Bitcoin: Next difficulty adjustment might affect your portfolio because…

Bitcoin‘s processing power appears to have taken a hit in recent days. At press time, it was down by 0.18% over the last seven days. Also, BTC’s hash rate has dropped by 24% since touching an all-time high earlier this month.

However, a larger concern dominates, one that mining Bitcoin might not be as profitable as it once used to be.

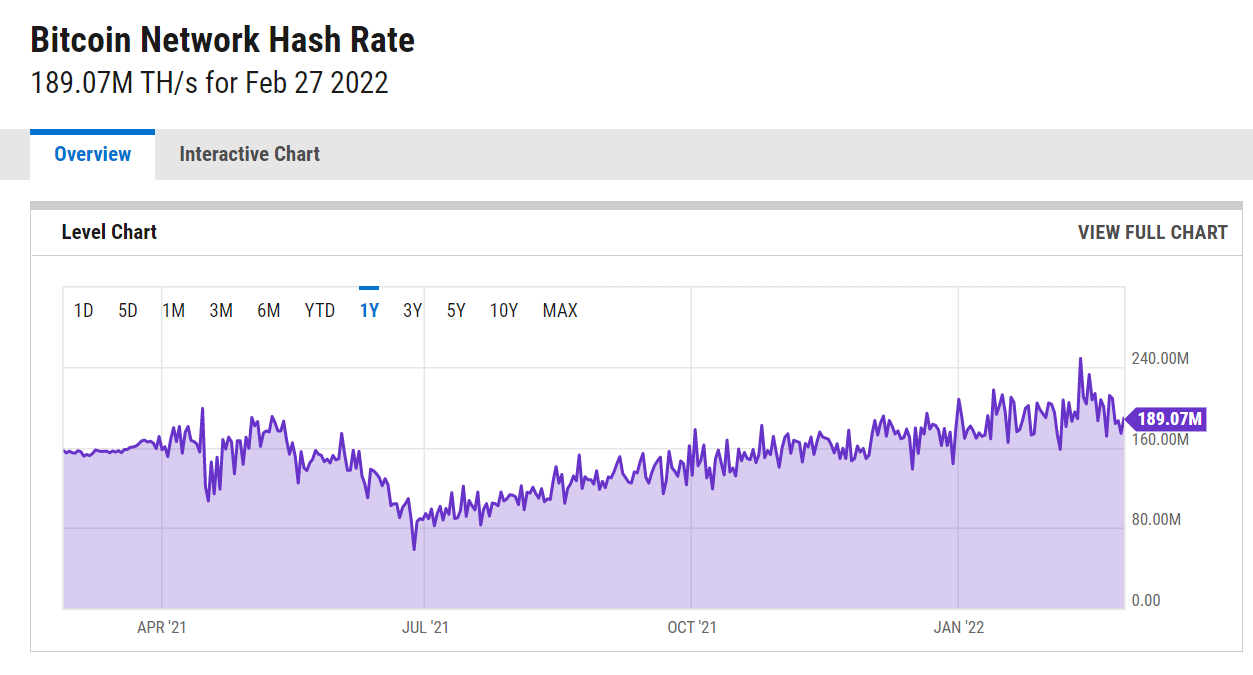

Source: YCharts

Since recording new highs on 13 January this year, Bitcoin’s hash rate had been enjoying higher highs until finally peaking at 249 exa hash per second (EH/s) on 15 February. However, a steep decline in the hash power has since been observed. In fact, the hash power was recorded to be just 189 EH/s, at the time of writing. It even dropped to as low as 169 EH/s on 27 February, before registering a short recovery.

