Bitcoin mining: Hut 8 expands to Texas amid drop in BTC miner revenues

- Hut 8 Corp has secured a PPA for a site in West Texas, getting access to 205 MW of power capacity.

- Despite multiple efforts, Bitcoin miner’s daily revenues have dropped by 63% post-halving.

Hut 8, a Canadian Bitcoin [BTC] mining firm, has recently concluded an agreement to expand its operational capabilities in Texas.

On 9th July, Hut 8 Corp. disclosed securing a power purchase agreement (PPA) for a West Texas site, providing it exclusive access to 205 megawatts of power capacity and accompanying land.

Hut 8 new initiative

This marks the first deal from Hut 8’s plan to secure 1,100 megawatts of energy capacity, significantly boosting its BTC mining operations.

Remarking on the same, Asher Genoot, CEO of Hut 8 said,

“This is the first time a large data center load has been approved under the complex regulatory framework in this particular market.”

Key advantages

The new PPA provides Hut 8 with several key advantages. The first is proximity to a wind farm and connection to the Electric Reliability Council of Texas (ERCOT) grid.

This would enable Hut 8 to leverage some of North America’s most competitive wholesale power prices.

Additionally, the site infrastructure includes an existing operational substation, simplifying the process of connecting to the power grid and reducing setup time.

Most importantly, the site is well-suited for various high-density computing tasks, including Bitcoin mining and artificial intelligence (AI) applications.

Expressing on the same, Genoot noted,

“This transaction exemplifies Hut 8’s differentiated approach to securing new energy capacity through mutually accretive partnerships.”

