Why Bitcoin miners have themselves an early Christmas

- Transaction fees made up nearly 37% of the total mining revenue over the weekend.

- Mining revenue hit the highest level since the peak bull market of November 2021.

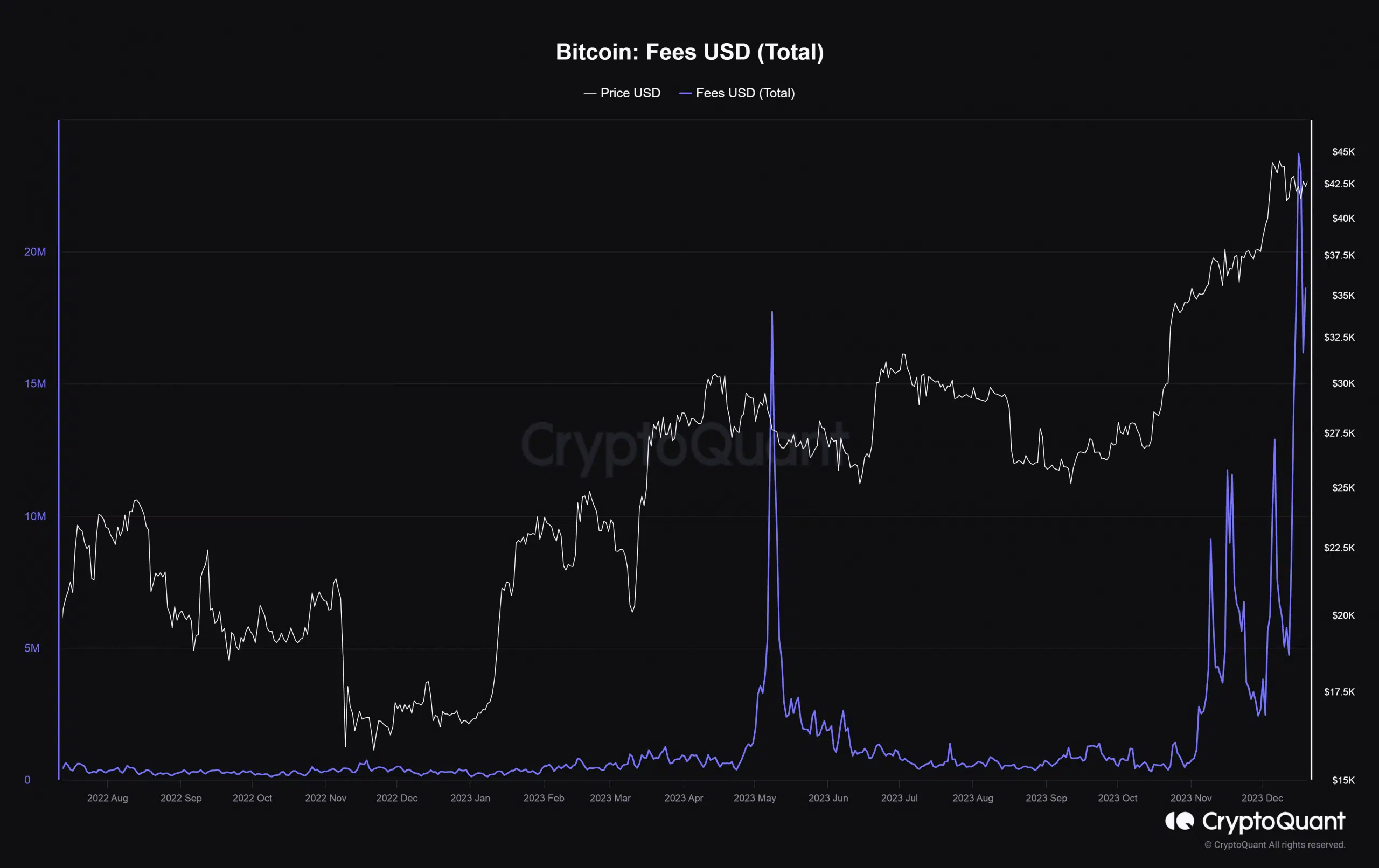

Bitcoin [BTC] miners racked up more than $23.7 million in transaction fees on a single day during the weekend, as Ordinals frenzy continued to push demand for blockspace.

As per on-chain analytics firm CryptoQuant, Bitcoin’s fee revenue on 16th December was the highest ever.

Miners’ earnings shoot up

The steep rise in transaction fees boosted miners’ overall revenue, which also includes the fixed block subsidy of 6.25 BTC. On the same day, miners made more than $63 million, the highest since the peak bull market of November 2021.