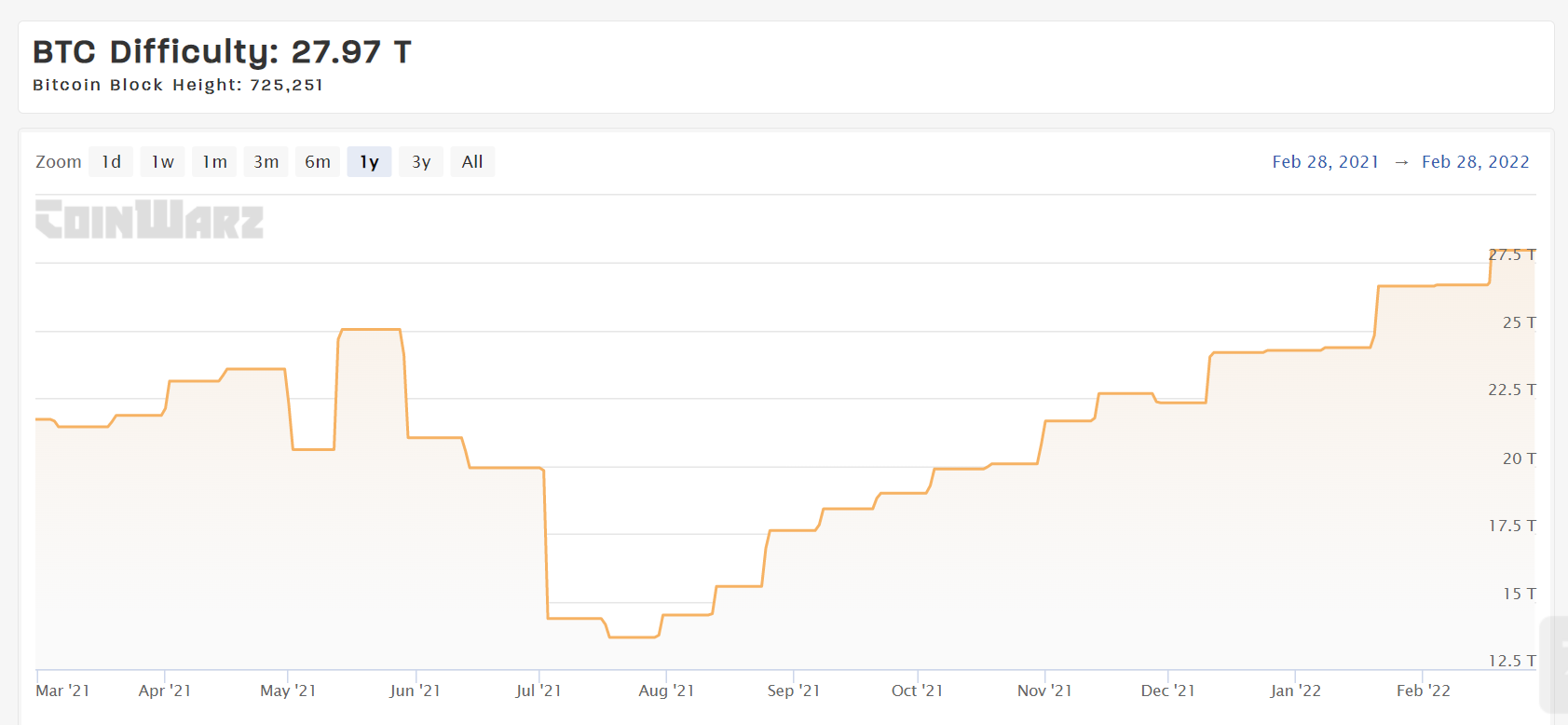

Furthermore, Bitcoin mining difficulty is also set to go through an adjustment in less than three days on 4 March. It is important to note that the mining difficulty automatically adjusts after every 2016th block is mined. This takes about two weeks since the average time for mining each block is 10 minutes. This determines how difficult it will be to mine the next block.

Curiously, the mining difficulty has been successfully increasing over the past six difficulty adjustments since 28 November 2021. In fact, it hit an all-time high as well last week at 27.97 trillion hashes.

Source: CoinWarz

Increasing difficulty indicates that there is more competition to mine blocks. This is evident from the steep increase in mining power since last year. This current fall in hash rate has led to estimates that the upcoming adjustment might decrease the difficulty by as much as 4.15%, according to analytics tool CoinWarz.

This could bring some respite to Bitcoin miners who have been seeing a sustained decline in revenue with increasing competition, computing costs, and BTC’s recent price devaluation.

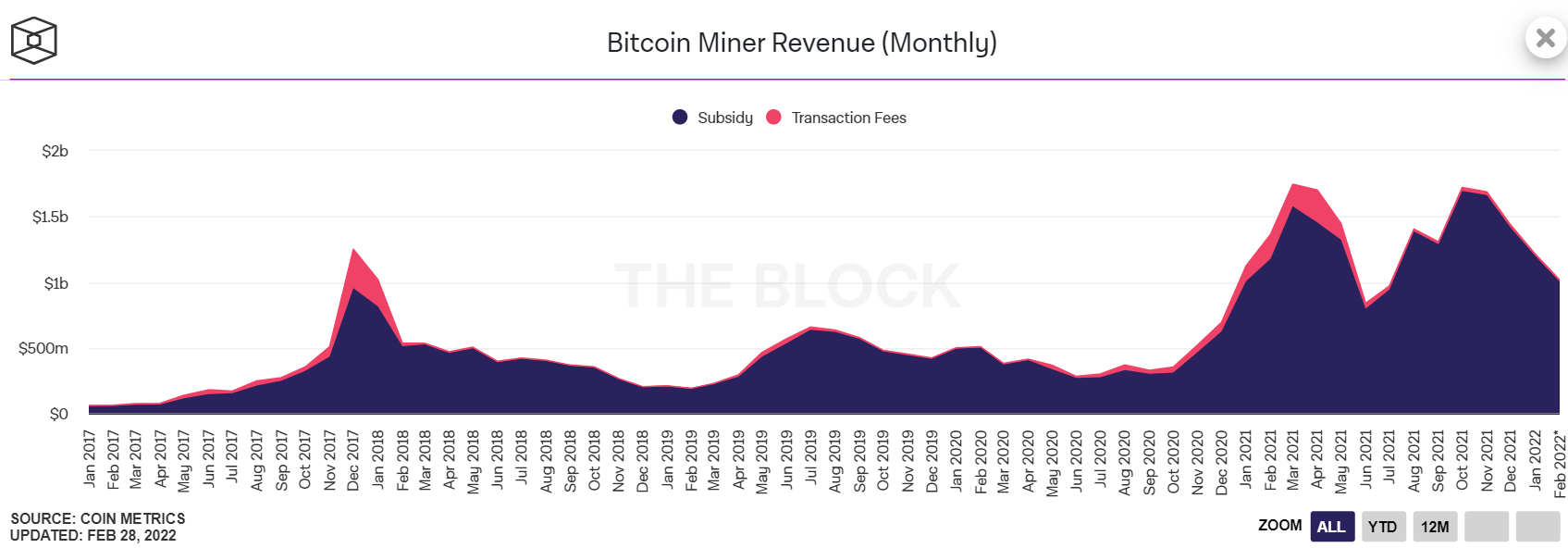

Bitcoin mining monthly revenue and 7DMA revenue mining stats have been on a downward spiral since peaking in October last year. This is a sign that it is becoming less profitable to operate mining rigs.

Source: TheBlock

Additionally, BTC miners who were once considered net accumulators of Bitcoin have turned into net sellers, according to Glassnode.

This has added to the already increasing selling pressure in the market. The fact that the average mining cost is just 16% below the average market price of Bitcoin could provide some explanation for this rising trend. However, a fall in difficulty could incentivize mining activity and sentiment, contributing to the price growth.