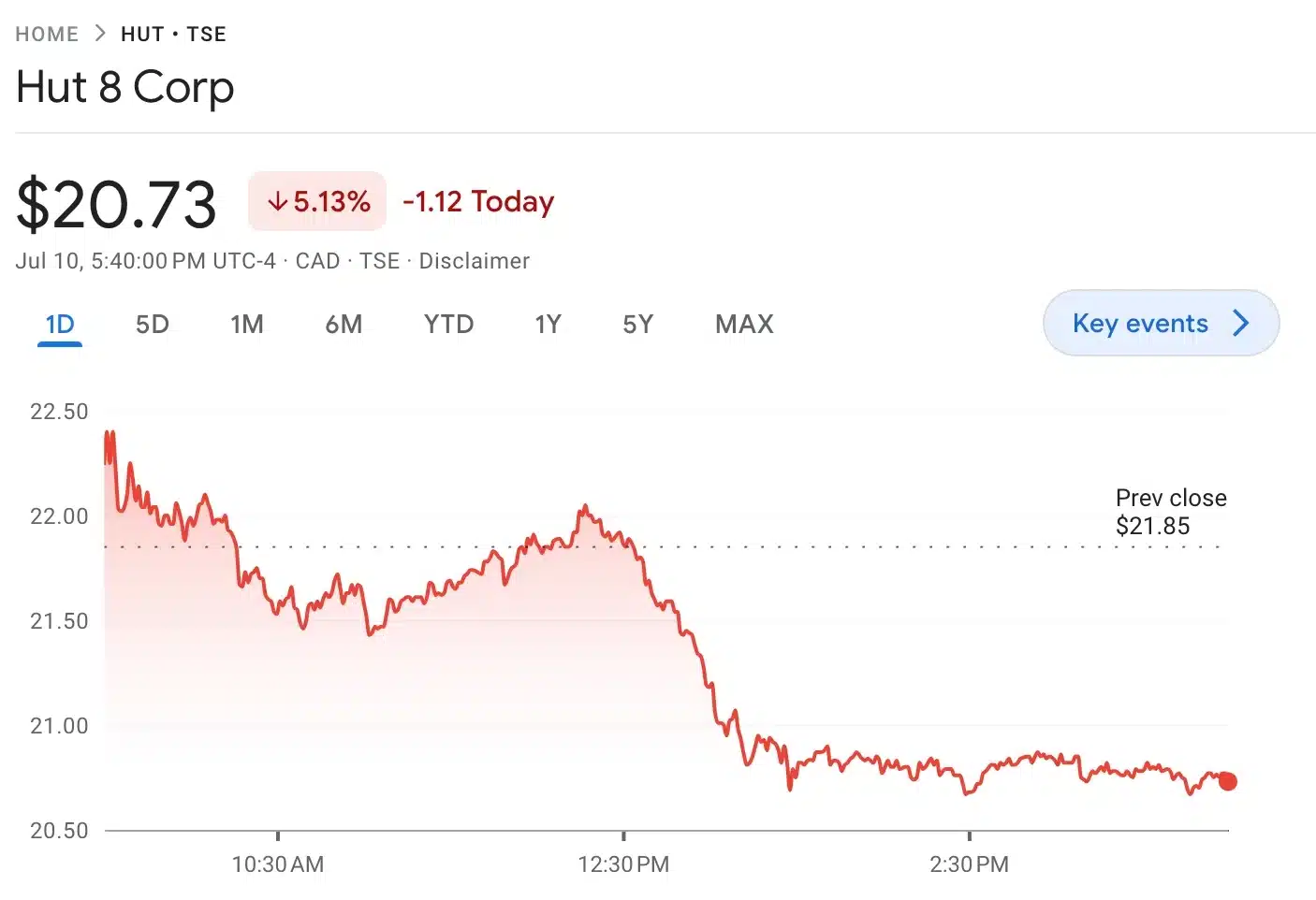

Following the announcement, Hut 8 shares initially rose by 1.54%, reaching $17.75. However, this increase was short-lived, as the latest update shows the stock price was down by 5.13% at the time of writing, now standing at $20.73.

Impact of Bitcoin halving on miners

That being said, following the recent Bitcoin halving, the industry has undergone significant changes. Miners are diversifying their revenue streams, increasing their hashrate, and pursuing mergers, acquisitions, and partnerships to maintain profitability.

For instance, CleanSpark acquired five mining facilities in Georgia, significantly boosting their processing power. Mining firms such as Marathon Digital, CleanSpark, and Riot Platforms collectively secured $2 billion in equity financing.

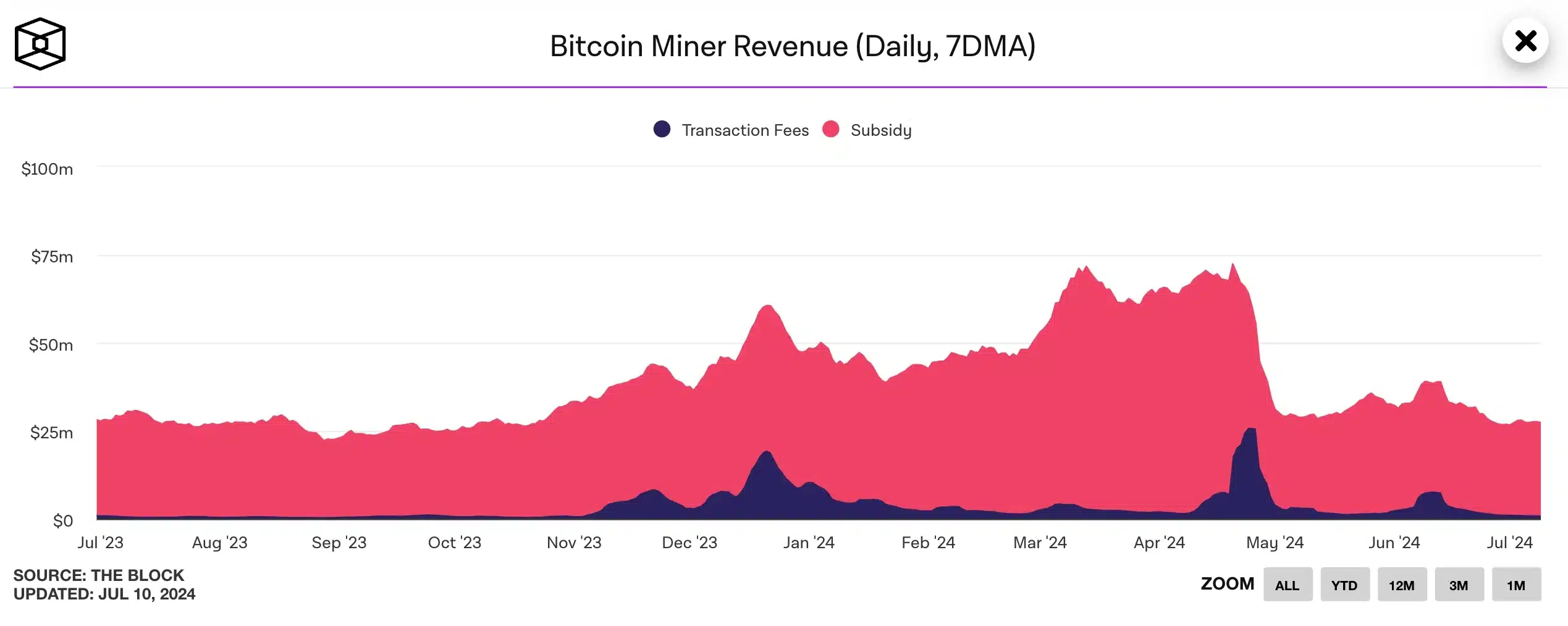

Despite these efforts, miners’ daily revenues have dropped by 63% since the halving.

AMBCrypto’s analysis of IntoTheBlock data confirmed this, showing total BTC miner revenue (7DMA) at $27.29 million, a steep decline from the $72.35 million recorded on 20th April, just a day after the fourth Bitcoin halving event.