Bitcoin miners, BTC halving rates, and what HODLers can expect in 2024

- A new report suggests that the next Bitcoin halving could trigger a rally

- However, miners could face the pressure as revenues and fees dwindle

The next Bitcoin [BTC] halving, which is expected to occur in 2024, could impact Bitcoin holders positively. According to a new report by Messari, a new Bitcoin halving can induce a BTC rally.

#Bitcoin's halvings reduce the security expense of Bitcoin in $BTC terms.

Through the lens of the Expected Demand for Security Model, it seems natural that the dollar demand for security is not affected by halvings, as demand for security remains no matter the block rewards. pic.twitter.com/K2tHbLWz30

— Messari (@MessariCrypto) December 11, 2022

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Glass ‘halve’ full

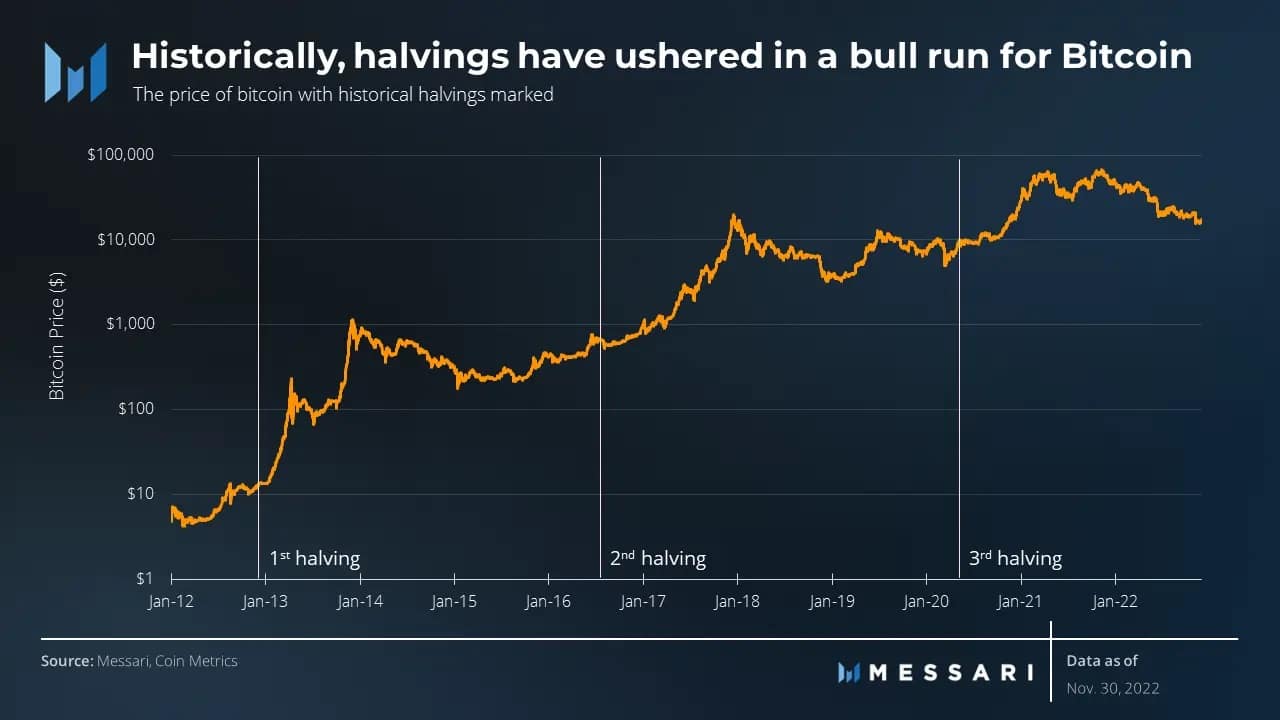

A Bitcoin halving is an event that occurs when the reward for mining Bitcoin transactions is cut in half. As can be seen from the image below, halving was always met with a spike in prices and a momentary rally.

Even though this halving could have a similar effect on BTC’s prices in the future, miners could be affected.

Cutting Bitcoin’s rewards in half would negatively impact the already suffering mining industry. According to Glassnode, miner revenue had reached a one-month low at the time of writing.

