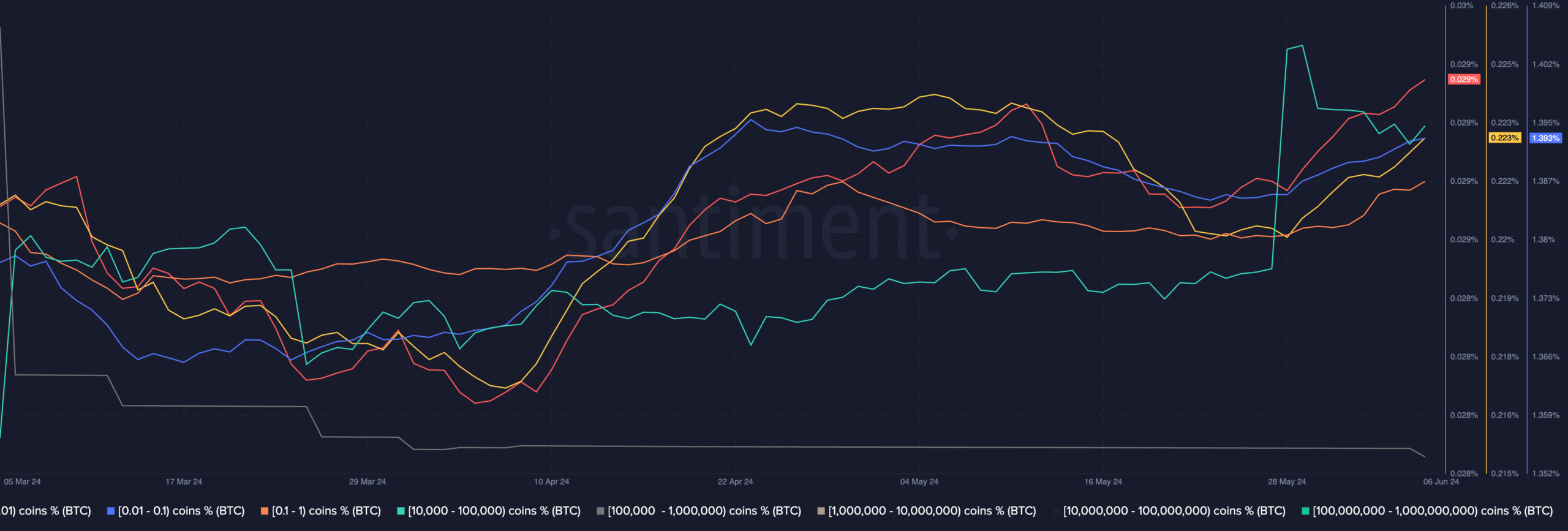

- Bitcoin whales accumulated large amounts of BTC over the last few days.

- Holder profitability grew, and miner revenue declined.

Bitcoin [BTC] witnessed a massive surge in whale accumulation over the last few days. Despite the price being extremely close to its recent all-time high, many whales haven’t lost conviction in the king coin.

Bitcoin: Big players invest

The rising appetite of whales indicated that there was a high expectation that BTC will surpass current price levels.

The story remained the same for retail investors as well. Over the last few days, the interest from retail investors for BTC had grown materially.

Addresses holding anywhere between 0.01 to 1 BTC had grown significantly. The push from both whale investors and retail investors can help BTC break past previously claimed levels.

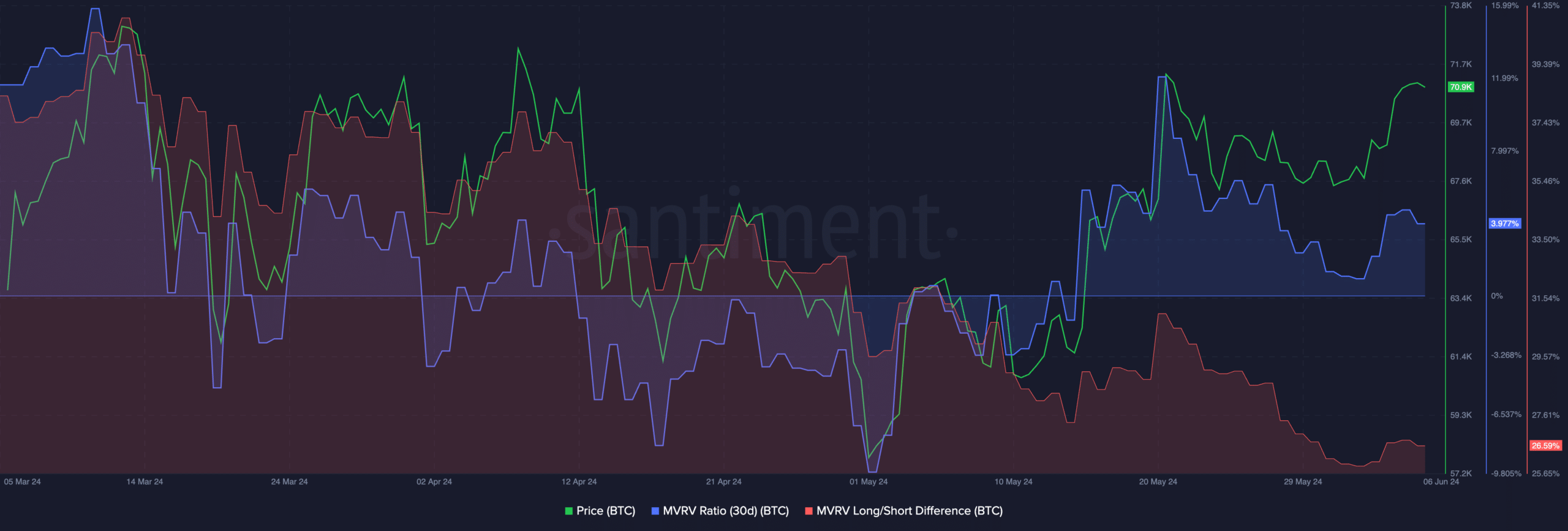

However, as BTC’s price rises, so does the MVRV ratio. AMBCrypto’s analysis of Santiment’s data revealed that the MVRV ratio for BTC holders had grown significantly.