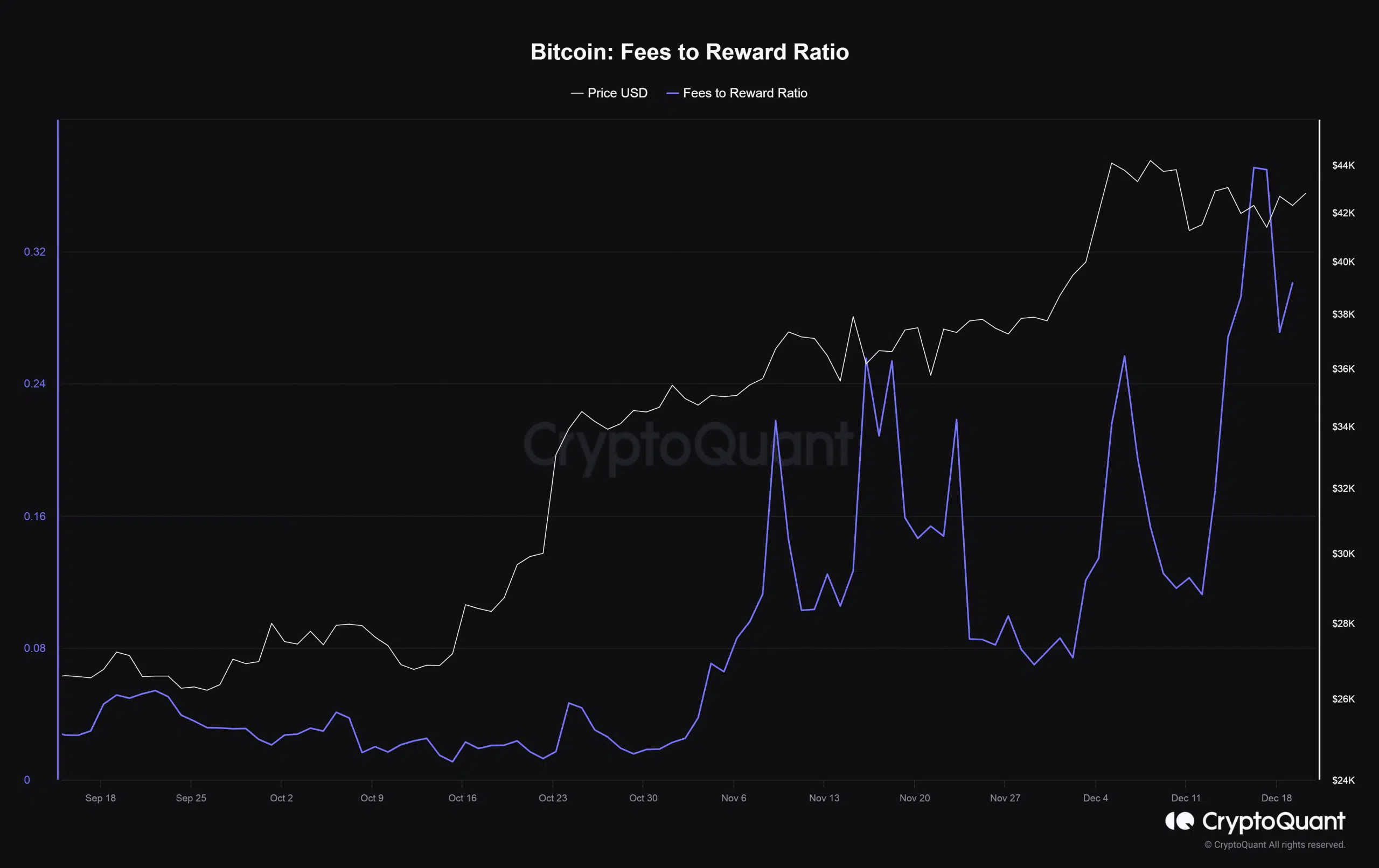

To get a fair idea about the network demand, transaction fees made up nearly 37% of the total revenue received by miners on the day, the second-highest since the previous Ordinals frenzy in early May.

Miners are not selling yet

Miners, as we all know, spend a hefty sum in setting up sophisticated infrastructure for creating blocks and securing the Bitcoin network. The rely on mining revenue to cover these exorbitant costs, which run into thousands of dollars.