? #Bitcoin $BTC Percent Miner Revenue from Fees (7d MA) just reached a 1-month low of 1.981%

Previous 1-month low of 1.998% was observed on 10 December 2022

View metric:https://t.co/NphJIZNcsL pic.twitter.com/haLVdFDR6C

— glassnode alerts (@glassnodealerts) December 11, 2022

The fees being paid to miners had also decreased and had reached a one-month low as well, according to Glassnode. This decline in revenue and fees before the halving could pose a serious threat to miners.

For mining to remain profitable, Bitcoin prices would have to soar to new heights.

Weighing the pros and cons of Bitcoin

At press time, the outlook for Bitcoin was looking uncertain. The number of addresses holding over one coin had reached an all-time high of 192,000. This suggested that there was growing interest in Bitcoin from large investors.

Although large addresses had shown their interest in Bitcoin, the number of traders going long on BTC had decreased. As can be seen from the image below, the number of traders who held a long position on Bitcoin decreased over the last month.

On 12 November, 70% of the top traders had gone long on Bitcoin. Since then, that value reduced and at press time, the percentage of traders going long on Bitcoin was 53/19%, according to data provided by Coinglass.

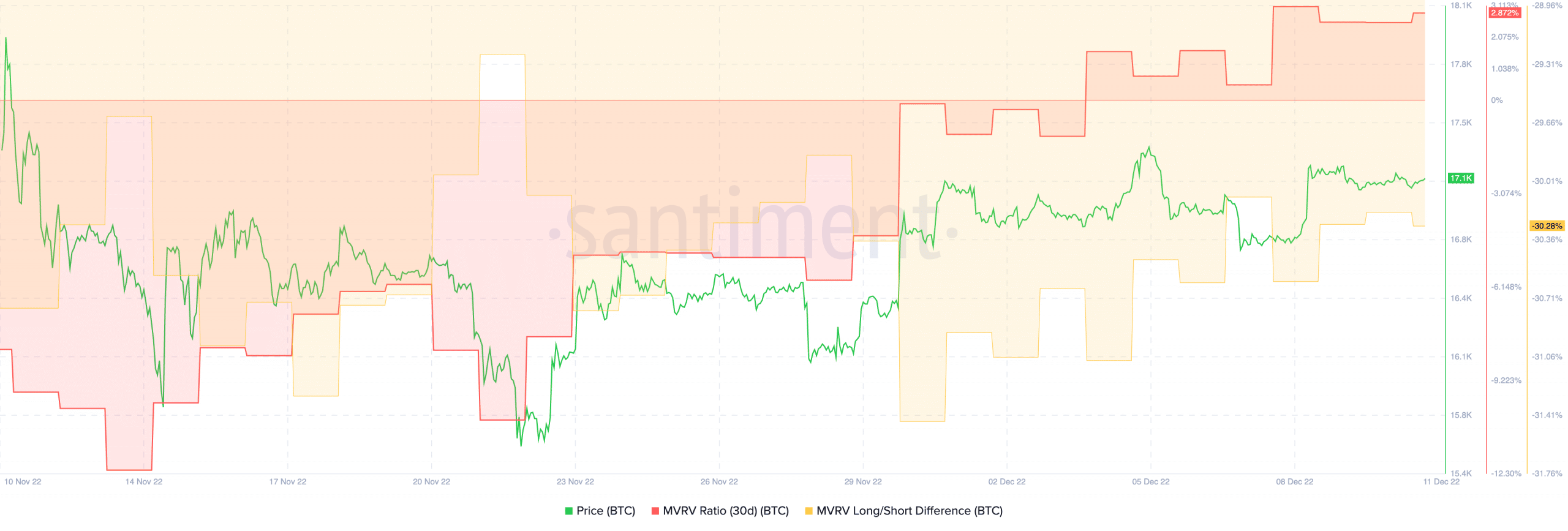

Another factor that could affect BTC’s prices could be the incentive of short-term holders to sell their positions. In the image below, it can be seen that the Market Value to Realized Value (MVRV) ratio increased. This implied that selling BTC at press time would generate a profit.

Even though long-term holders and maximalists weren’t inclined to sell, a declining long/short difference showed that short-term holders would profit from this trade. If short-term sellers succumb to the selling pressure, it could lead to a slight depreciation of Bitcoin’s prices in the near future.