This indicated that most holders were profitable at the time of writing. Due to this, the incentive for these holders to sell also grows, which can add selling pressure on Bitcoin.

Coupled with that, the Long/Short difference for Bitcoin had declined.

This meant that the number of new addresses holding BTC had grown, and the percentage of long-term holders who have held BTC for large periods of time had declined.

Short-term holders are more likely to sell their holdings amidst price fluctuations and uncertainty.

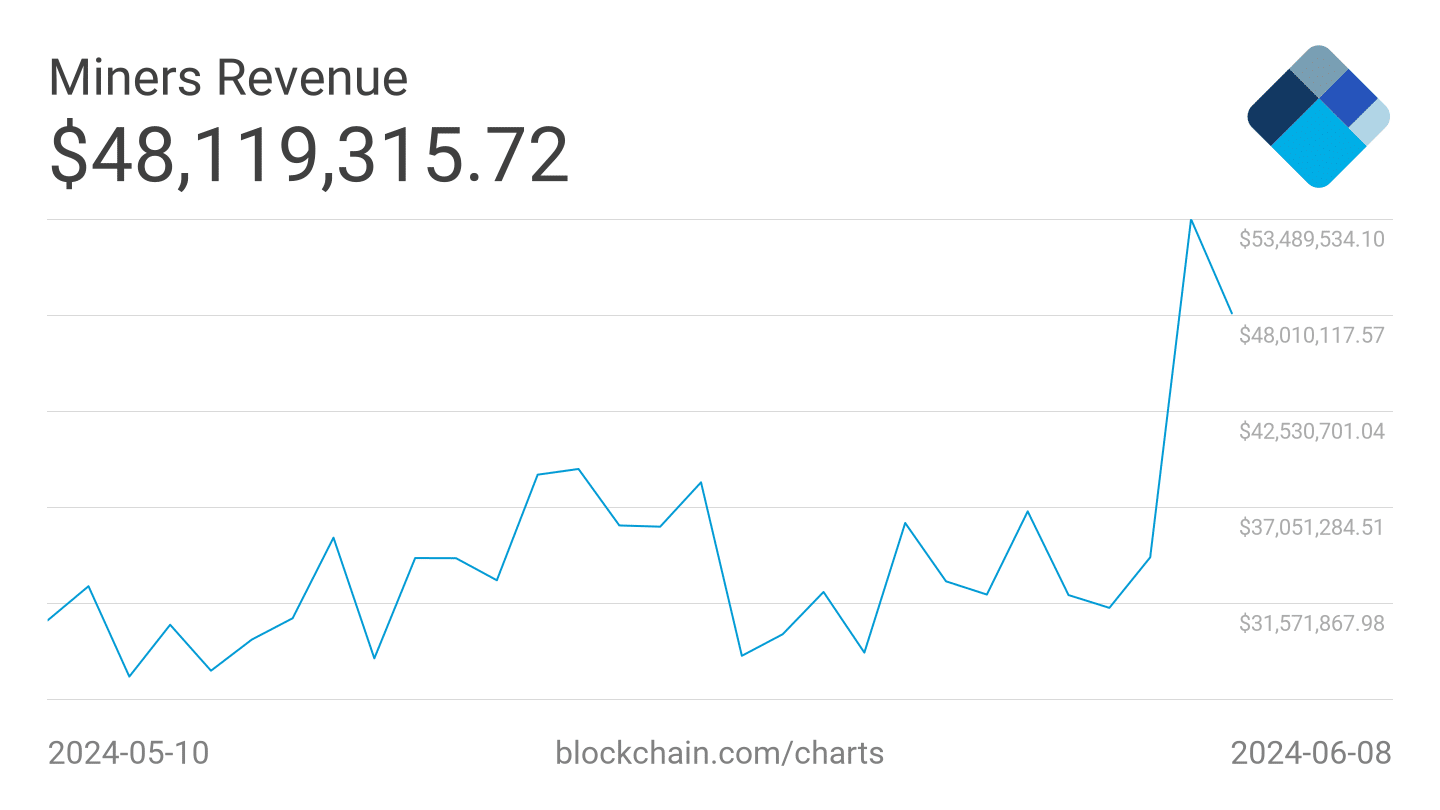

Miner revenue declines

Another factor that could impact the state of BTC would be how the miners are doing. During the last few days, the revenue collected by miners had fallen from $53.48 million to $48 million.

If this trend continues, miners would have to sell their holdings to remain profitable. This could further add selling pressure on BTC and drive prices down further.

Read Bitcoin’s [BTC] Price Prediction 2024-25

What could help ease off the selling pressure around BTC would be the interest in BTC ETFs. Since the 31st of May, ETF inflows have been extremely positive.

If interest in BTC continues to rise at this rate and more institutional investors continue to buy BTC, there could be more upward price movement in the future.