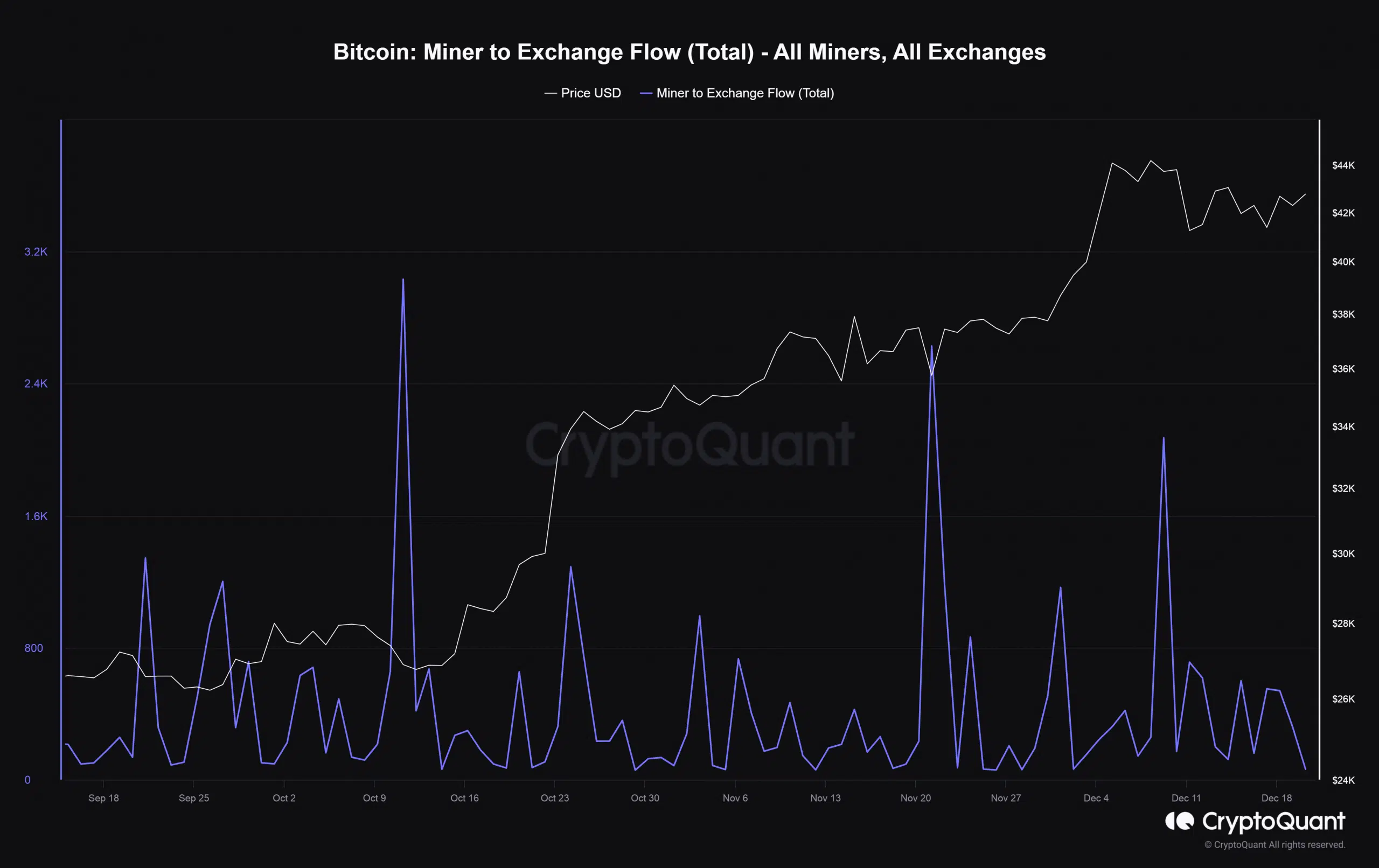

Due to this, miners’ frequently liquidate their holdings. The latest surge in their coffers fueled strong expectations of similar sell-offs. However, this wasn’t the case.

AMBCrypto didn’t notice substantial spikes in the movement of coins from miners to exchanges. This implied that miners could be eyeing some more profitable days before they start offloading their bags.

Bitcoin becomes the biggest NFT chain

The Ordinals concept has taken the blockchain world by storm in 2023. Pioneered by Bitcoin in early 2023, other EVM and non-EVM chains have mimicked the technology and launched their own inscriptions.

Ordinals work by embedding images or other data directly on the chain. They can be used to create digital assets like non-fungible tokens (NFTs) and even fungible tokens using the BRC-20 standard.

Ordinals’ major use case has been NFTs, catapulting Bitcoin into the elite league of NFT-friendly networks.

Read BTC’s Price Prediction 2023-24

As per AMBCrypto’s analysis of Cryptoslam data, Bitcoin has been the dominant chain for NFT trades over the last month, with sales worth more than $700 million.

In comparison, traditional leaders like Ethereum [ETH] and Solana [SOL], could only muster $389 million and $245 million respectively.